Portugal hires banks to issue ten-year bonds

Portugal has instructed several banks to issue their first ten-year bonds of 2017. The Portuguese Treasury hopes to raise 3,000 million euros through banking syndicate.

BBVA, HSBC, JPMorgan Chase, Morgan Stanley, Novo Banco and Société Générale. These are the banks the Portuguese Treasury and Debt Management Agency (IGPC) hired for the first issuance of ten-year bonds of 2017, according to a source close to the process to Bloomberg.

Through this issuance by syndication, the Portuguese Treasury should raise 3,000 million euros, according to the Portuguese newspaper Jornal de Negócios that also adds the interest rate to be paid by the country should be around 4.25%.

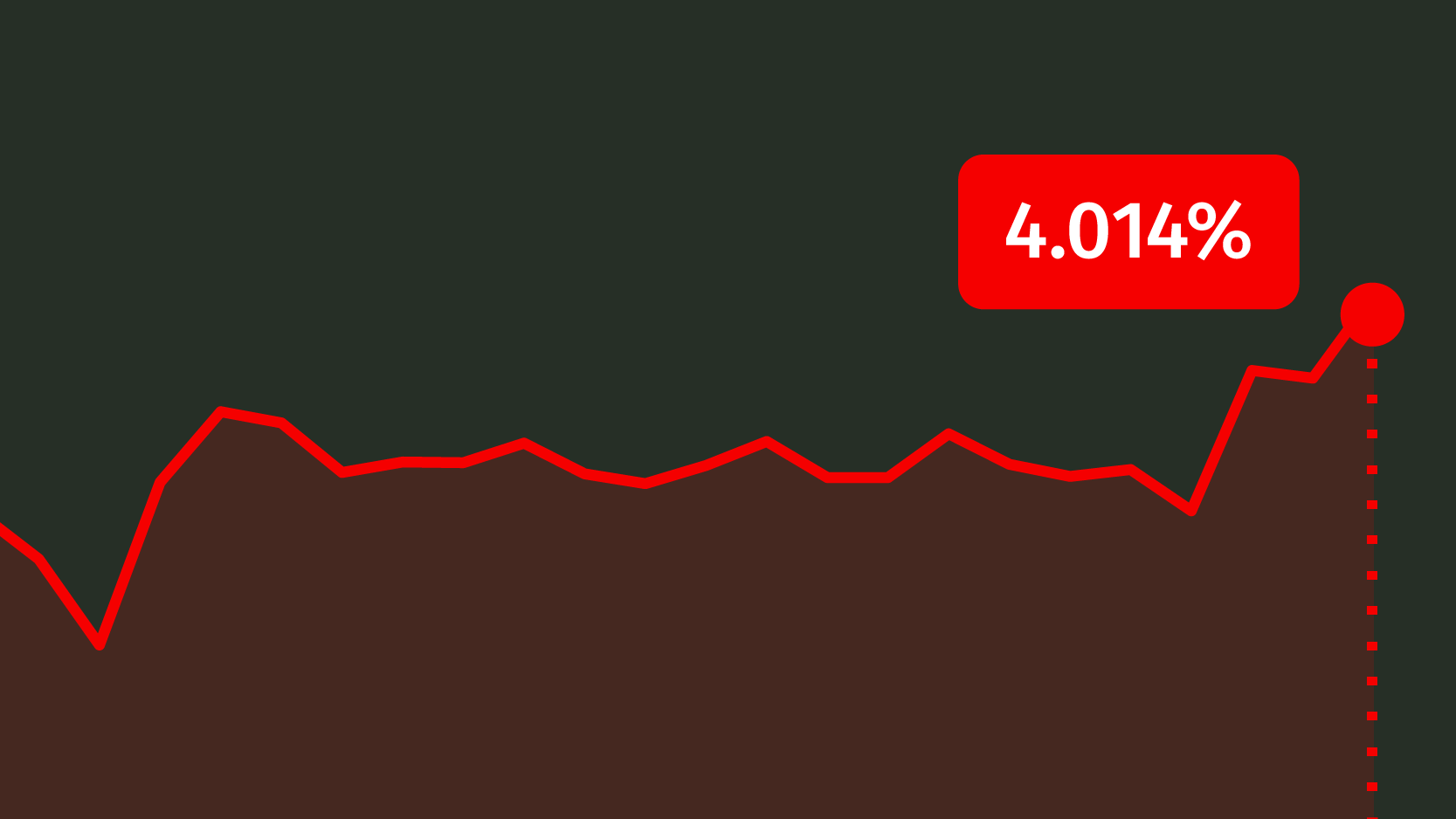

The market was expecting this issuance; it was, in fact, one of the reasons for the recent increase in Portugal’s risk in markets, placing the yield for ten-year bonds above 4%. But this does not worry the Portuguese Government: Mário Centeno, Portuguese minister of Finance, brought forward this Monday that he expects a decrease in interests as soon as the economy shows signs of improvement.

In 2017, the Portuguese Treasury expects to issue between 14 and 16 million euros in government bonds through monthly issuance, according to IGCP’s Financing Programme for 2017.

After Bloomberg disclosed the news yesterday, Portuguese debt interest increased even further to 4.097%, its highest percentage since February 2015.