Neither 7%, nor 4%? “There is no magic threshold in yields” for DBRS

The Portuguese interests’ peak does not worry the Canadian agency. Over 4%? “There is no magic threshold in yields… we analyze hundreds of variables”, DBRS told ECO.

Portuguese interests have rocketed in the debt secondary market and the Canadian rating agency DBRS, which keeps Portugal’s image relatively positive in the eyes of investors, is not concerned with daily fluctuations in bond rates. Over 4%? “There is no magic threshold in yields or any other asset prices that would trigger a rating action”, stated Fergus McCormick, chief economist for DBRS, to ECO, adding: “We analyze hundreds of variables”.

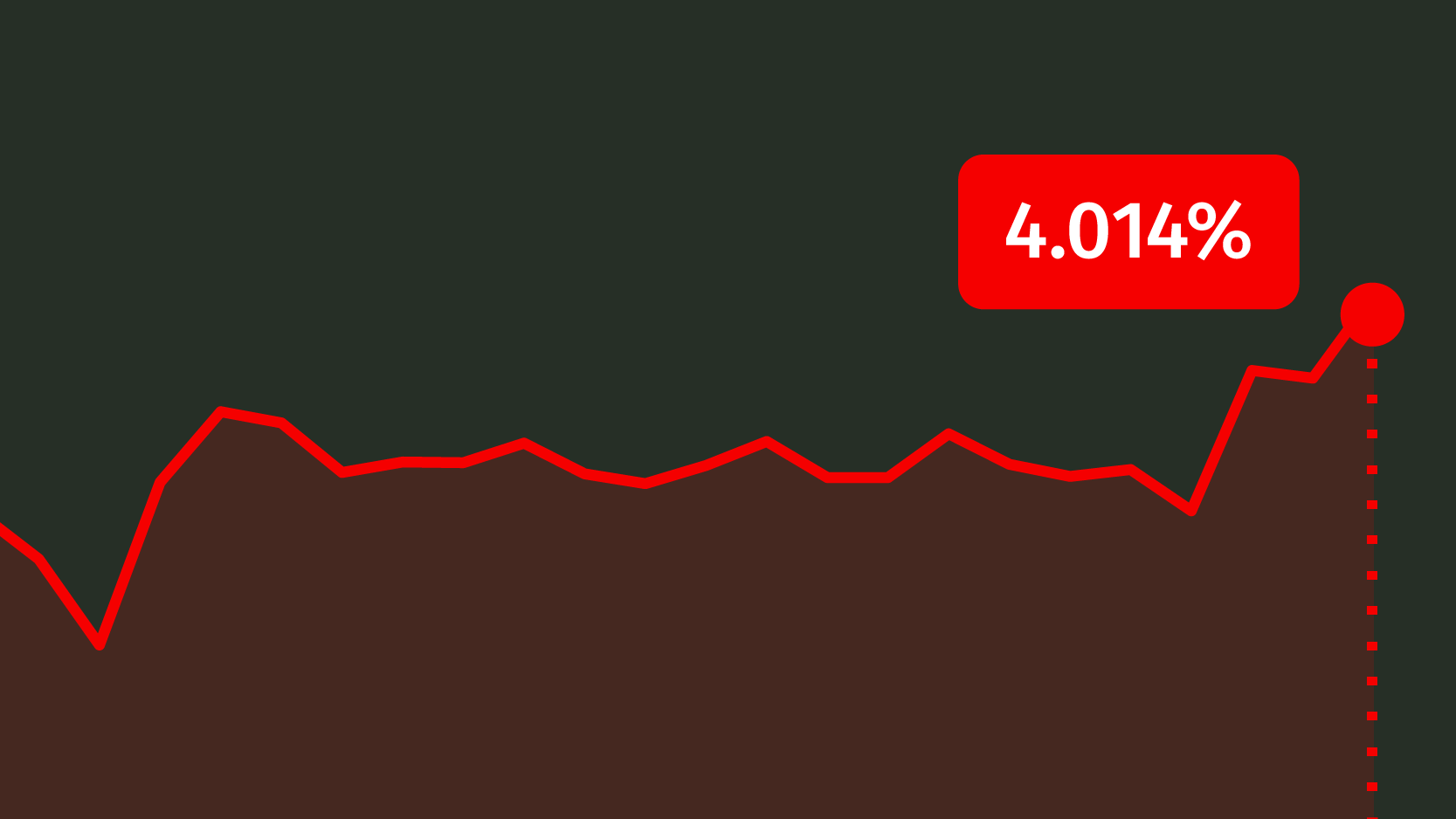

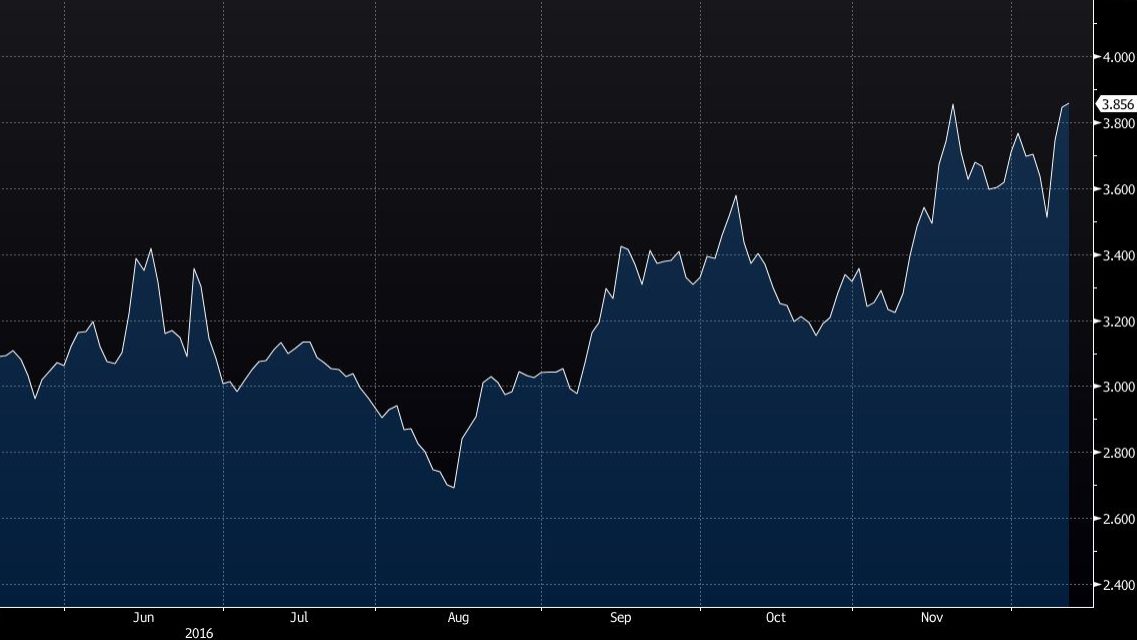

Portuguese ten-year debt interests surpassed this Thursday the 4% threshold. The rate increased more than ten basis points to 4.014%, its highest value since February 2016. This was the percentage the rating agency DBRS had identified as “uncomfortable”.

There is no magic threshold in yields or any other asset prices that would trigger a rating action. We analyze hundreds of variables.

Portugal will be evaluated by DBRS on April 21, but McCormick states that “an incremental increase in bond yields is not sufficient to cause undue downward pressure on our ratings on Portugal”. And he justifies the pressure in the market with the European Central Bank (ECB): “The unwinding of ECB quantitative easing, and the anticipation of a slowing down in ECB net asset purchases, is causing some dislocations in European bond markets, including in Portugal. This is to be expected”, clarified the economist.