Interests reach new minimum after DBRS maintains Portugal’s rating

The Canadian agency kept Portugal eligible for ECB’s purchase programme. Portuguese interests are revised downwards, reaching a new minimum since the previous month.

There had been many warnings, but the final result is what matters the most. The Canadian agency DBRS said it is maintaining Portugal at BBB (low), with a stable outlook for the country’s credit risk, which indicates there should be no changes in the Portuguese rating for the following months. In practice, when considering Portuguese debt with an investment grade, allows for government bonds to continue being eligible for the European Central Bank’s public debt purchase programme.

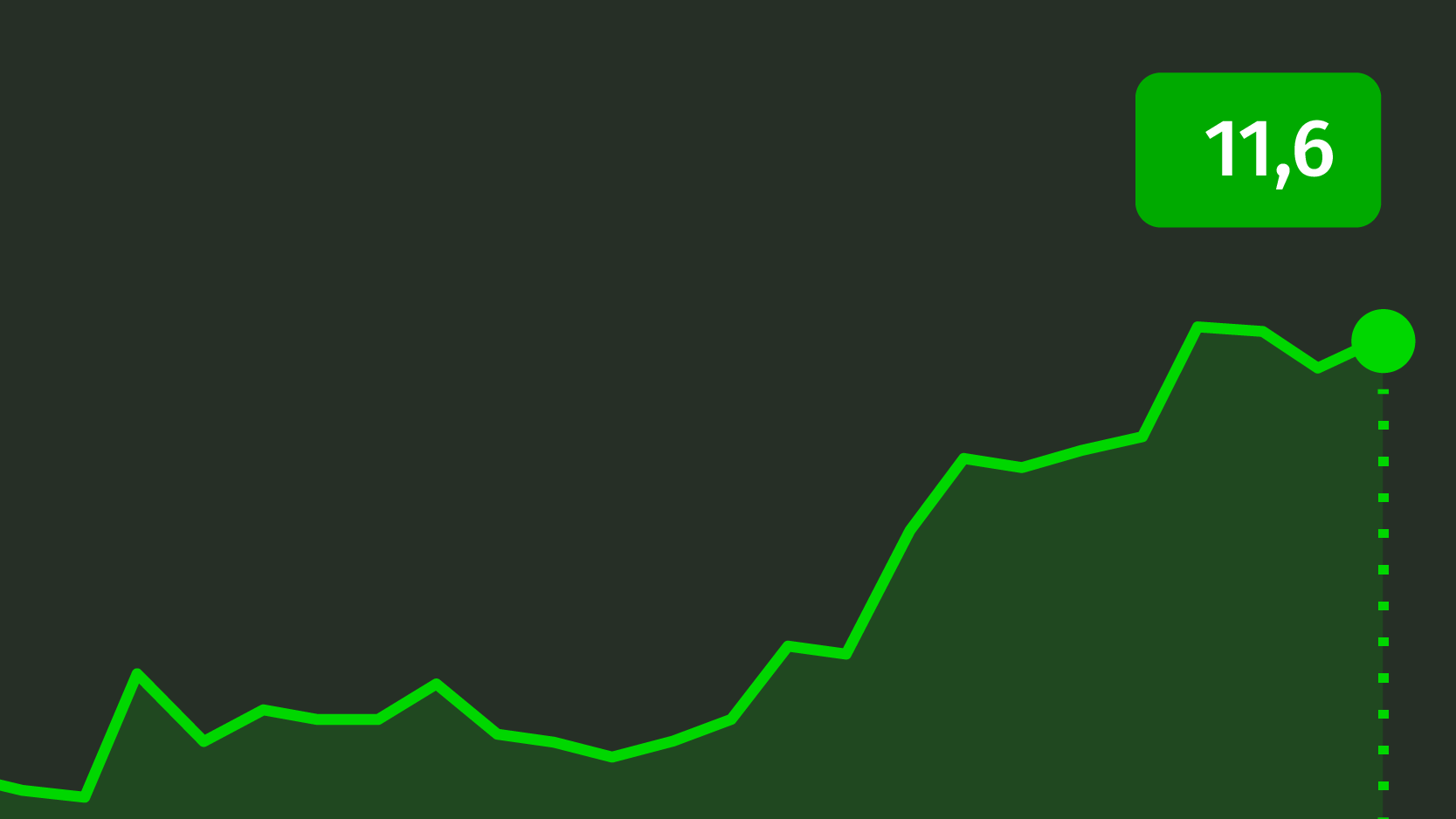

Monday morning is the scenario in which the Portuguese bond market registered decreases at all maturities. As for ten-year bonds, which serve as a reference point for the market, their interest rate plummeted more than 16 basis points to 3.025%, a new minimum since the previous month. The yield on five-year bonds dropped more than ten basis points to 1.691%, its minimum in over two months, when next Wednesday the IGCP (Public Debt Management Institute) returns to the market in this maturity to try to achieve a billion euros.

Evolution of the ten-year bond interest rate since September

“As mentioned last Friday, the bond market’s reaction to the decision made by DBRS would be asymmetrical since rating maintenance was the scenario investors hoped for”, brought forward the analysts for the Portuguese bank BPI in their Journal – Diário de Bolsa.

“Portuguese bonds may be affected by Fitch’s decision to reduce the outlook of the Italian debt. The agency has reduced the outlook of Italian debt to negative, because of the political uncertainty and the modest economic perspectives, as well as the excessive public debt”, the analysts added.

As for other European countries, the atmosphere is calm when it comes to investors’ risk perception. In Germany, interests plummeted once again to negative values. Bund rates devalued two basis points to -0.014%.

In Italy, after the rating agency Fitch cut the debt outlook, the decrease in ten-year interest rates on debt was of three basis points to 1.342%.