Subir Lall: “It’s still early to conclude something has changed concerning growth”

The IMF mission chief for Portugal, Subir Lall, is cautious of growth perspectives and wisely critical of the way public deficit is being reduced.

The economy has recovered in the third quarter, “GDP news is very good”. But it is necessary to wait before concluding a stronger growth has returned. Subir Lall, IMF’s mission chief, was in Portugal between November 29 and 07 December, in an interview to ECO, analyses the current situation, defines as priorities both the banking and public accounts, discusses debt and what is being done in the financial system, as well as the criticism towards Troika.

This is the first part of an interview given in the last day of his trip to make the fifth post-programme evaluation. In this interview he evaluates the overall current economic and financial situation.

What’s your main conclusion in this fifth post-programme evaluation?

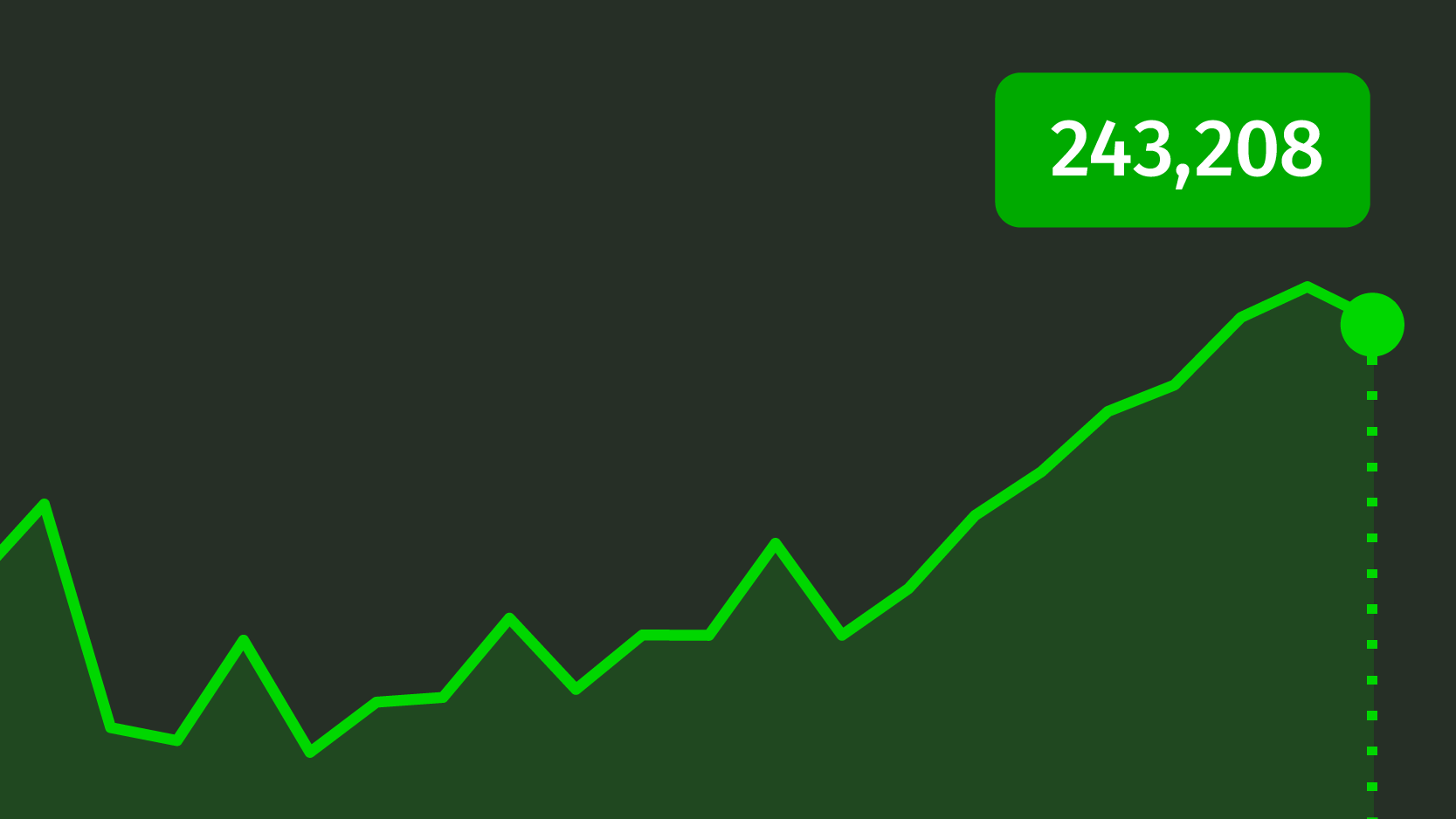

So we were here last in June, so it has been almost six months since our last visit. What we have seen is there is relative macroeconomic stability, which was less clear in the first half of the year, when the trimestral growth rates were lower than anyone expected. And there is also the increase in growth in the second and third quarter and there was also a recovery in investment in equipment, which is good news. And especially welcome was the economic performance in the third quarter after two quarters of very weak growth. The other thing from the mission that becomes clear for the team [IMF] was that the government will comply with the fiscal deficit objective of this year. Budget execution is on track to have a deficit lower than 3% this year. On the financing side, Portugal has been able to access markets regularly and issue bonds and placements. And the banking system finally is on the ongoing process of changes to hopefully be completed in the upcoming months. If you compare to where we were six months ago, those would be the four areas I highlight were there have been some changes and some movements.

Good movements?

Yes, obviously the macroeconomic stability is good news. The sovereign yields remain contained, although they are a bit higher than in August, when they were very low. On the banking system, there is forward momentum, so this is good news.

Are you now much more optimistic than in June?

