Novo Banco: bond exchange will move forward this month

Novo Banco's bond exchange offer will move forward this month and it will be opened during August and September. The success of the operation will allow the sale to be concluded by November.

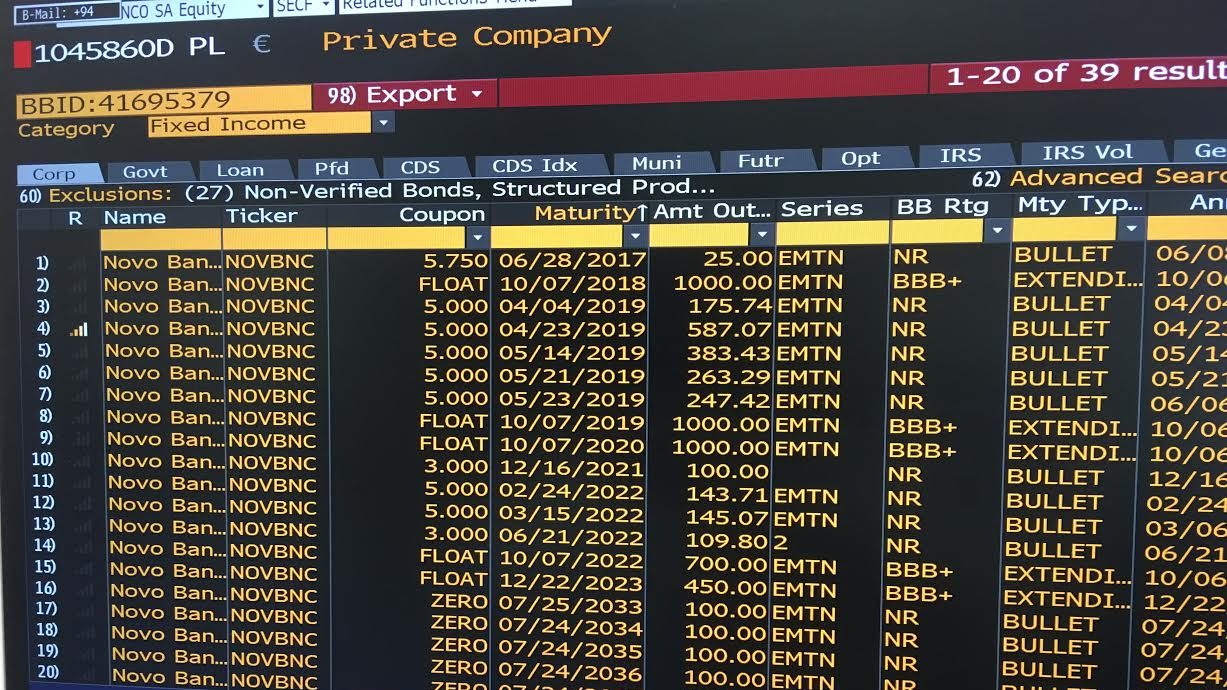

Novo Banco’s bond exchange proposal will enter the market in July, a source close to the process told ECO. The Liability Management Exercise (LME) will be presented by the administration of Novo Banco to international investors by the end of this month and, if it is successful, the NB’s sale will be completed in November, as the State secretary Mourinho Félix had announced.

The sale of Novo Banco to Lone Star had been announced by the Government on March 31, but the terms of the operation are still unknown. It was made known to ECO that the proposal had already been approved by the banks’ board of directors, although there is no official confirmation.

According to sources contacted by ECO, the bond exchange operation (assessed in three billion euros) will be presented this month and it should continue until September, precisely because of the summer vacation month. “We need to make sure that investors have time to properly assess the proposal”, a source told ECO, adding that the goal is to “assure investors don’t loose money in nominal terms, but that they just earn less money — which is different”.

In this context, because it is voluntary and aims to achieve 500 million euros, the voluntary senior bond exchange implies the risk that some investors may decline the proposal and maintain their profitability conditions, at the expense of those who do accept the proposal.

At the moment, in line with the conclusion of the final term of the LME financial conditions, the ECB and Lone Star are discussing the business plan and its effects on the bank’s capital ratios. A source that knows of the operation told ECO that negotiations have not been easy, but he believes there is no chance the operation will not be concluded because of those difficulties.