Novo Banco has repurchased 4.74 billion in debt. Sale to Lone Star is almost concluded

It's official: Novo Banco has convinced its creditors with short-term debt to sell their securities. Now, the only thing missing is Brussels' green light.

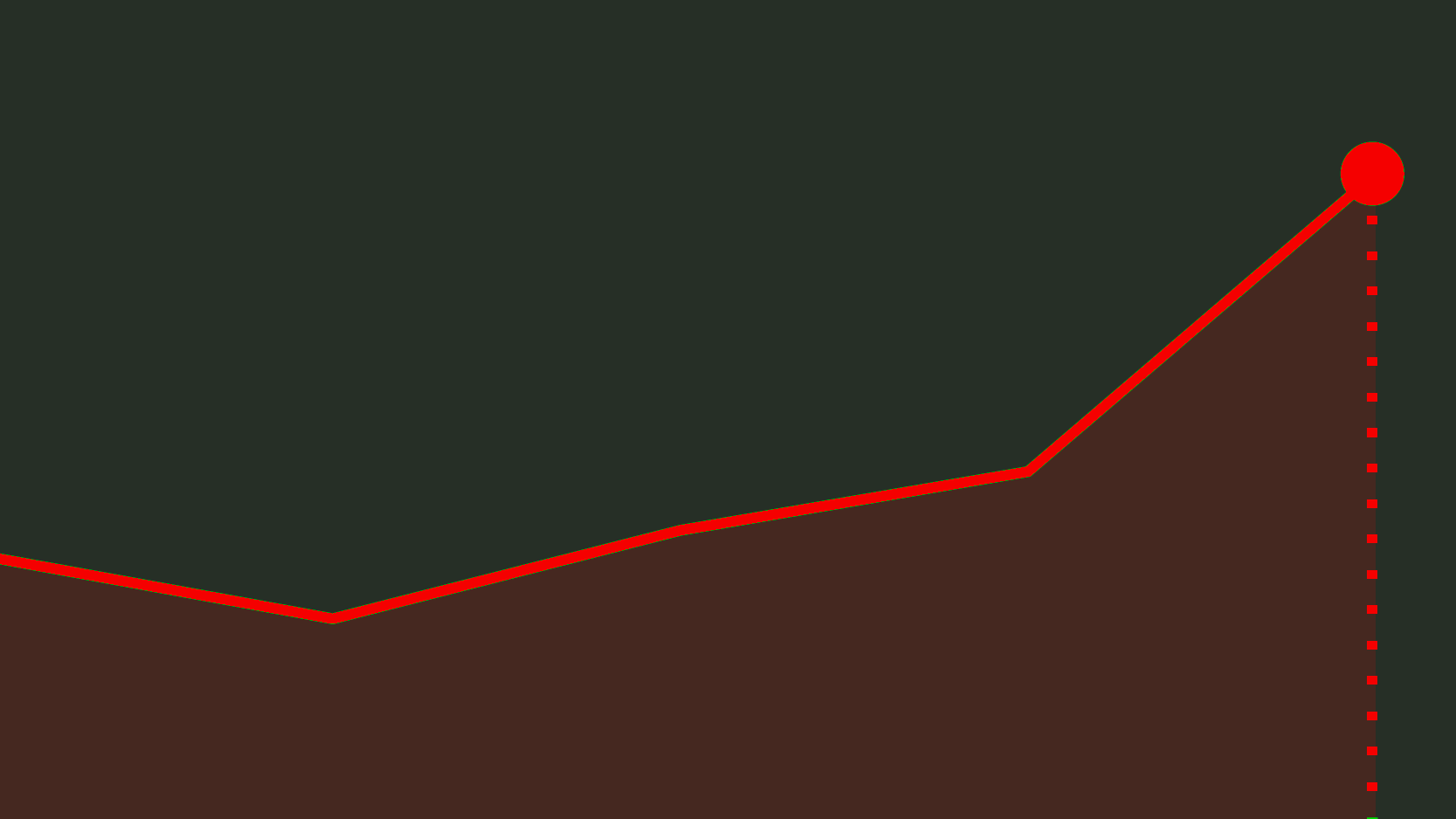

Novo Banco has successfully concluded the debt repurchase offer program, one of the key terms for concluding its sale to Lone Star. The institution’s creditors have accepted to exchange 4.74 billion euros in bonds. By means of this Liability Management Exercise (LME), Novo Banco was able to guarantee more than 500 million euros of capital ratios, already taking into account the impact of these deposits which were a counterpart for the repurchase. Now, all that is left is for Brussels and Frankfurt to formally accept the sale of the bank to the North-American Fund.

"The aggregate nominal amount of (i) the Securities which have been validly tendered and not withdrawn pursuant to the Offers in those Series where the Extraordinary Resolution did not pass and (ii) the Securities of those Series in respect of which the Extraordinary Resolution passed is €4,742,867,393 1, of which €1,871,369,393 in aggregate nominal amount was issued by Novo Banco S.A., London branch.”

“Clearly more than 75%” of investors with shorter-term debt took part in the LME, which was decisive for achieving Novo Banco’s goal — repurchasing enough debt to get a 500 million euros’ capital ratios reinforcement. As for longer maturities, creditors did not participate in such a large scale, but because those are longer-term bonds, especially with a zero coupon, have less of an impact in the capital.

