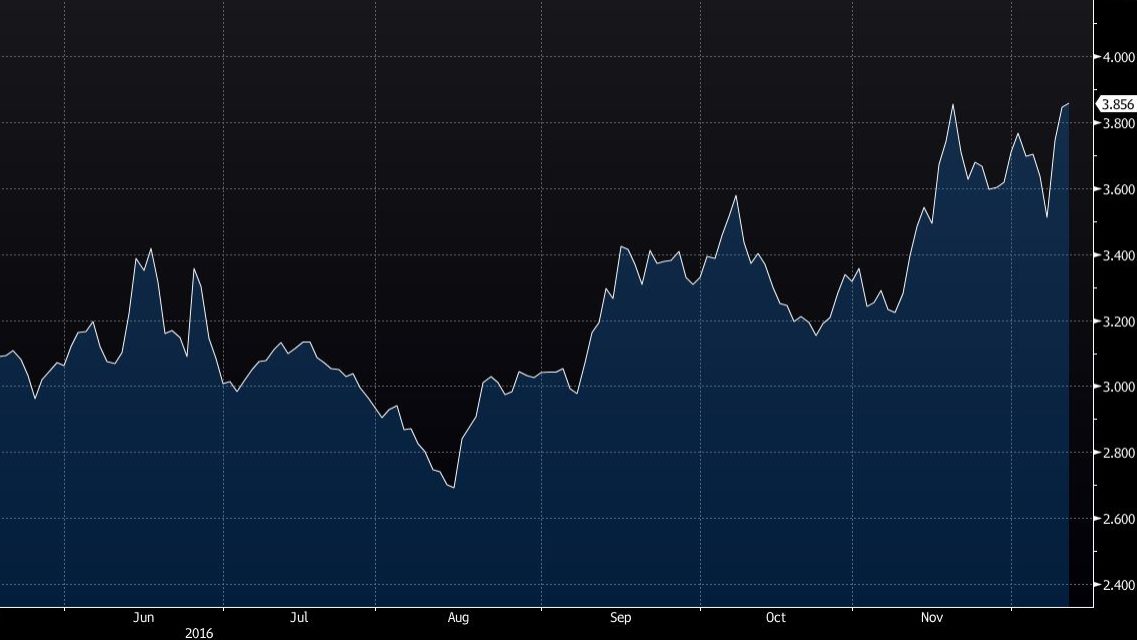

ECB returns to the market and Portuguese interests plummet

The Central bank was absent from the market since December 21. That break ended on the last day of 2016 and in the first session of the new year, Portuguese interests plummet.

After the European Central Bank (ECB) ended their hibernation period, interests associated with the debts of Euro Area governments have experienced a strong adjustment this Monday: Portuguese debt rates have decreased the most among other European countries.

The implied 10-year bond yield has decreased more than six basis points to 3.696%, its lowest value in the last month, following a decreasing trend that is applicable to the Portuguese debt maturities in general. For 5-year bond yields, for example, the interest rate decreased 5.5 points to 1.811%.

Draghi returns and interests decrease

The ECB has an active public sector debt purchase plan of approximately 80 billion euros per month, an amount which will be reduced in April to 60 billion euros per month. The programme, aiming to end in March, was elongated until the end of the year. Since December 21st, the ECB stopped purchasing debt in order to “reduce possible market distortions” due to low market liquidity during the holidays season of Christmas and New Year.