The Bank of Portugal: the economy gives positive signals, but they are not enough

The Bank of Portugal is moderately optimistic about the future of the Portuguese economy. But that is not enough. The bank requests more structural reforms, more consolidation and less debt.

The Portuguese economy is growing along with its euro partners, and the economic activity pattern actually improved. However, “there are several constraints” and so the government has to do more and faster, namely: more structural reforms, more efforts to keep the tax environment, more measures to improve the financial system and more fiscal consolidation. This is the assessment that can be made from the Bank of Portugal Winter Economic Bulletin, brought forward this Wednesday.

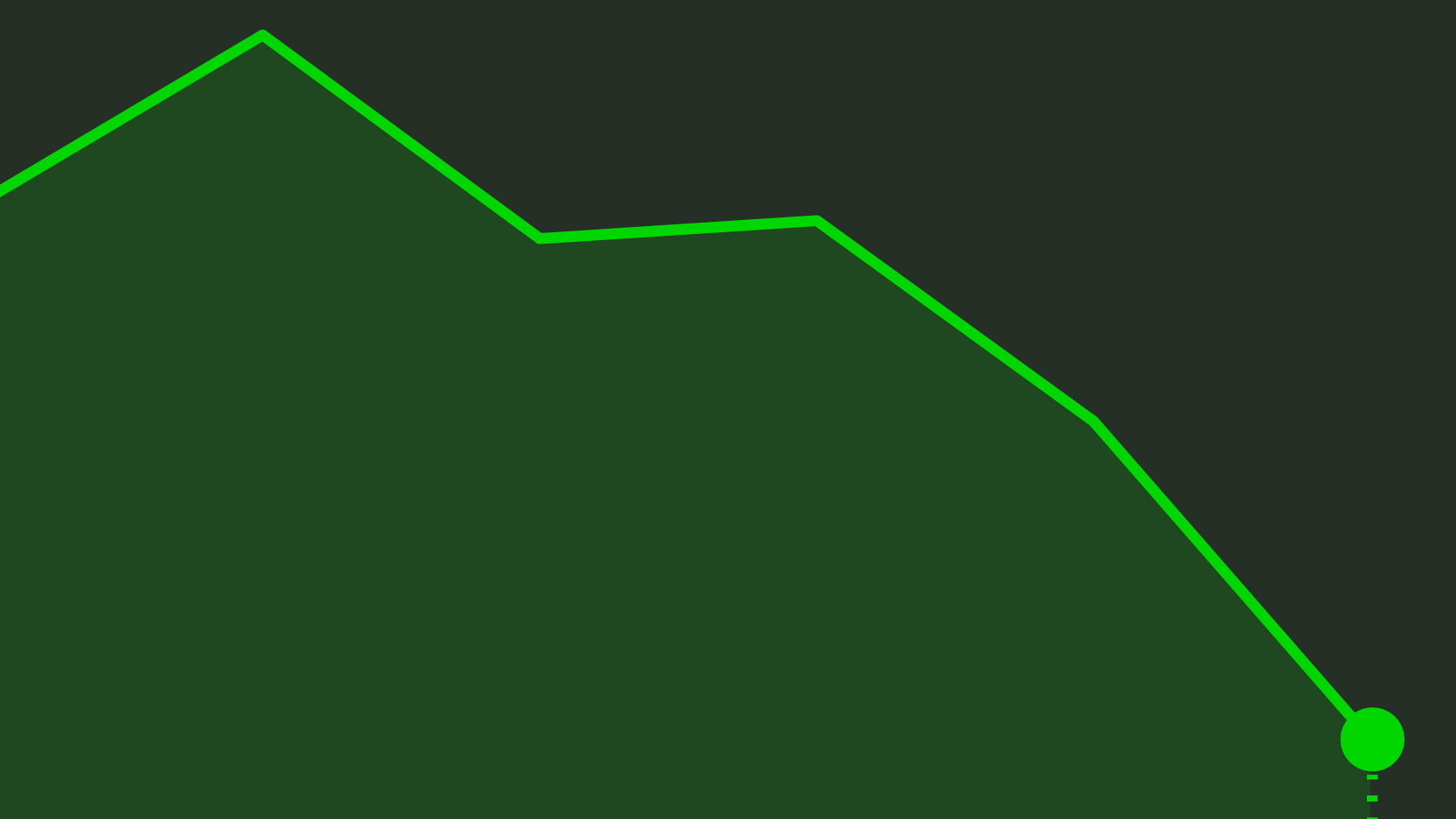

The macroeconomic framework anticipated by the central bank does not significantly differ from the Portuguese government’s expectations. For 2016, the Bank of Portugal (Banco de Portugal) expects a 1.2% GDP growth – one decimal more than what was estimated in October. For 2017, the expectation for the economy is that it should grow slightly to 1.4% (in June the anticipation was 1.6%), followed by an economic activity rhythm of 1.5% in 2018 and 2019.

What went fairly well

The report from the institution headed by Carlos Costa mentions some aspects which demonstrate a moderate optimism, namely:

- Rhythm, that although shy, is not much different from the expectations for the Euro Area;

- Pattern, in which “the economic recovery should remain sustained by the exports’ strength” and in the “moderation of private consumption”;

- Nature, both of the growth noted and the growth projected for Portugal, which show improvements.

