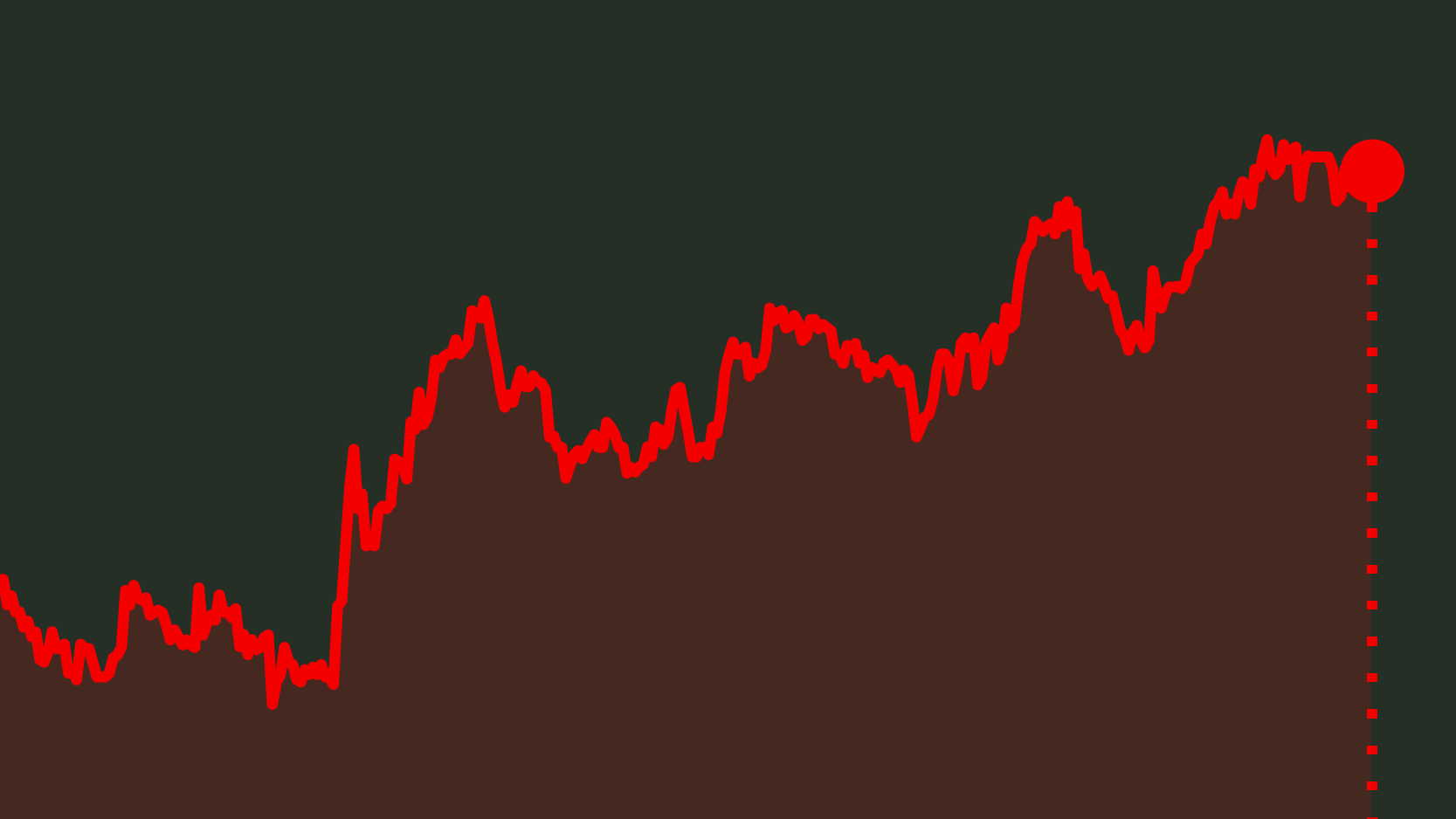

Portuguese economy’s indebtedness reaches a new record of 723.2 billion in August

Public administrations, companies and families' indebtedness reached a new peak in August, after the revision of the series. It increased to 723.242 billion euros, according to the Bank of Portugal.

After July’s relief, the economy’s indebtedness — public administrations, companies and families, excluding banks — reached a new peak in August to a new record: 723.242 billion euros. The public sector was responsible for this increase, according to data disclosed this Friday by the Bank of Portugal.

The amount of indebtedness, in nominal terms, has been growing every month since the beginning of the year, with July as the only exception in 2017. In August, it returned to the upward tendency, with a 1.48 billion euros’ increase.

Even though private companies and families contributed to deleveraging the economy, the non-financial public sector had a 2.4 billion euros’ growth in indebtedness to a total of 319.2 billion euros.

It is important to highlight that the Bank of Portugal revised the series on the non-financial sector indebtedness. For example, in June, the economy’s indebtedness had reached a record at 726 billion euros, a number which has now been updated to 722.4 billion euros (below August’s number) after the whole series was revised, reaching 383.2% of GDP — in the same month of 2016, it was 389.7%.

As for August, it is expected that the increase of nominal debt was accommodated by the economic activity growth; GDP numbers from the third quarter will be revealed by Statistics Portugal (INE) on November 14.

Low net public debt

According to today’s Statistical Bulletin, the Bank of Portugal also changed their report on public debt net of deposits: now, it embodies deposits from all public administrations, instead of just central administrations, as until now.

By incorporating this change, public administrations’ net debt in deposit assets reached 222.7 billion euros in August — and not the 228.4 billion euros, as initially reported by the central bank.

As for Portugal’s debt according to Maastricht’s definition, there were no alterations: it remained above the 250 billion euros’ psychological threshold.