Can Portugal raise income and reduce the deficit? Mário Centeno believes so

The Finance minister is counting on 248 million to progressively remove the civil servants career promotions' freeze; he is also counting on 200 million to improve lower incomes.

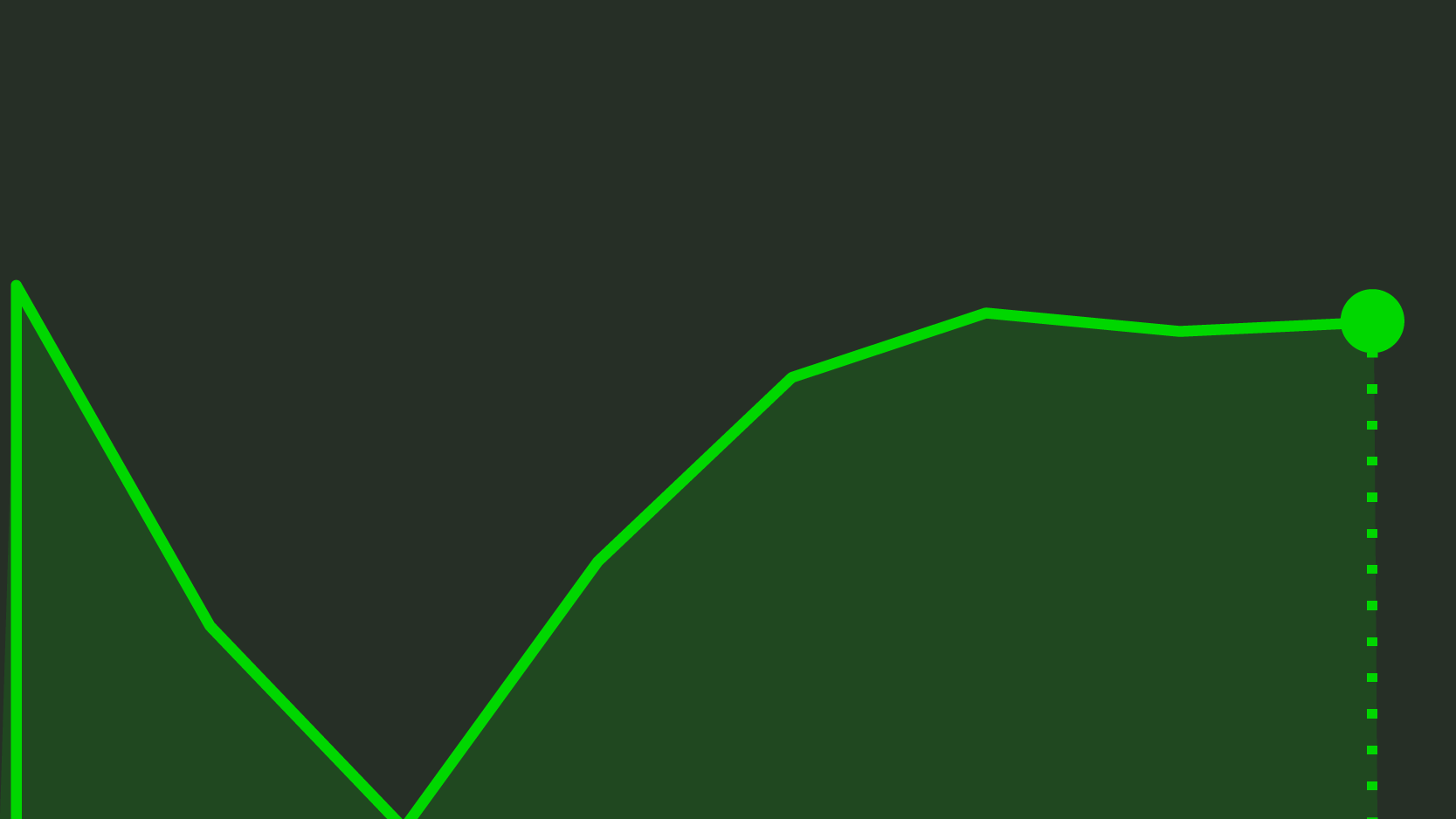

Mário Centeno assures it is possible to decrease the deficit and raise income, all at once. For the 2017 to 2021 Stability Programme, the Finance minister has ambitious budgetary plans which will make Portugal have a budgetary surplus and a public debt percentage below 110% of GDP.

This Thursday, the Portuguese government has sent the Stability Programme update to the Parliament. The document, which was not yet assessed by the Public Finance Council, shows the updated 2017 macro-economic scenario, as well as the projections for Portugal until 2021: the Finance minister’s perspectives point to a country which will grow a little faster each year, until it has a 2.2% growth in 2021.

At the same time, the minister promises a sharp decrease in the country’s budgetary deficit — this year, it should decrease to 1.5% and in 2018, to 1% –, meaning there will be a surplus from 2020 onward. Centeno forecasts that in 2021 there will be a surplus in public expenditure of 1.3% GDP.

In order to achieve those results, the Government acknowledges the need for consolidation measures, namely a set of initiatives which until 2021 are worth 1,337 million euros, excluding one-off measures. Yet, that does not mean there isn’t room to apply 248 million euros in the removal of the civil servants career promotions’ freeze, or to apply 200 million euros in a new measure for the Personal Income Tax (IRS), meant for lower incomes.

