Banks with €24.6 billion exposure to areas most affected by storms

More than 2,000 companies have already resorted to guaranteed credit lines. Banks warn that non-repayable subsidies will be needed. Exposure to disaster areas amounts to €25 billion.

Last week, the CEO of BCP warned that swift action is needed to save businesses and jobs in the wake of storms that have left a trail of destruction in several areas of Portugal in recent weeks. “The sense of urgency is very high”, Miguel Maya dramatised.

And with good reason. Banks are also assessing the damage, with many millions at risk: in regions where a state of emergency has been declared, exposure in terms of credit to households and businesses amounts to more than €24.6 billion.

“If we are not quick to resolve this problem, the implications for the Portuguese economy will worsen”, warned the BCP leader last Friday at a conference in Lisbon, as quoted by Jornal de Negócios.

The problem is clear: “If companies do not return to the market quickly, they will be excluded from these circuits, and this will have an impact on the profitability of these companies and the income of these people.”

Coimbra, Leiria, Lezíria do Tejo and Oeste were among the regions most affected by the storms in recent days and where most of the municipalities (nearly fifty) were declared to be at the highest risk level following the passage of storm Kristin at the end of January.

Although these regions are far from being those where banks are most active, they accounted for approximately 11% of the credit portfolio to individuals and companies at the end of 2025, according to data from the Bank of Portugal.

With regard to companies located in disaster areas, banks’ exposure amounted to €8.2 billion in December. This amount is almost double the €16.5 billion exposure to households, including mortgage and consumer credit.

“Companies cannot lose touch with the market”

Banks are facing a challenge similar to the one they faced during the Covid-19 pandemic, when many businesses were closed for a long time to stop the spread of the virus. This time, the problems are somewhat limited to the municipal level, but they are more complex.

