Novo Banco: voluntary deal with bondholders might become mandatory. Liquidation is off the table

The voluntary debt exchange, a demand to conclude the sale of Novo Banco, will imply losses for shareholders. And what if there are no volunteers? The offer will become a mandatory bail in.

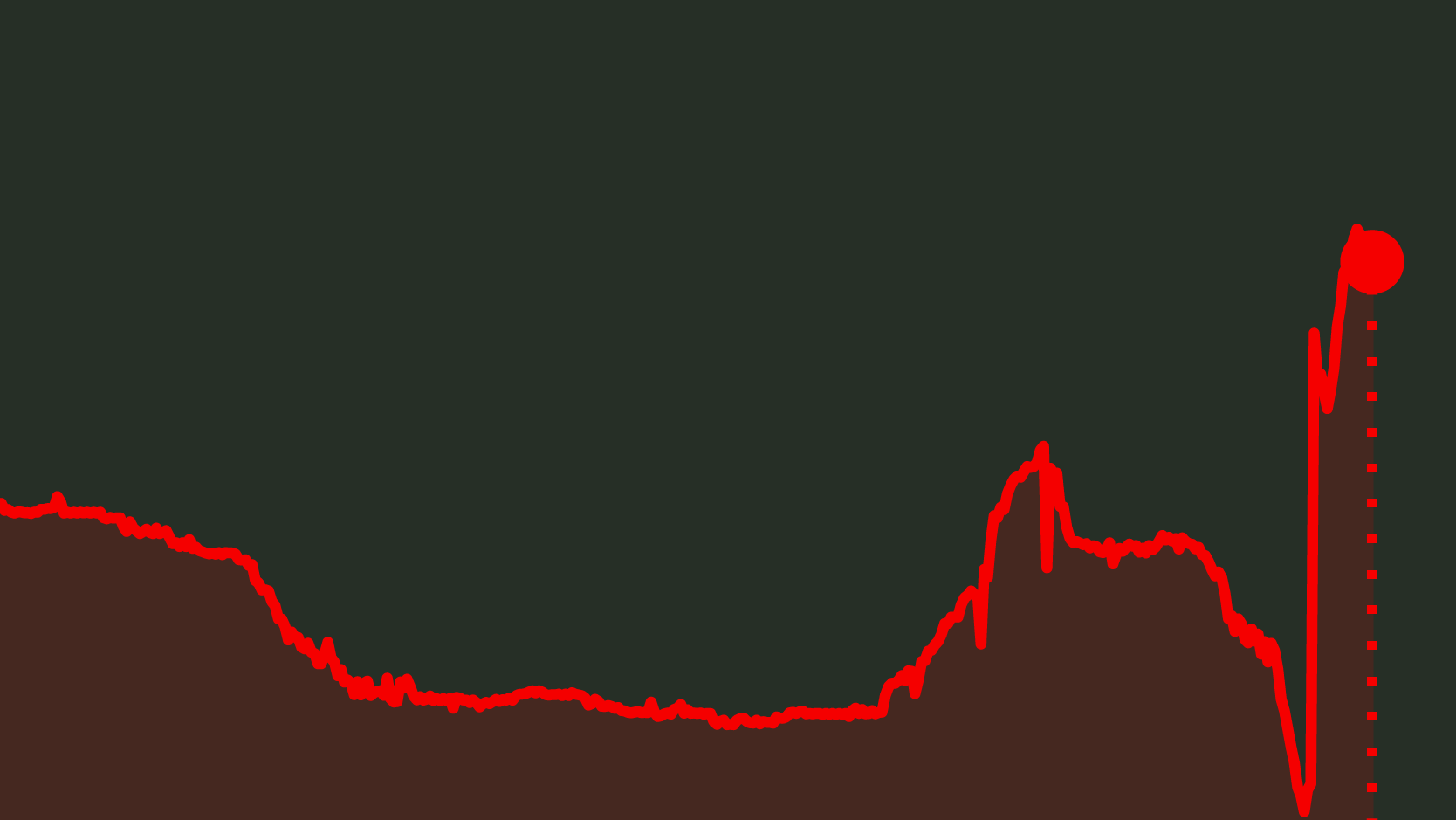

Novo Banco‘s sale process to the North-American fund Lone Star is still dependent on the senior debt exchange, which allow the transition bank to save 500 million euros in capital ratios. Senior bondholders will be asked to “voluntarily” exchange these titles, in an operation whose details are still unknown. If they do not accept to do so, there will be a forced and mandatory bail in, which corresponds, in practice, to a new resolution of NB, ECO discovered near sources close to the process. Nonetheless, it is now sure that the liquidation of the transition bank carved out of BES will never be an option.

After being up for sale for almost three years, Novo Banco now prepares to be owned by Lone Star. But in order for the sale process to be concluded, NB‘s senior bondholders must accept the conversion proposal which will be presented by the Government. There are three criteria to bear in mind in that conversion: maturity, remuneration and liquidity. That conversion will concern senior bonds, and the capital the bank needs can be obtained, for example, through the exchange of very long-term securities — with high rates –, for other securities with a lower maturity — and lower interests. Investors will suffer losses with the operation.

"The solution found does not involve an involuntary action.”

The Portuguese Executive insists: the exchange is voluntary. Yet, ECO knows that if bondholders do not accept the proposal (which is the responsibility of Novo Banco‘s administration), they will still be called to contribute with the 500 million euros’ needed to conclude the sale process of the transition bank.

According to sources close to the process, if bond holders reject this voluntary proposal, a second “proposal” will be mandatory. It is still unknown whether or not the proposal presented will be made line by line — around 40 debt lines were blocked in the negotiation — or jointly. Nor is it know if it will be voted in a bondholders’ general assembly or through a scheme of arrangement, the most likely possibility.

Debt exchange is not a demand made by Brussels

This debt exchange was an alternative found by the Bank of Portugal to make it possible to drop the counter guarantee Lone Star demanded the Portuguese State. And although it was not a demand made by Brussels, sources close to the process reveal to ECO that the European authorities view this solution favorably, since they support burden sharing.

In order to safeguard private savers — who hold 43% of the 3.2 billion euros worth of debt –, ECO knows there will be different proposals between privates and funds. Institutions will be able to choose the proposal they will present to retail clients, even if that presentation is made under the threat of larger investors, who have already moved forward with a proceeding to block the sale process to Lone Star.