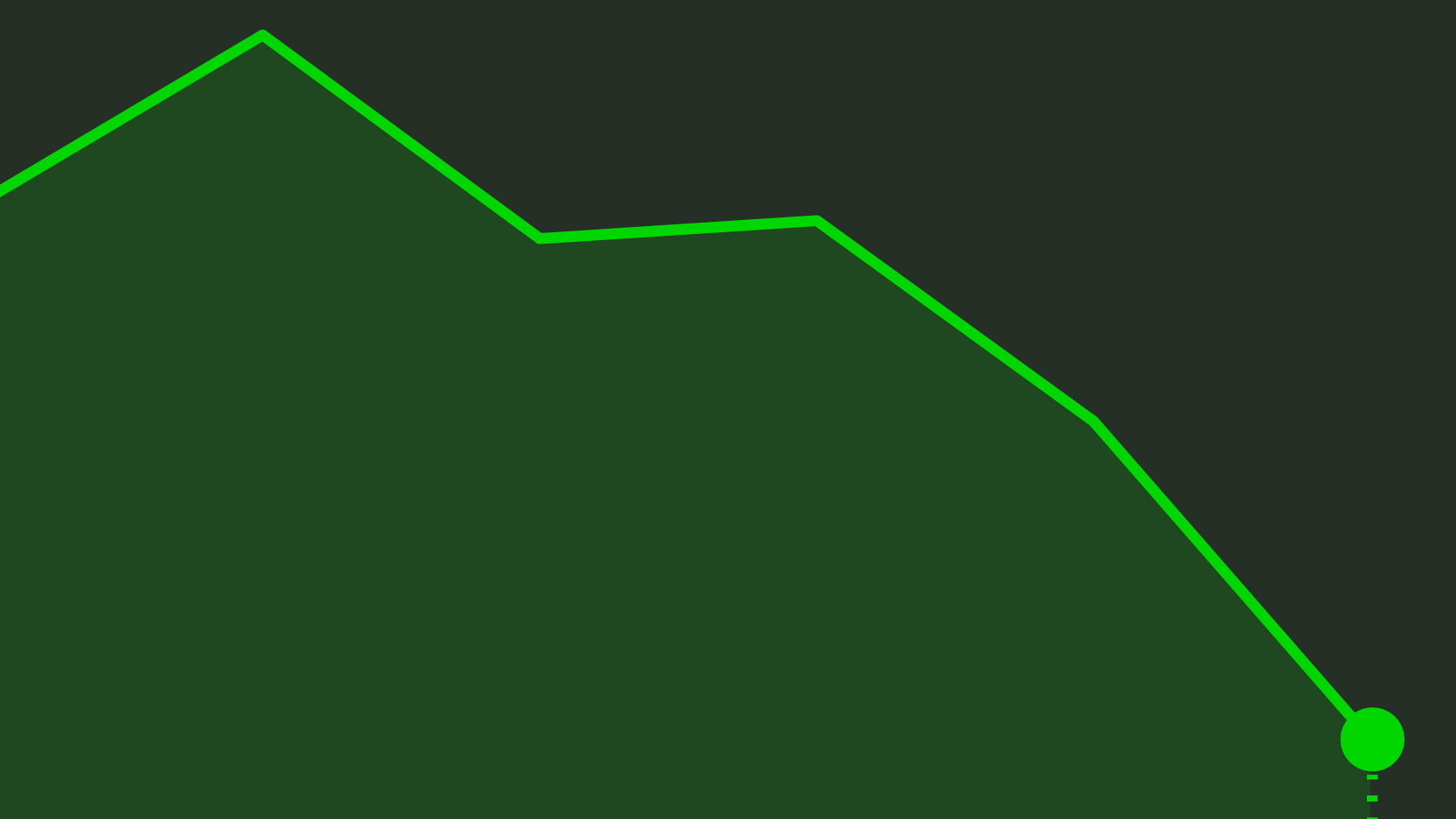

Well, we have to put recent developments in context. In the third quarter, GDP news is very positive, obviously, but it is still just one quarter, influenced a lot by net exports. If you mean fundamentally changing of our view of Portugal’s growth, potential, it would take some time to conclude and we need a few more quarters to see a sustained higher level of growth. And you would need to see if that the growth is more balanced between exports and investment. Investment continues to be relatively weak. While this is good news, it is too early to conclude that something has fundamentally shifted about the growth trajectory. And that is why our medium term perspectives for growth are of 1.2%, a low number. We have revised our forecast in the short term, but it was because of the effects of two or three numbers and not because of a fundamental dynamics.

Are there any urgent and important measures that Portugal needs to take?

I would divide that into two broader areas. One is the financial system and the other is the fiscal area. On the financial system, obviously it is important to carry forward the recapitalization of Caixa Geral de Depósitos and the sale of Novo Banco, which is supposed to be completed in the upcoming months. It is an immediate priority that everybody is working towards. And then there are also the ongoing operations with other big private banks. That is in our immediate agenda, for these things to be completed in order to help reduce some uncertainties around the banking system. Another urgent priority is also to tackle the issue of nonperforming loans of the banking system. We have been talking about it for a long time and nonperforming loans have been rising. But there is more awareness and appreciation for the problem, but in terms of actual concrete reductions, we have yet to see that. Nonperforming loans remain a very important issue for Portugal and for the banking system.

And how about public accounts?

