Portugal puts the market to the test with its ten-year debt

IGCP returns to the debt market next week. The Portuguese Treasury aims to achieve 1,250 million euros in five to ten year bonds next Wednesday: it's round two of last auction's maturities.

Portugal is back at the primary debt market. The Portuguese Treasury predicts issuing up to 1,250 million euros in ten to five year bonds next Wednesday, so it is round two of last auction’s maturities, which took place on May 10.

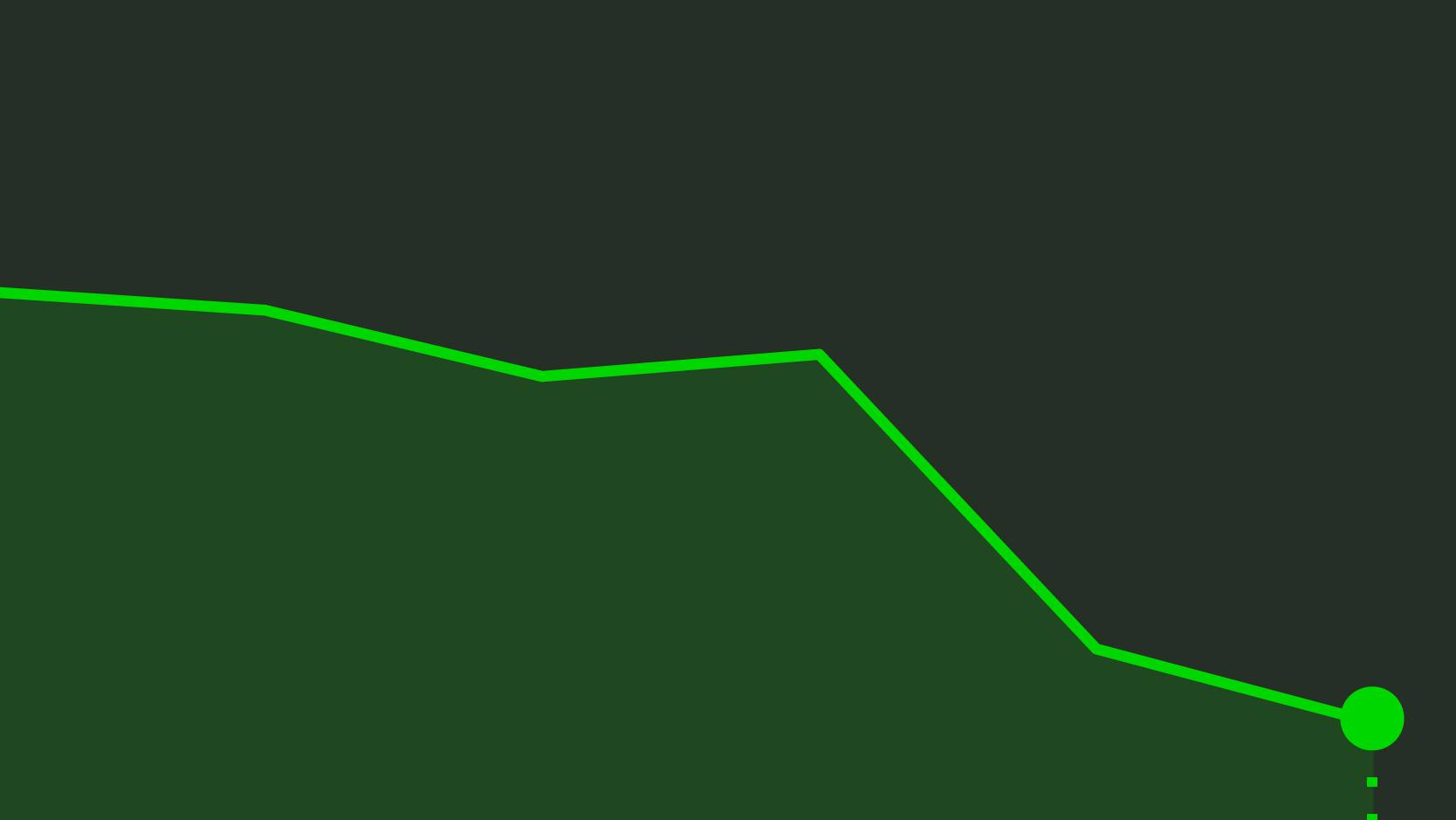

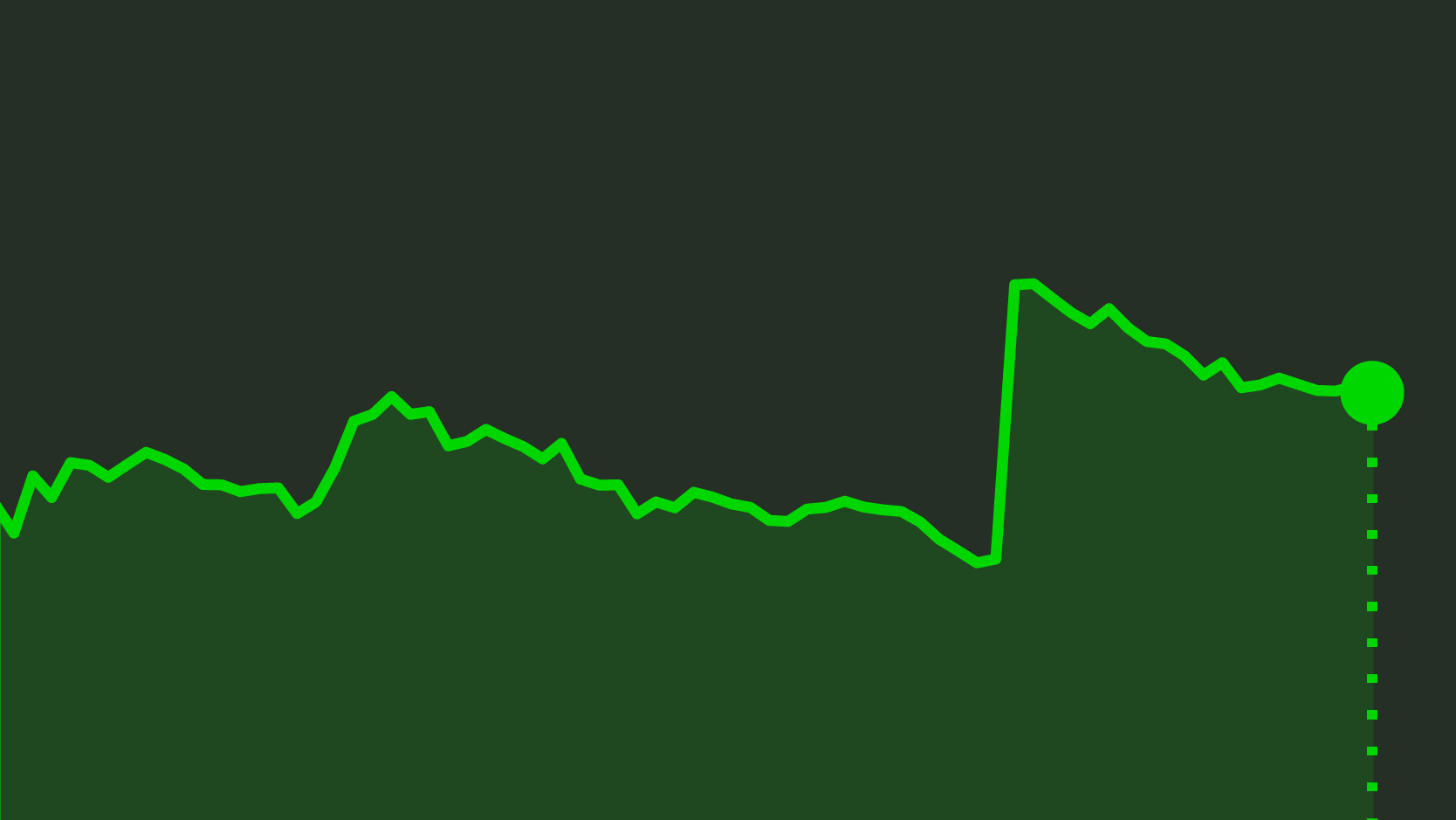

This double auction takes place in time of decompression of secondary markets. Portuguese interest rates suffered a sharp dive during the past few weeks, with the ten-year yield on securities decreasing to a threshold below 3%, which had last happened in September 2016. Currently, the five-year rate stands at 1.386%, while ten-year rate trades at 3.015%.

In addition, next Friday, Fitch reassesses the Portuguese debt rating; the stable outlook does not leave much room for an increase of the BB+ rating, considered a speculative investment.

On the last investors note, the Portuguese Debt Management Agency (IGCP) brings forward that 55% of the goal for the 2017 Treasury Bonds’ financing has already been achieved, having raised around 15 billion euros since the beginning of the year. Therefore, this financing operation will allow the entity headed by Cristina Casalinho to assure its “comfortable liquidity position and pre-finance its 2018 needs”.