Ten-year interests are almost at 4%

Ten-year interests have been very close to the 4% threshold. They are already adjusting, nonetheless, but the market stress emphasizes the discomfort over ECB’s limited action in Portugal.

The debt markets are in a fright over the European Central Bank’s decision of maintaining the limits of bond purchases at 33% per issuing line, and are already charging governments. Debt interests in the Euro Area have increased this Monday, which reflects the investors’ stress for a potential limit of central bank’s intervention, after having announced that the public sector purchase programme will be extended. Portugal is among the countries most influenced by the market’s negativity; analysts’ perception places the country among the most harmed in decisions lastly made by Mario Draghi.

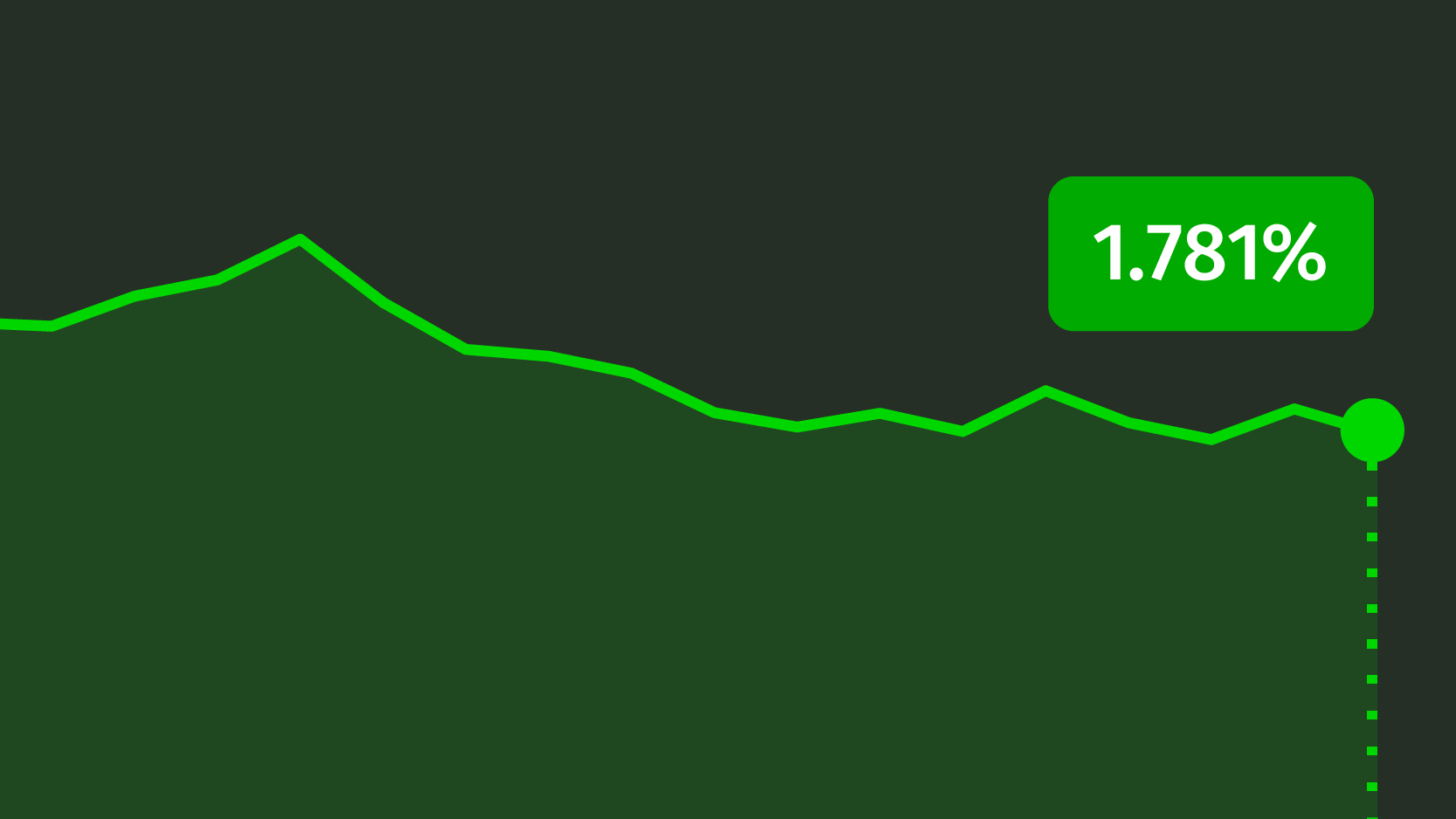

Ten-year government bonds interests are very, very close to the 4% psychological bar this Monday (3.957%), later negotiating at 3.839%. But Portuguese bond yields have risen in the majority of terms. This means investors are demanding a higher return in order to hold the Portuguese debt. If this tendency continues, the next time the Portuguese government is out in the stock market it will have to pay more to sell its debt.

The 4% interests’ threshold had been initially identified as “uncomfortable” for the DBRS, the North-American agency that keeps Portugal eligible for ECB’s purchase programme. Meanwhile, to ECO, Fergus McCormick, chief-economist for DBRS in Portugal, brought forward that, more importantly than an increase in interests, DBRS’s main concern is “the economy’s slow growth”.

Ten-year interests reach maximum of ten months

Last Thursday, the ECB decided to extend the public assets purchase plan for another nine months, until the end of 2017, predicting a plunge in the purchase rhythm of the current 80 billion euros to 60 billion per month starting from April. But what really disappointed the markets was the non-decision from the Board of Governors to increase the purchasing maximum for issued bonds, currently at 33%, restricting the range of action for the central bank’s plan, which has allowed to restraint Portugal’s interests.

“The ECB is pushing the PSPP [Public Sector Purchase Programme] to its limits, exacerbating anomalies. Smaller issuers like Portugal will be hit hard”, stated the Société Générale, in an analysis note. “Portugal is Thursday’s major loser. The new rules hardly make any difference, i.e. there is only €6 billion left to buy (according to our estimates)”, they added.

Meanwhile, Portuguese debt interests have inverted to a red zone. The ECB has been particularly active in secondary markets this season, anticipating the upcoming festive season, usually characterized by a lack of liquidity in markets.