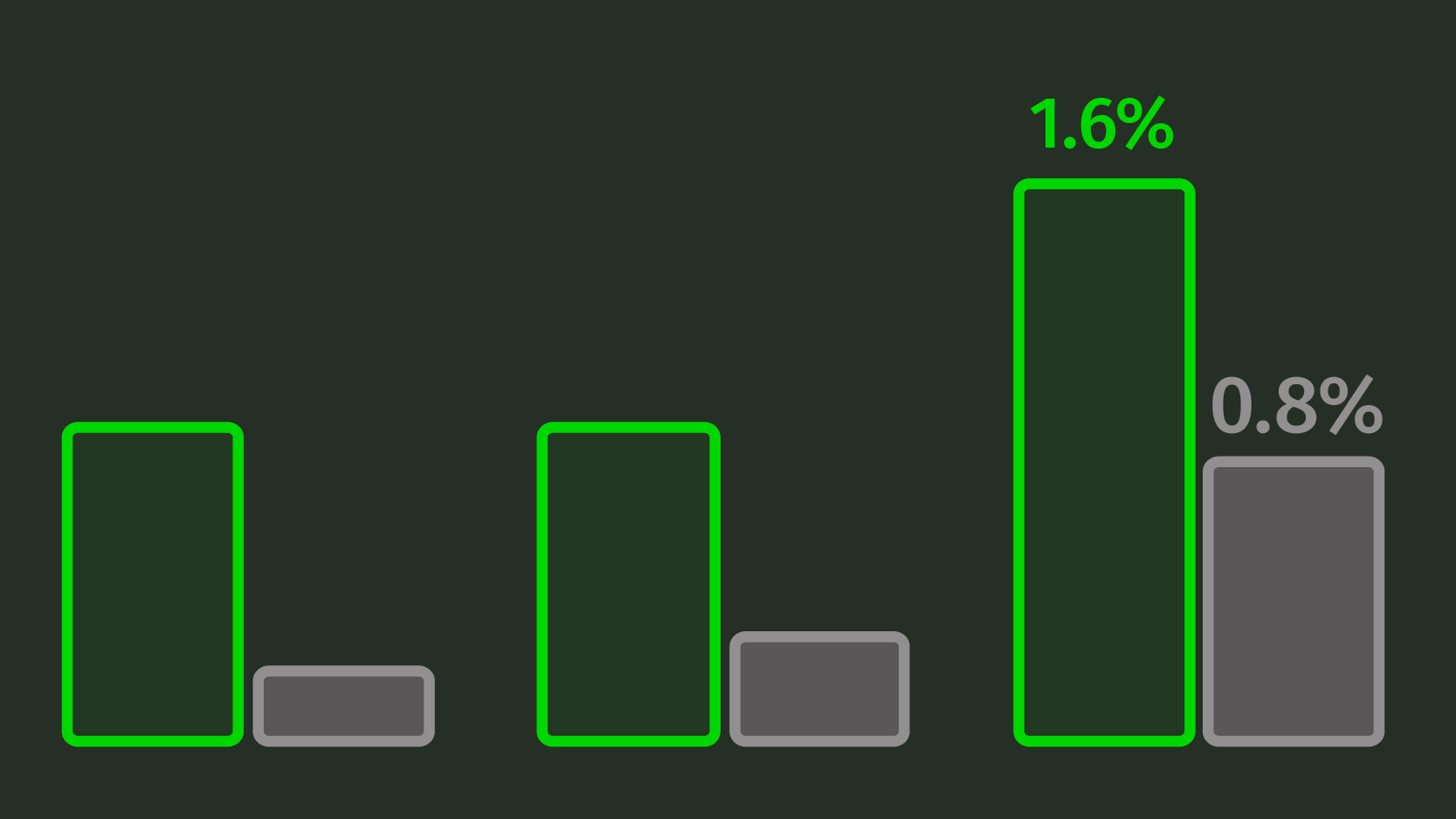

The other concerns we have are about the fiscal policy. The deficit reduction is certainly welcome and is in the budget for next year, but even with the reduction in deficit this year, it is implicit a loosening in structural terms. So when you take all the effects of the economic cycle, there has been a fiscal structural loosening, as we call it. So that is two consecutive years [2015 and 2016] in which there was a structural fiscal loosening. To achieve a durable public debt reduction – and as we know, debt to GDP percentage has not been not coming down, it has more or less flattened out at a fairly high level – you need to have structural fiscal loosening and for that we need a focus on permanent expenditure measures to deal with that problem. For the moment, this year’s execution, for instance, registers an evolution of revenues lower than what the Budget predicted, and it was the strict control in expenses that helped reduce public deficit, underspending on intermediate consumption and public investment relative to the Budget. We think that to achieve durable fiscal consolidation, the underlying causes of expenditure growth need to be tackled, which leads us to thinking hard about issues such as civil services’ wages and the pensions. Because controlling the deficit through underspending is probably not a sustainable way to keep doing year after year. Public investment is at fairly low levels and at some point one has to invest in the maintenance of existing infrastructures. Also, investment matters for potential growth, which is a priority.

Do you think this kind of deficit reduction is unsustainable?

The public debt challenges are huge. In the sense that public debt stock is quite high, meaning it will take a long period of sustained fiscal discipline to bring the public debt down steadily over a number of years, it is not going to be achieved in one or two years. To be able to do that, underspending of categories of the budget, is something that will be very difficult to do year after year. Probably some more cuts on those expenses [intermediate consumption and investment] can be made next year, but we need to have a long term view. We need to go back to dealing with the public expenditure on a durable basis. We’ll need to be back on the agenda, to be able to deliver that kind of debt reduction – the objective of deficit targets.