2018

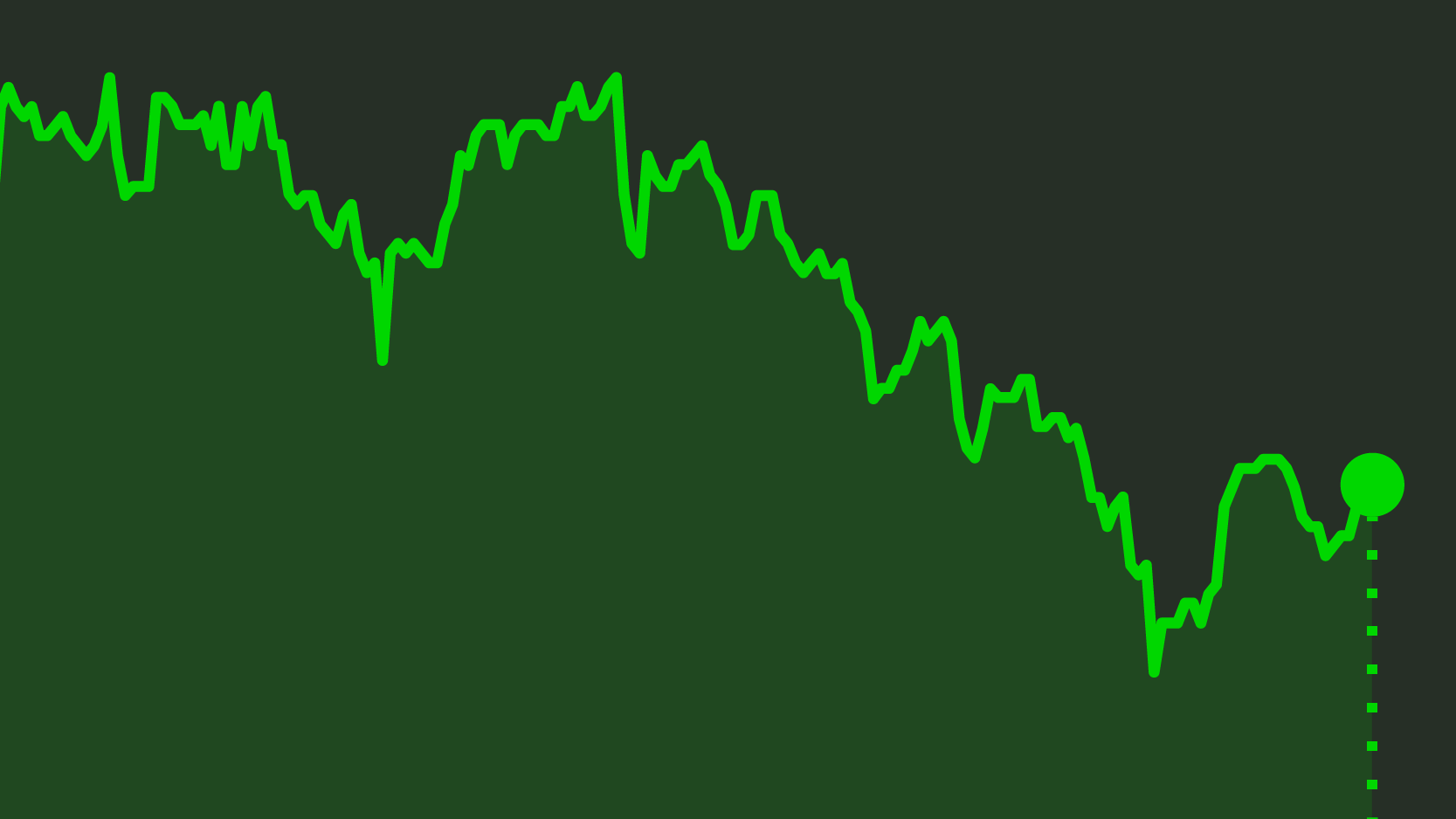

There are no new measures predicted for 2017. As for 2018, the Government predicts it will apply a package of initiatives with a positive impact in the 699 million euros’ balance. Concerning income, the Finance minister is counting on over 461 million euros (in a scenario of invariant policies); as for expense, he promises to cut down 238 million euros.

- Income: Centeno hopes to get 321 million euros from the extraordinary contributions’ renewal on the banking, energy and pharmaceutical sectors. The minister also states he intends to achieve an additional 90 million euros on taxes on production and imports; he is also counting on 167 million from structural funds.

- Expense: civil servants’ career promotions will highly pressure expenses (248 million euros), with a 162 million investment promise. Concerning cuts, the most relevant are 300 million euros in intermediate consumption, 180 million in “curbing of current expenditure” and a 152 million euros’ cut in interests savings. The restraint in public sector employment will help reduce 31 million euros in expenditures.

2019

In comparison to the previous year, 2019 will have significant differences concerning income: the Government predicts to end extraordinary contributions on the banking, energy and pharmaceutical sectors. Savings with interests should happen again, although slightly smaller (134 million euros), and a new effort concerning restraint in other current expenditures is expected, worth 90 million euros. The overall measures package is worth a little less than what was predicted for 2018: it is assessed in 486 million euros.

2020 and 2021

As for 2020 and 2021, the main news is that the Government — assuming it will have their mandate renewed — no longer predicts to reduce the number of public service employees; the commitment for these years is only to maintain the number of employees unchanged. The 2021 accounts will be influenced by an extraordinary effect of 948 million euros (another tranche of the Financial and Economic Stabilization Fund’s pre-paid margins).