Portugal gets record negative interests in short term debt auction

This Wednesday, Portugal was able to raise 1,250 million euros in short term debt, in a double auction for Treasury Bills which registered record negative interests.

This Wednesday, Portugal was able to raise 1,250 million euros in short term debt in a double auction for Treasury Bills maturing in three and four months, which registered record negative interests. This was the first time Portugal went to the market after the Government presented in Parliament the 2018 State Budget draft, last Friday.

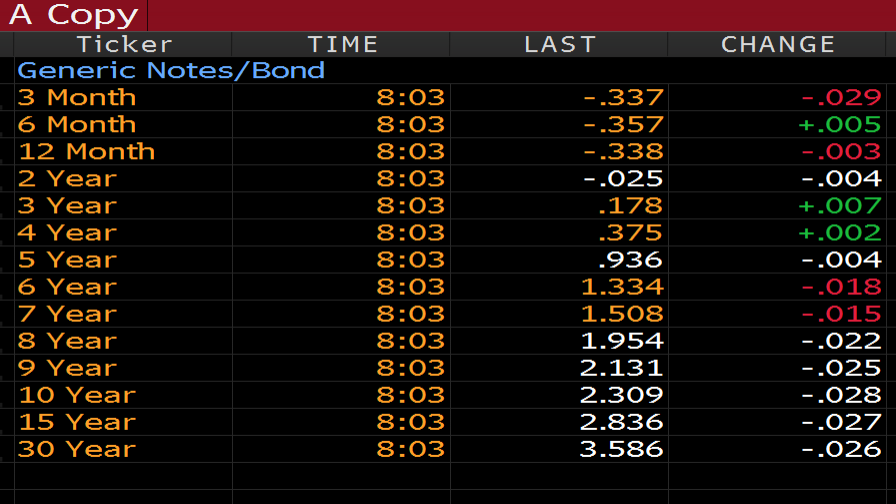

According to IGCP (Portuguese Treasury and Debt Management Agency), 950 million euros were obtained by placing titles maturing in September of 2018 (11 months). In this auction, the Treasury paid a -0.325% interest, comparable to the -0.291% rate registered in the last comparable auction which was performed last August, with a high level of demand: 1.75 times more than supply.

As for the three-month auction, Portugal went to the market and got 300 million euros also with a new minimum interest rate of -0.389%, in comparison to the -0.337% from the previous auction. The market was more interested: demand surpasses IGCP’s offer in 4.55 times.