Brussels authorizes Novo Banco’s sale to Lone Star

The European authorities approved the sale of the transition bank Novo Banco - which emerged from the resolution of BES - to the North-American fund Lone Star.

The European Commission gave the green light to the sale of Novo Banco to the North-American fund Lone Star. This decision takes place when the Liability Management Exercise (LME) proposal is still unknown by the transition bank’s shareholders. The operation, aiming to have a positive impact of 500 million euros in the bank’s capital ratios, is a necessary condition for the conclusion of the deal with the fund.

Brussels “has approved under the EU Merger Regulation the planned acquisition of Novo Banco S.A. of Portugal by Lone Star Funds of the US“. In the press release disclosed this Monday, the European Commission also stated there were no concerns about the acquisition because “the companies have no overlapping activities in banking in Portugal”.

The European Commission has approved under the EU Merger Regulation the planned acquisition of Novo Banco S.A. of Portugal by Lone Star Funds of the US. (…]) The Commission concluded that the acquisition would not raise concerns under the EU Merger Regulation because the companies have no overlapping activities in banking in Portugal.

The Commission further discloses that another approval related to state aid rulings still needs to be made. Brussels clarifies that, on this matter, “the Commission continues its discussions with the Portuguese authorities on a restructuring plan to ensure the return to long-term viability of Novo Banco”.

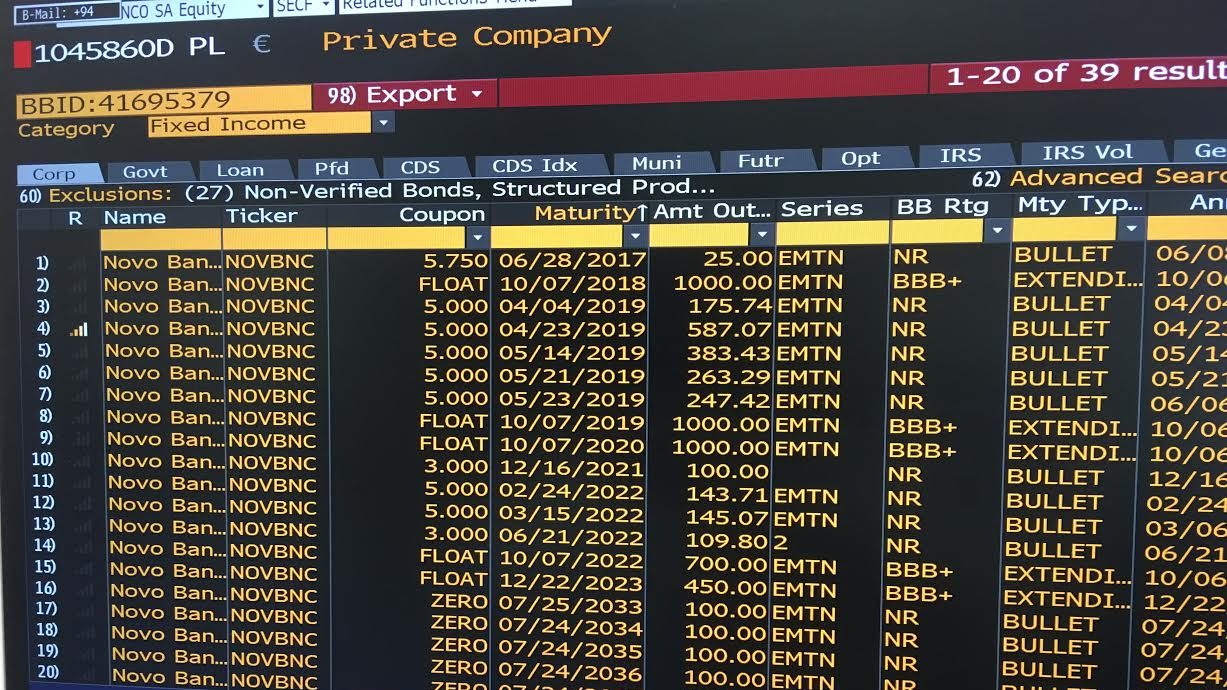

The sale of Novo Banco to Lone Star was announced by the Government on March 31, but the terms of the debt exchange operation are still unknown. The proposal will be disclosed to the market in July, a source close to the process told ECO. The operation will be presented by NB’s administration to international investors by the end of the month. If the bond exchange is successful, NB’s sale will be completed in November, as the State secretary Mourinho Félix had announced.

Officially, all that is known is that the exchange operation must contribute to a reinforcement of the bank’s capital ratios, and that Lone Star will enter with one billion euros in the bank’s capital, out of which 750 million euros will enter when the deal is signed. The Resolution Fund will maintain a 25% stake in the bank and, in addition, it will provide a 3.9 billion euros guarantee to safeguard the risk of the side bank.