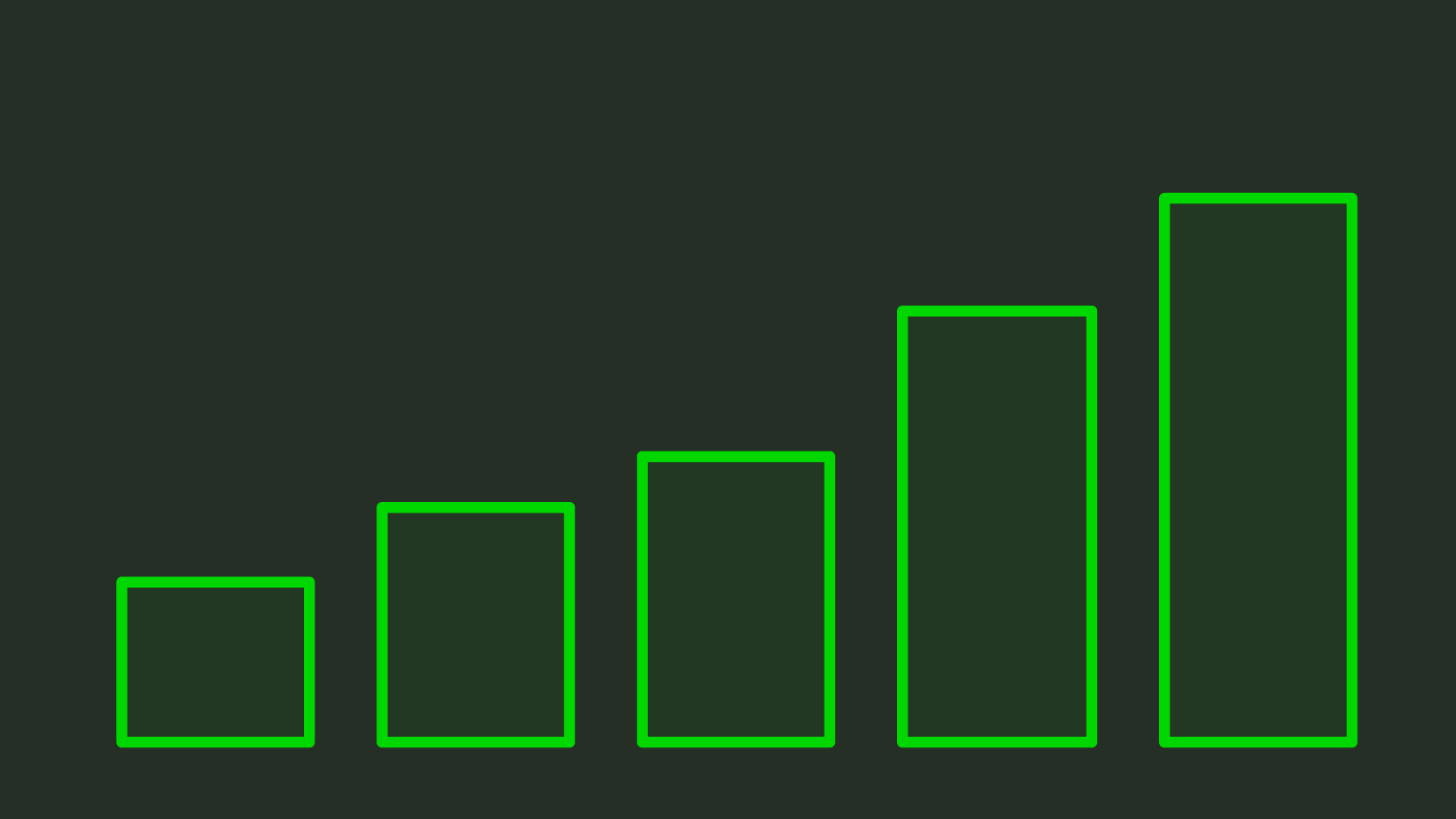

With these results, António Ramalho’s team, Sérgio Monteiro (the Bank of Portugal representative in charge of NB‘s sale process) and the Bank of Portugal are finally able to claim victory on Novo Banco’s sale process, whose alienation attempt goes back to 2015. After much negotiation, especially on the bank’s business plan, the results of the operation were disclosed early morning this Wednesday . Yet, the closing deadline needs to be met in less than ten days — all that is left is the European Directorate General for Competition’s all clear.

The success of the debt repurchase operation was one of the key terms for concluding the sale of Novo Banco to the North-American fund Lone Star, which will keep 75% of the institution resultant from the resolution of the bad bank Banco Espírito Santo.

Lone Star will make a 750 million euros’ injection when the operation is concluded, and it commits to placing another 250 million in three years. The Resolution Fund will continue to hold 25% of the bank’s capital; this Monday, the Government approved a framework agreement which allows the Resolution Fund to continue complying with their commitments, “and therefore contribute to the conclusion of Novo Banco’s sale”.

The framework agreement was made because the sale process foresees a contingent capital mechanism, in which the State assures the North-Americans they will guarantee capital ratios up to 3.9 billion euros. This will happen any time the ratio falls below a certain level — which should be 12.5%.