Fitch maintains Portugal’s rating

Fitch maintains Portugal's rating in the 'junk' status - with a stable outlook, nonetheless. Fitch warns the country about the deficit and banking, but commends the prime minister António Costa.

The rating agency Fitch maintains Portugal’s BB+ rating with a stable outlook. After international markets closed, Fitch Ratings, in accordance with the rules, stated on February 3rd they are maintaining the Portuguese Republic’s rating.

Portugal’s sovereign ratings are supported by sturdy institutions, a strong business environment and one of the highest rates of per capita income in the ‘BB’ category.

“Portugal’s sovereign ratings are supported by sturdy institutions, a strong business environment and one of the highest rates of per capita income in the ‘BB’ category”, the agency stated in a press release, which means Portugal remains in the ‘junk’ status, far from investors’ range.

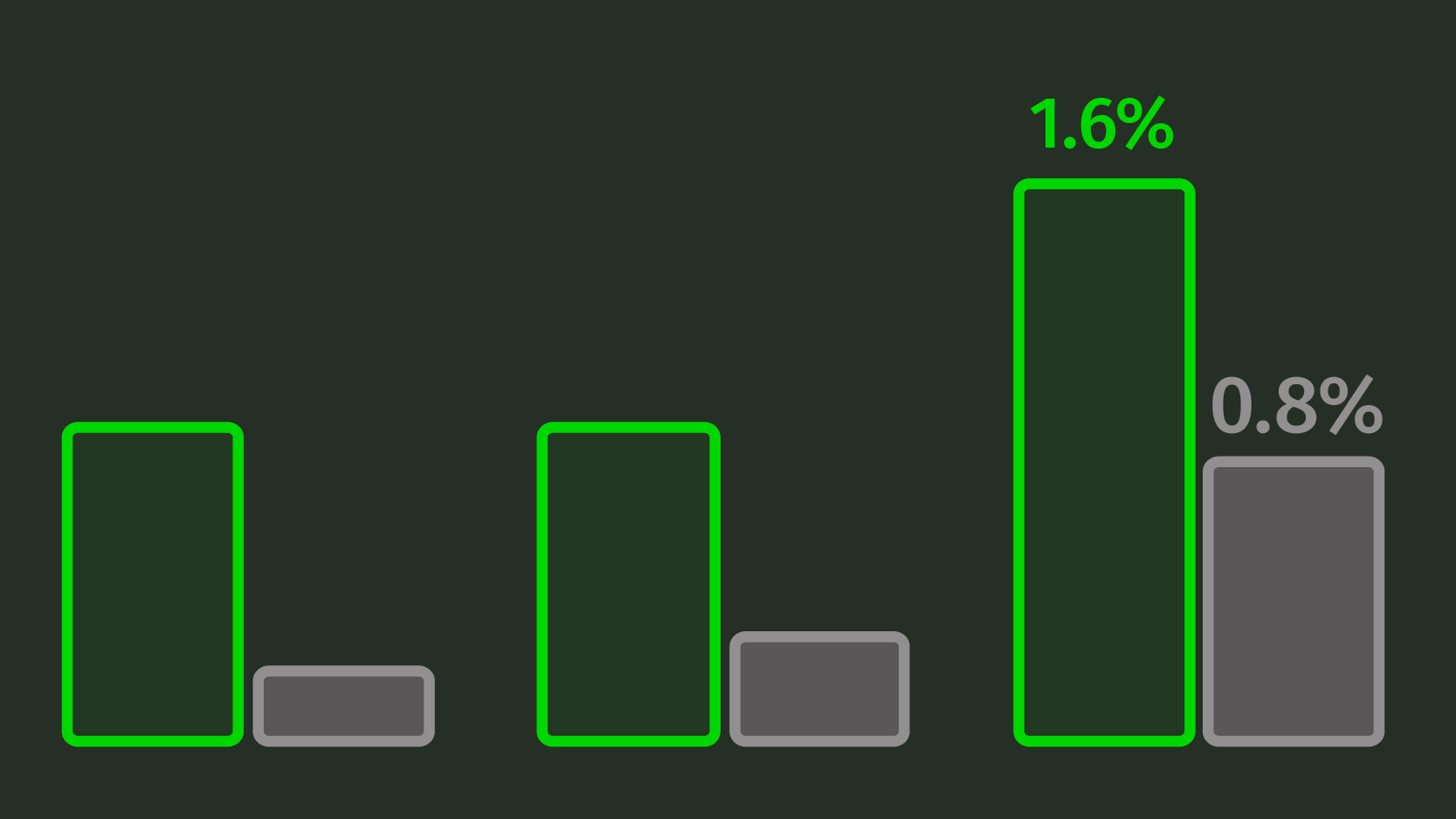

Fitch anticipates the 2017 deficit will return to numbers close 3% GDP because of the CGD 2.7 billion euros’ recapitalization, which they expect will account for “about 1.1% of GDP”. Concerning the 2016 deficit, the rating agency commends the low levels of expenditure, estimated at around 46% of GDP. However, the agency highlights that goal was partly achieved “by restricting public investment, which compounds challenges in boosting medium-term growth“. The rating agency also considers that if the financial sector requires “substantial financial support from the state”, that could result in a negative revision of the Portuguese rating.

The agency commends António Costa, Portuguese prime minister, stating he has a “track record of managing party differences well, which assures political stability”, in spite of the “little scope to implement ambitious structural reforms in other economic areas”. Finally, Fitch warns against external risks: “Upcoming elections in key European countries could also lead to political and market volatility, which in turn could increase Portugal’s borrowing costs and affect confidence and investment”.