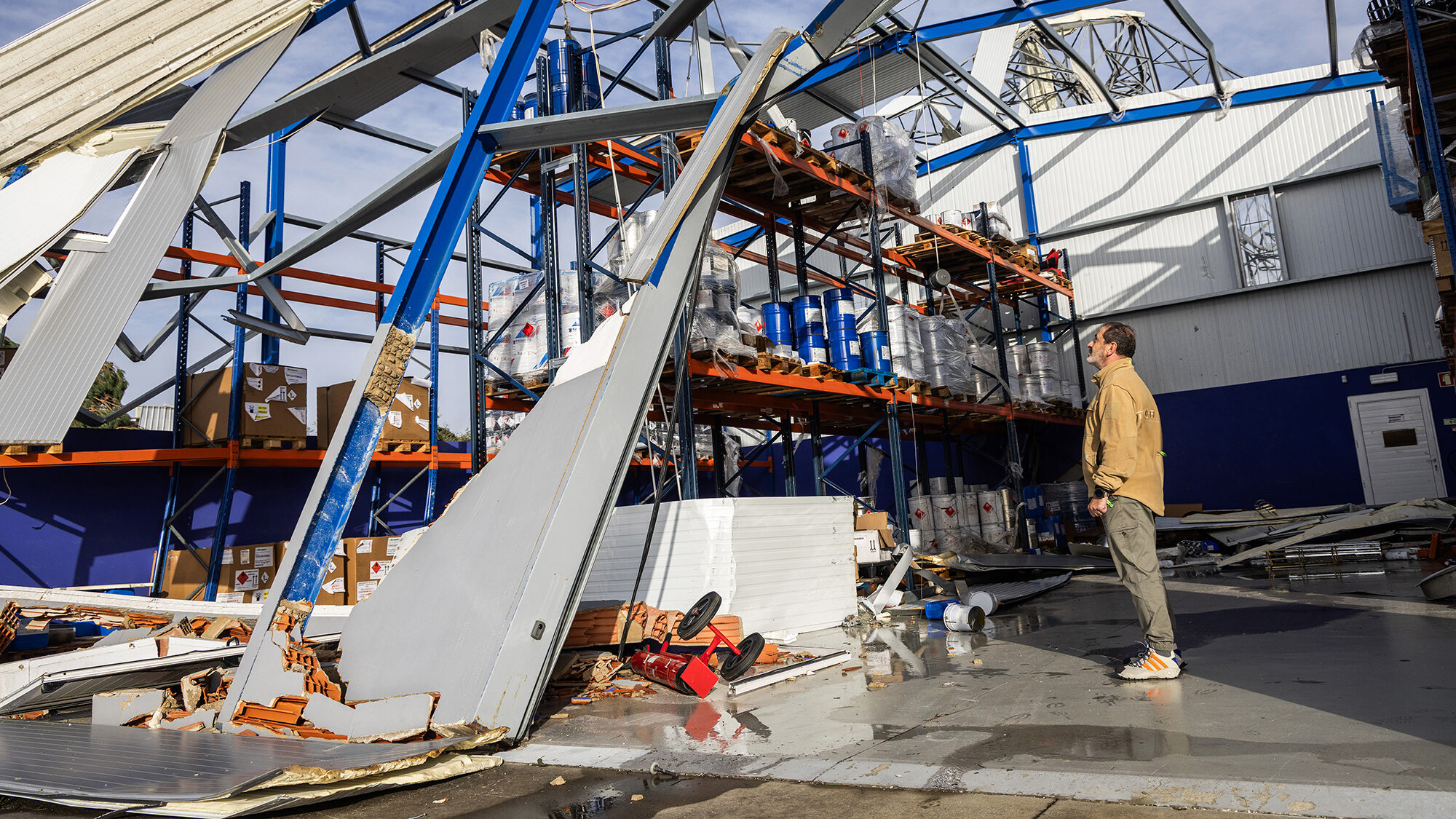

In addition to damage to homes and factories, there is uncertainty about the restoration of electricity and other basic services for a return (as far as possible) to normality. And the longer a business is out of operation, the greater the risk of losing customers to the competition. As Miguel Maya and Manuel Oliveira, secretary-general of the National Association of the Mould Industry (Cefamol), warned in statements to ECO: “Companies cannot lose touch with the market”.

For banks, this situation could turn into a bad debt problem. Something they were far from predicting just a few weeks ago. If factories do not reopen (or if they encounter many difficulties in returning to work) and throw many families into unemployment, it will be difficult for them to honour their commitments to the banks.

For now, the support measures announced by the Government, such as the moratorium and simplified lay-offs, may represent an important lifeline for these regions. However, in the short term, a worsening of the crisis could have implications for banks in terms of the provisions they may have to make to protect themselves from the worst-case scenario.

ECO asked the banks about their adherence to the moratorium in the first few days (the order was only published last Thursday, but with effect from 28 January), but none responded by the time this article was published.

On whether banks should take a cautious approach and set aside money to cope with an increase in credit risk, the Portuguese Banking Association (APB) said that “the way banks manage their relationship with customers, use public policies and manage the associated risks are matters for each individual bank and for which only each individual bank can be held accountable”.

The Bank of Portugal also did not respond to ECO’s questions, namely on whether it is taking measures regarding what banks should do in this situation.

Banks want more non-repayable support

In addition to moratoriums and lay-offs, companies can also resort to state-guaranteed credit lines worth €1.5 billion, of which €500 million is earmarked for cash flow support and €1 billion for recovery and investment. In the latter case, the government has set aside €100 million in grants that companies can benefit from if they maintain their activity and jobs. More than 2,000 companies have already taken advantage of this measure in the first seven days, with complete applications amounting to more than €500 million, according to Banco de Fomento.

Bankers believe it is still too early to take stock, but admit that the measures already announced may be insufficient. And they want more non-repayable support.

“There may eventually have to be more measures. We are in a phase of taking stock, of understanding the scale”, said BPI chairman João Pedro Oliveira e Costa, considering that the Executive had a “meaningful reaction” and that it was important to move forward with immediate measures for companies to “seize now” to ease their cash flow.

“With the level of destruction we are seeing in the Leiria and Marinha Grande areas, it does not seem that this will be resolved with moratoriums and more credit alone”, acknowledged Pedro Castro e Almeida, CEO of Santander Portugal.

Castro e Almeida – who is leaving for Spain – considered that the Government has the budgetary margin to move forward with this. “Portugal has shown above-average growth in the Eurozone, its public debt is falling, and it is recording surpluses. If there is a time when the surplus can be used to support people and businesses, it is now”, he stressed.