Portugal pays less than 3% for ten-year debt

Portugal returned to the markets at a time when interests are at its lowest. And the country took advantage of the timing: it raised 1,250 million euros with lower rates than in the last auctions.

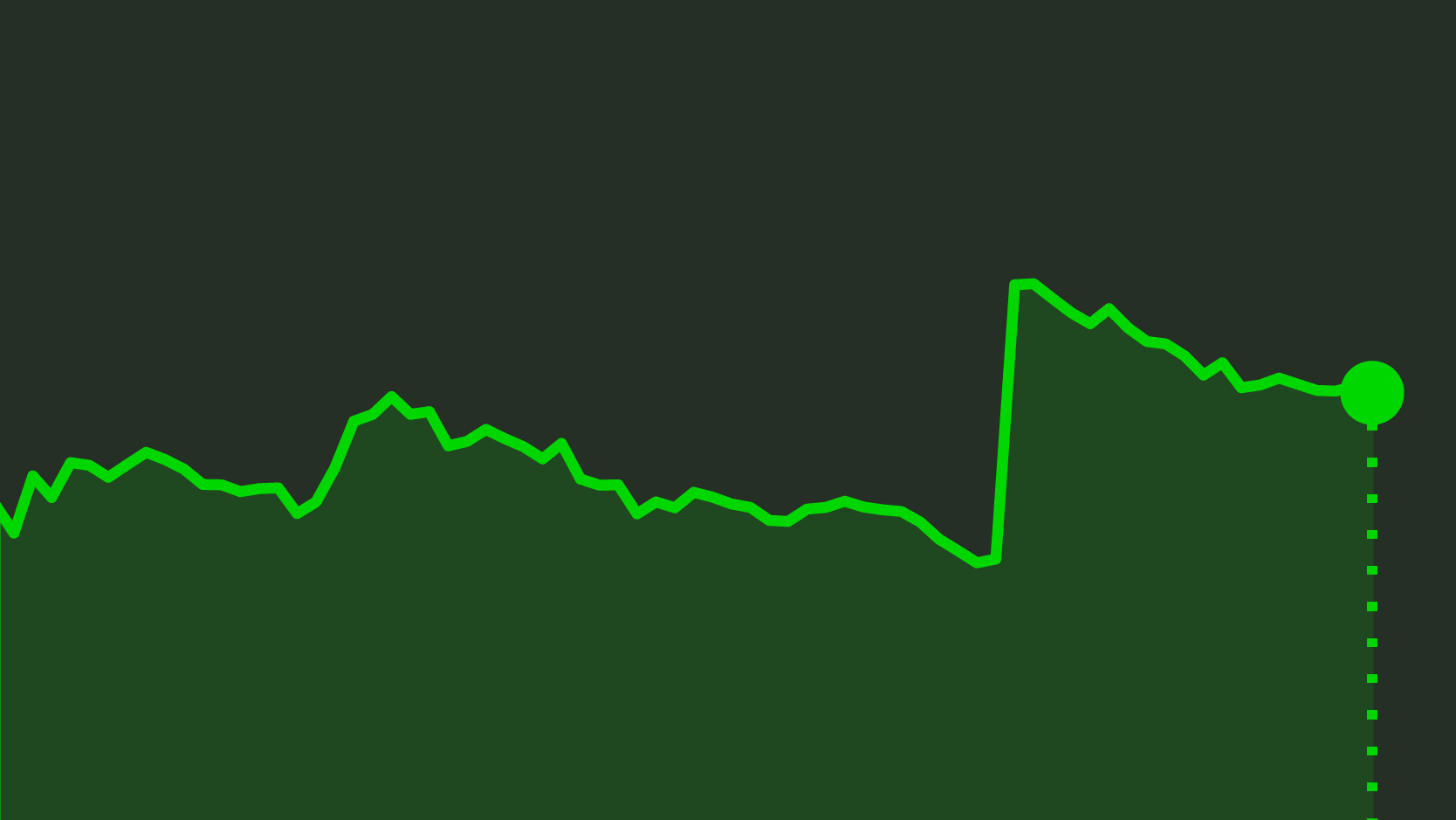

Portugal was able to have lower interests in the long-term debt double auction. It placed 1,250 million euros in five and ten-year Treasury bonds, benefiting from the dive in markets’ rates to self-finance with an interest rate below 3% in the longest maturity. It is the lowest since the end of 2015.

The IGCP (Portuguese Debt Management Agency) placed 500 million euros in five-year bonds, leaving the largest “portion” to the longer maturiy — ten-year bonds. Overall, the Agency headed by Cristina Casalinho got 1,250 million euros with lower rates than the identical double-auction performed in May. The five-year rate was 1.1982%, and it decreased to 2.851% in ten-year bonds.