However, there are “several structural constraints”

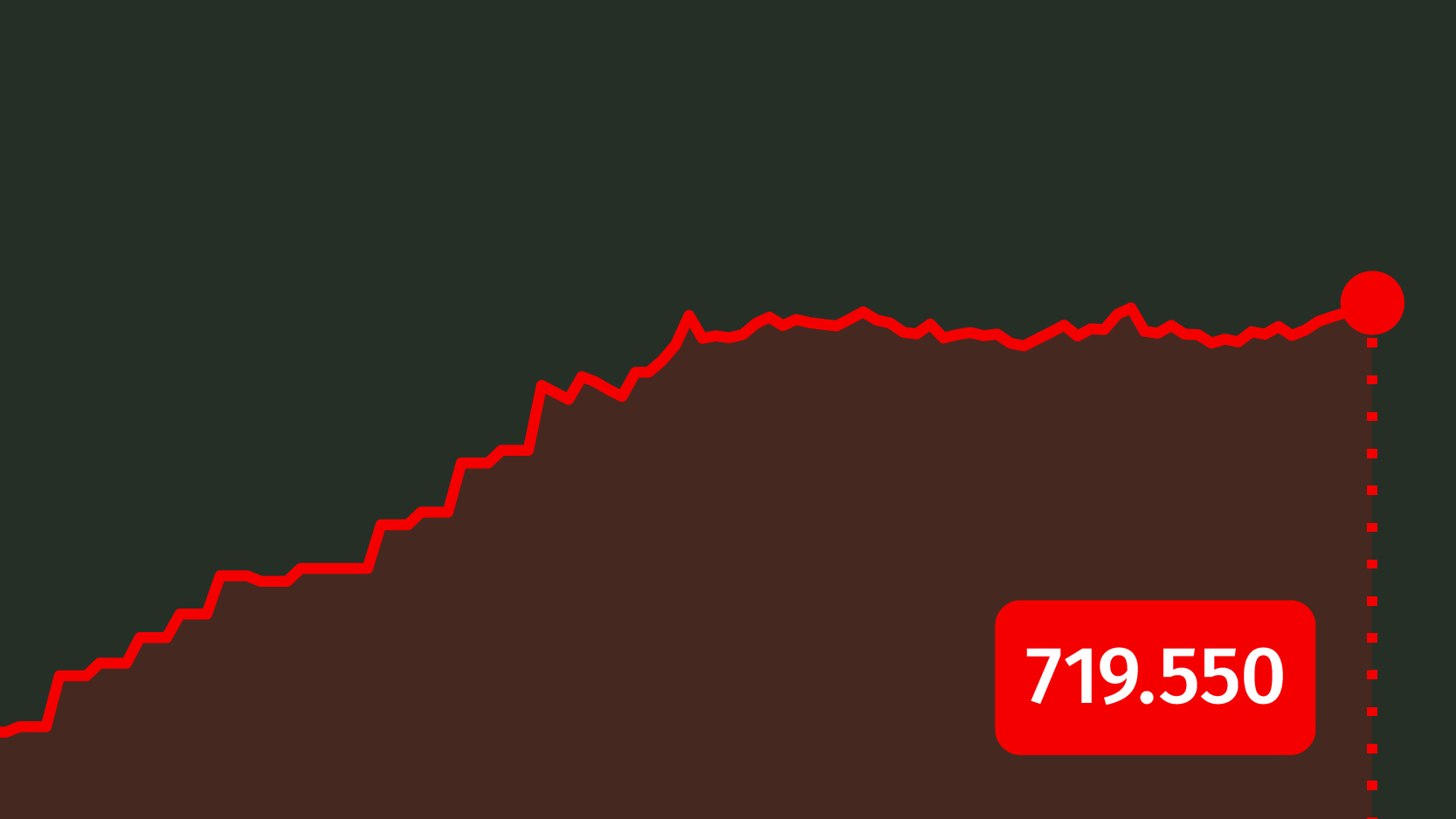

In spite of the good signs, the Portuguese economy is still subject to restraints, which can be found namely in the excessive indebtedness from households, non-financial companies and the public sector. To this problem adds up the “unfavorable demographic evolution, a high level of long-term unemployment and a worse recovery rhythm of investment than previously observed”.

This means that even though Portugal is not growing substantially less than other Euro Area members, the current growth levels mean that only in 2019 will Portugal be able to recover the GDP level it had in 2008. The Bank of Portugal warns: the country cannot reduce its “negative differential accumulated between 2010 and 2013”. Portugal will also benefit from an artificially low public debt interest rates – it should be close to 6%, an unbearable amount given the current nominal GDP growth.

What António Costa must do. And fast

The current monetary policy means structural reforms are needed, says the Central Bank, “which increases incentives to innovation, the factor’s mobility and the investment in both human and physical capital”. Considering the “high levels of uncertainty”, the Portuguese government must also make an effort to maintain a “predictable institutional and tax framework”.

The financial sector must continue to improve its sustainability, and fiscal consolidation must not shrivel: the Bank of Portugal warns “the pursuit of an additional effort concerning fiscal consolidation is crucial for a strong downward tendency in public indebtedness, capable of dealing with any harsh impact”.