VAT and tax return reimbursements continue to harm budgetary deficit until May

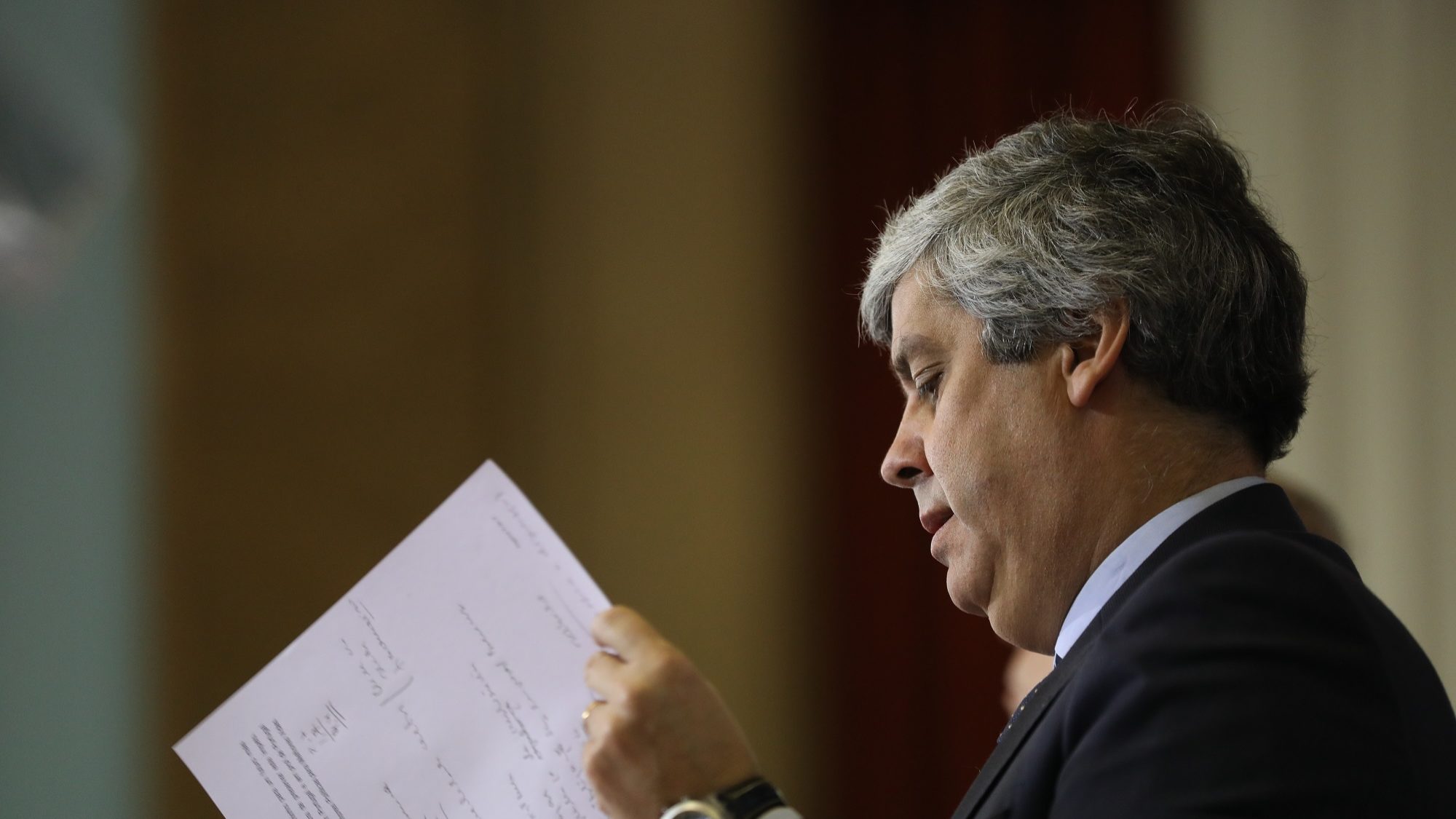

Portugal’s January to May public administration budget deficit was 698 million euros, 359 million more than in the homologous period of 2016. Yet, this year's goal is still attainable, Centeno says.

January to May’s public administrations deficit was once again above the homologous number of 2016, mainly because of tax reimbursements, stated this Monday the Finance ministry, anticipating this afternoon’s information from the Directorate-General for Budget. According to Mário Centeno’s ministry, the deficit was 698 million euros, 359 million more than in May 2016.

In the first five months of the year, tax reimbursements increased 1,546 million euros, although “throughout the year, the effects of the anticipation of reimbursements will fade when the definite deficit is determined”, the Portuguese Government states. The increase in reimbursements happened due to “a larger efficiency in procedures, which assured a faster tax return to companies and families”, the ministry states.

"Throughout the year, the effects of the anticipation of reimbursements will fade when the definite deficit is determined.”

In Personal Income Tax (IRS), more than 1,190 million euros were reimbursed by May, “six times” more than the number of the same month in 2016. As for VAT, reimbursements increased 323 million euros, because of the decrease in the average reimbursement deadline. Portuguese Finance have explained the monthly regime went from 26 to 20 days in the beginning of 2017.

Although the numbers show a worse public administration’s deficit than in the same period of 2016, the Executive believes the deficit goal for national accounts (the definition which matters to Brussels) will be achieved.