Portugal obtains 1,250 million euros. Interests decrease

This Wednesday, Portugal raised 1,250 million euros in five and eight-year government bonds. Cost decreased considerably in both maturities.

Portugal was able to raise 625 million euros in each of the two auctions it held this Wednesday morning, and costs decreased considerably in comparison to previous operations. In five-year maturities, bonds had a 2.174% rate, which is comparable to the 2.75% interest rate paid in the last auction, which took place two months ago.

Overall, the IGCP (Portuguese Treasury and Debt Management Agency) was able to get 1,250 million euros in this double auction, which was the maximum amount appointed by the agency. This operation signals an inversion in the worsening tendency in the financing costs Portugal saw since the beginning of the year. This time, costs decreased — a lot.

In the debt auction maturing in 2022, the interest rate paid by the Portuguese Republic was 2.174%; in the last comparable auction, which took place in February, the rate was 2.75%. Demand surpassed supply 1.7 times.

As for eight-year maturities, markets were more eager to buy these debt securities, which made possible to reduce interests paid to investors: the rate was 3.303%, comparable to the 3.95% paid in the auction for nine-year bonds which took place in March.

With this operation, Portugal already assured a little over 6.5 billion euros in long-term financing; the goal is for Portugal to finance itself in the bond market between 14 and 16 billion euros in 2017.

“In both maturities, the demanded yields were lower than those previously payed for and the search was considered larger than the previous issuances made in March and February of 2017”, stated Marisa Cabrita, asset manager in Orey. “Portugal ended up benefiting from the correction in yields made over the last few weeks in the majority of European countries, as well as from the budgetary progress reported in 2016”, she adds.

"Portugal ended up benefiting from the correction in yields made over the last few weeks in the majority of European countries, as well as from the budgetary progress reported in 2016.”

The decrease in the countries’ financing costs takes place after a particularly costly first quarter concerning new debt issuance. And it may pave the way for new auctions with broader auctions to take place during the course of this month.

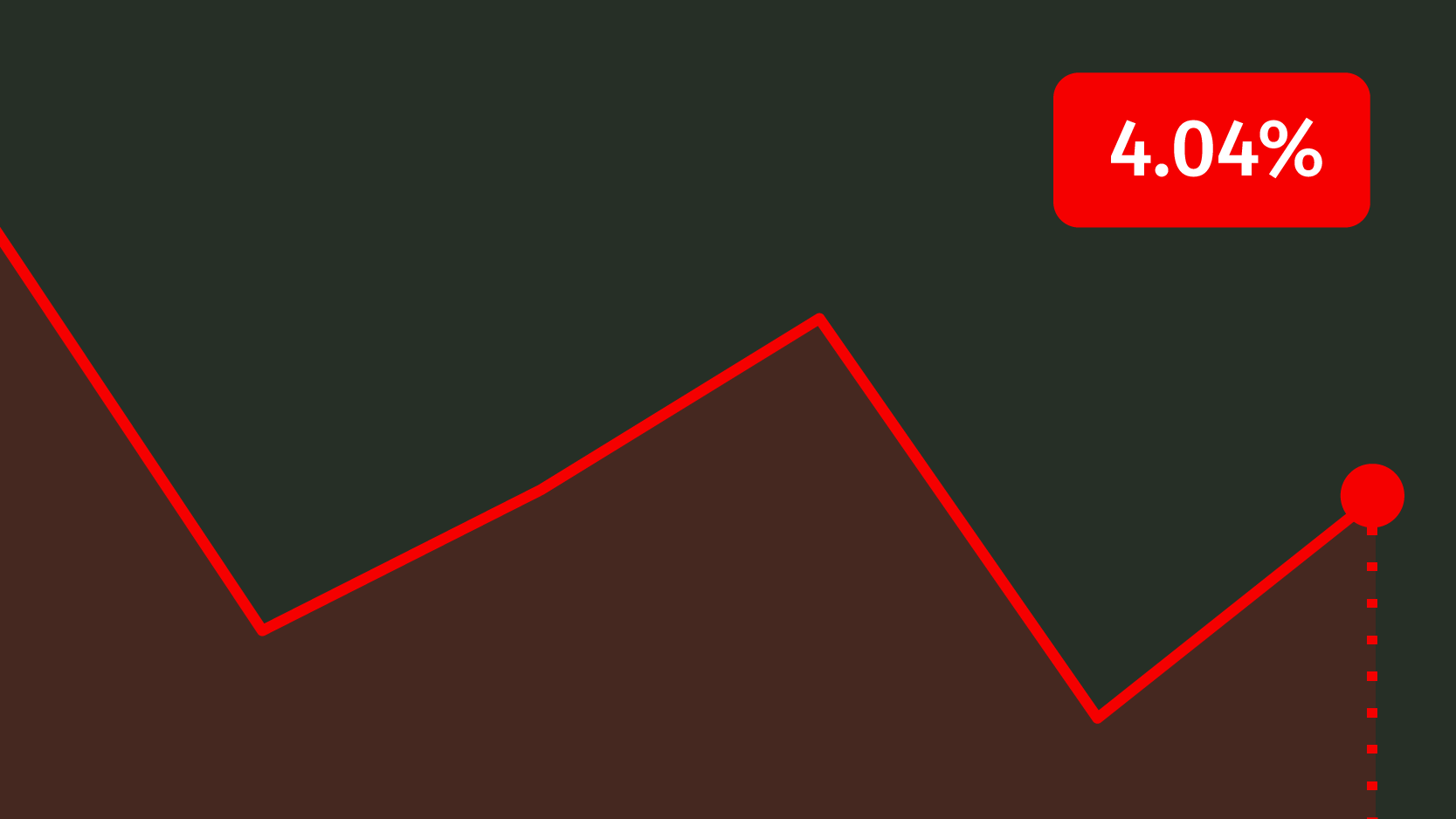

The average cost of the new debt issued in the first three months of 2017 increased to 3.4%, in comparison to the 2.5% rate the Portuguese Treasury payed on average last year.

Interests decrease after the auction