Portugal sells one billion in debt at a lower cost

The average interest rate demanded by international investors to buy a billion euros in five-year bonds decreased to 1.751% after DBRS kept Portugal’s rating.

This Wednesday, Portugal had a billion euros worth of five-year Treasury bonds, with an interest rate falling to 1.751%, relating to the last comparable emission of 1.87%.

"This is one step further in lowering the country’s average financing costs is a sign investors believe in the maintenance of DBRS’s rating. In fact, everything will continue to go well as long as ECB keeps buying Portuguese debt.”

This was the first auction after the Canadian rating agency DBRS kept, last Friday, Portugal’s debt rating at BBB (low), keeping the country eligible for the European Central Bank’s public sector’s debt purchase program, a decision much awaited by the market.

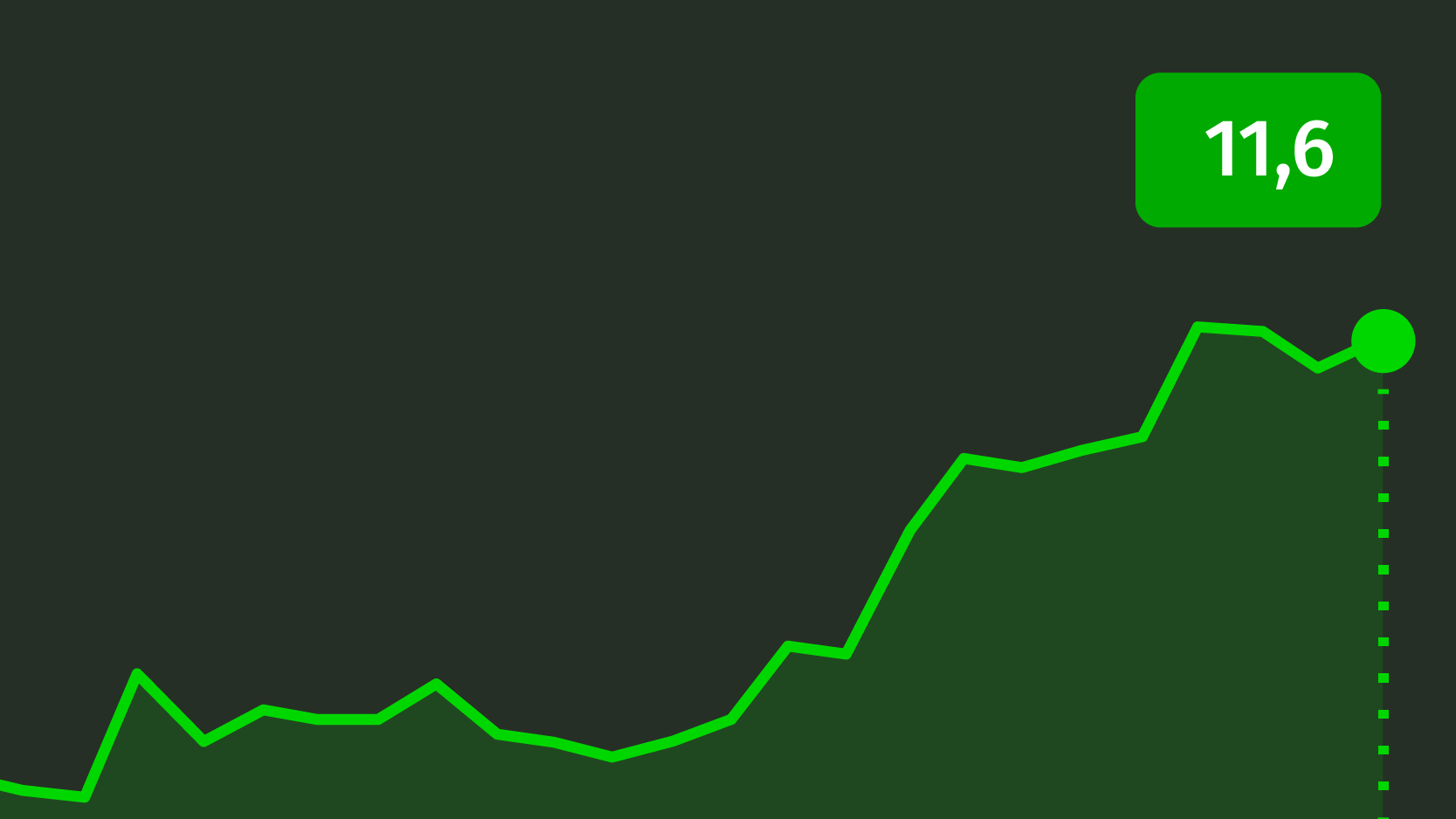

Evolution of five-year bond interest, in October

In spite of the setback in the financing rate, the IGCP (Portuguese Treasury and Debt Management Agency) verified a weaker demand on the investors’ side, being 1.93 times higher than supply – below the 2.15 ratio of the last comparable auction. Even so, the agency has managed to raise the proposed indicative maximum amount.

As far as Marisa Cabrita from Orey Financial is concerned, the fact the bid to cover ratio is slightly below the previous one may “reflect a decreased interest from yield hunters on the current yield level”. The Asset Manager also explains: “However, there are other challenges for the Portuguese Economy, namely the modest growth expectations, as Fitch states”.

In the secondary market, the five-year bond interests kept their downward tendency in October, in the 1.781%.