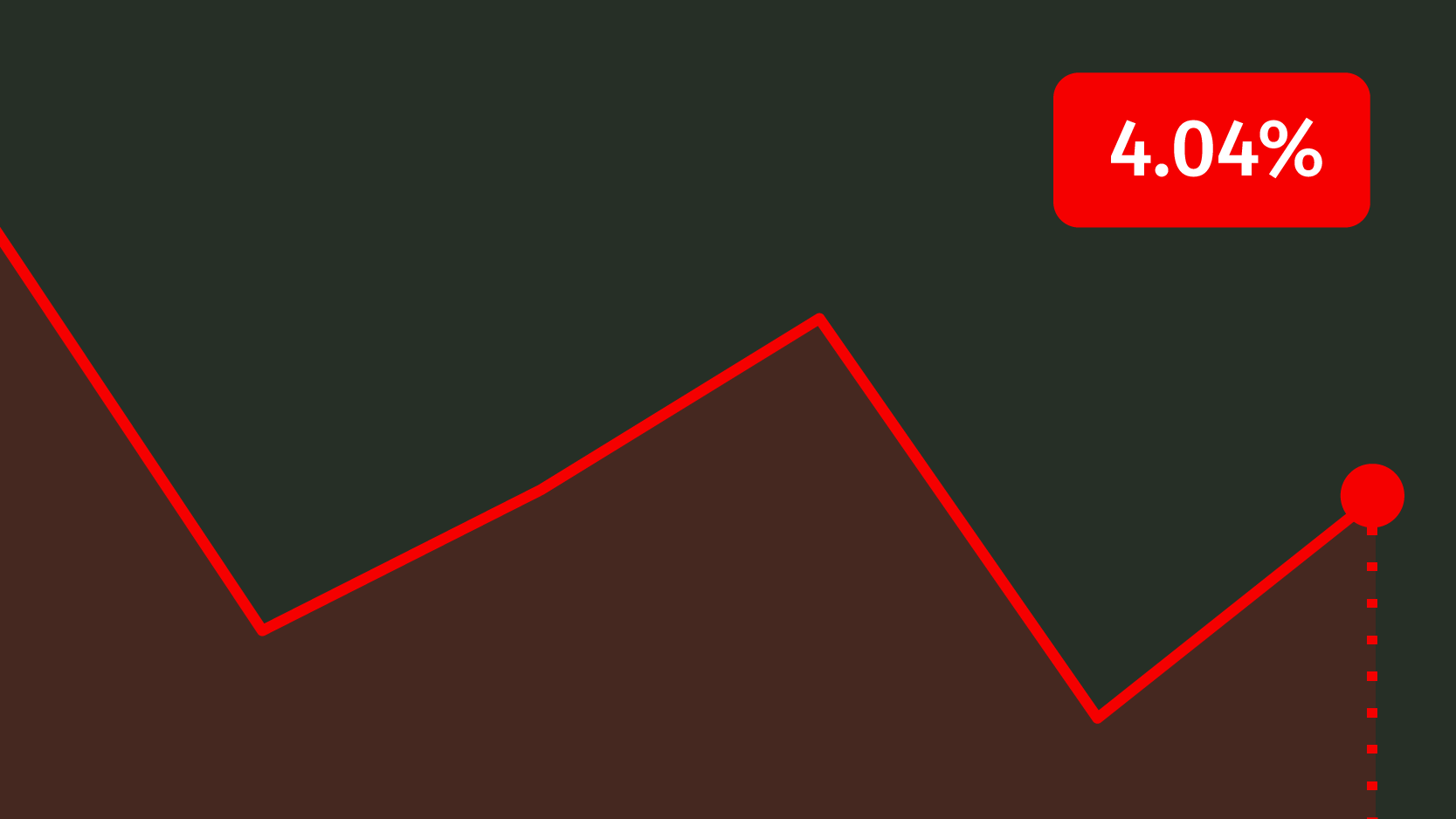

In May, Portugal had payed a 1.828% rate in five-years maturity, while in ten-years maturities the rate was 3.39%, a decrease in comparison to the over 4% interests payed in the only ten-year issuance performed by then. June’s rate for ten-year maturities was the lowest since the November 2015 auction.

The significant reduction in both maturities’ rates reflects the plunging tendency of debt interests in international markets — the ten-year rate is at its lowest in ten months. The ten-year rate has been decreasing significantly in view of the more frequent positive indicators from the Portuguese economy, namely the country’s exit of the Excessive Deficit Procedure.