Portuguese Debt interests dive the most

The ten-year rate taking the largest dive is the Portuguese, since the market is betting on the extension of economic stimuli from the ECB in the last meeting of 2016 taking place this week.

The European tendency is that sovereign debt yields are worsening, following the expectation that the European Central Bank (ECB) will announce, this Thursday, a strengthening of the assets purchase programme. Public debt is the one taking the most advantage of this scenario.

The Portuguese ten-year interest rates – the reference for the sovereign national debt – are reduced by ten points, the largest fall among its European peers. The rate has been 3.531%, and this morning it reached its minimum of three weeks, at 3.506% (minimum of November 15). For the remaining peripheral countries, the tendency is also of a decrease in interests. The ten-year rate on the Italian sovereign debt has decreased 4.1; as for Spain, it has decreased 2.4 basis points to 1.468%. Germany’s bunds also follow this tendency, with their ten-year interest rate decreasing 2.1 basis points, to 0.351%.

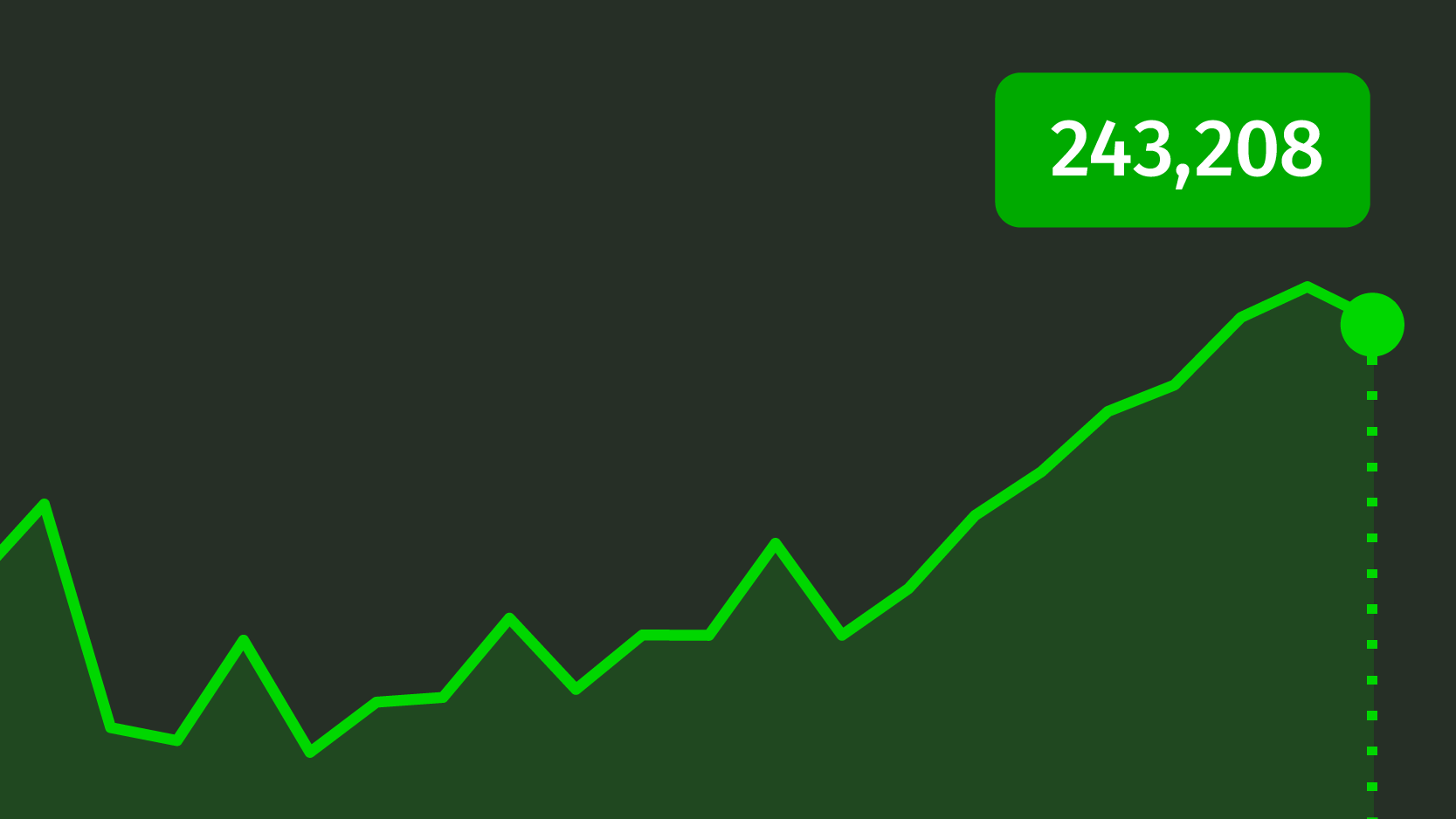

Portuguese ten-year interest rates

Many analysts foresee that the ECB should announce this Thursday the extension of the current monthly debt purchase programme of 80 billion euros to March 2017 or further. The majority of them predict the ECB, headed by Mario Draghi, will extend this programme to September 2017, with the intention of helping the European economy, especially of peripheral countries. This could help justify why it is the sovereign debt in those countries that is having the largest decrease in interests on the secondary market.