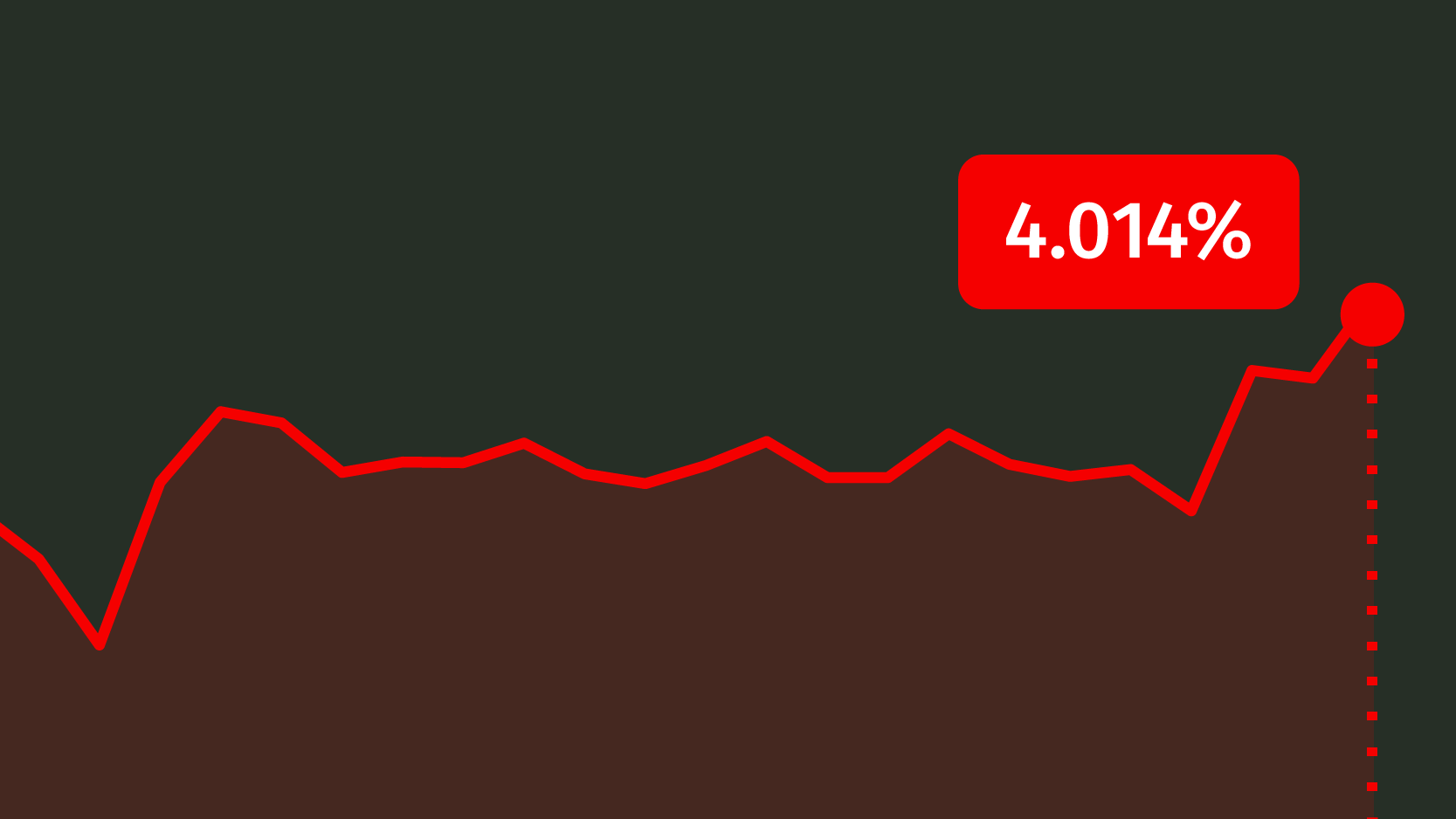

Debt interests reach the 4% threshold again

Portuguese yields worsen on the day of the Euro group meeting, in which Mário Centeno will probably be criticized for its situation, characterized as “not good”.

Portuguese debt interests have once again reached the 4% threshold for ten-year maturities, its maximum since February last year, during the day in which sovereign yields increased all through Europe. It is a sign of a worsening in the sovereign risk perception.

The worsening of national interest – and the surpassing of the psychological threshold of 4% – takes place on the same day Mário Centeno, Portuguese minister of Finance, will most likely be criticized by the Euro group about the current situation Portugal is facing. A source of the Euro group quoted by Bloomberg stated, after this Wednesday’s meeting to prepare the Euro Area Finance ministers’ meeting, that “Portugal’s situation is not good”, highlighting the fragility of the Portuguese banking.

Portuguese 20-year interest worsen

One of the topics of the Euro group meeting will be the follow-up of the post-financial assistance programme, both for Portugal and Ireland. More precisely, it will be discussed if there are any risks that may jeopardize the ability to return the loans received within the financial assistance programme.

This concern happens due to a period of an increase in Portuguese debt interests, which worsened two basis points to 4.004% on ten-year maturities.