Portuguese interests reach minimum of six months

Portuguese interests are shrinking in all maturities, on the day the country returns to the market. This decrease happens after the Portuguese economic growth, the sixth largest in the Euro Area.

Portugal has returned to the market to issue short-term debt and was able to get even more negative interests in comparison to the last comparable issuance. The Portuguese Treasury was able to place Treasury bills worth 1,500 million euros, an amount which corresponds to the maximum placement predicted. Today’s placement, made through two auctions with six to twelve months maturities, takes place in a period of national yield relief in the secondary market.

In the 12-months Treasury bills auction, the IGCP (Portuguese Treasury and Debt Management Agency), the institution headed by Cristina Casalinho, was able to place one billion euros, with an average interest rate anchoring at -0.153%. That rate is lower than the -0.112% from the previous comparable issuance done in March, 2017.

As for the six-month issuance of Treasury bills, 500 million euros were placed with a -0.210% average rate, an even more negative interest than the -0.158% achieved in the previous auction for that maturity, which also took place last March.

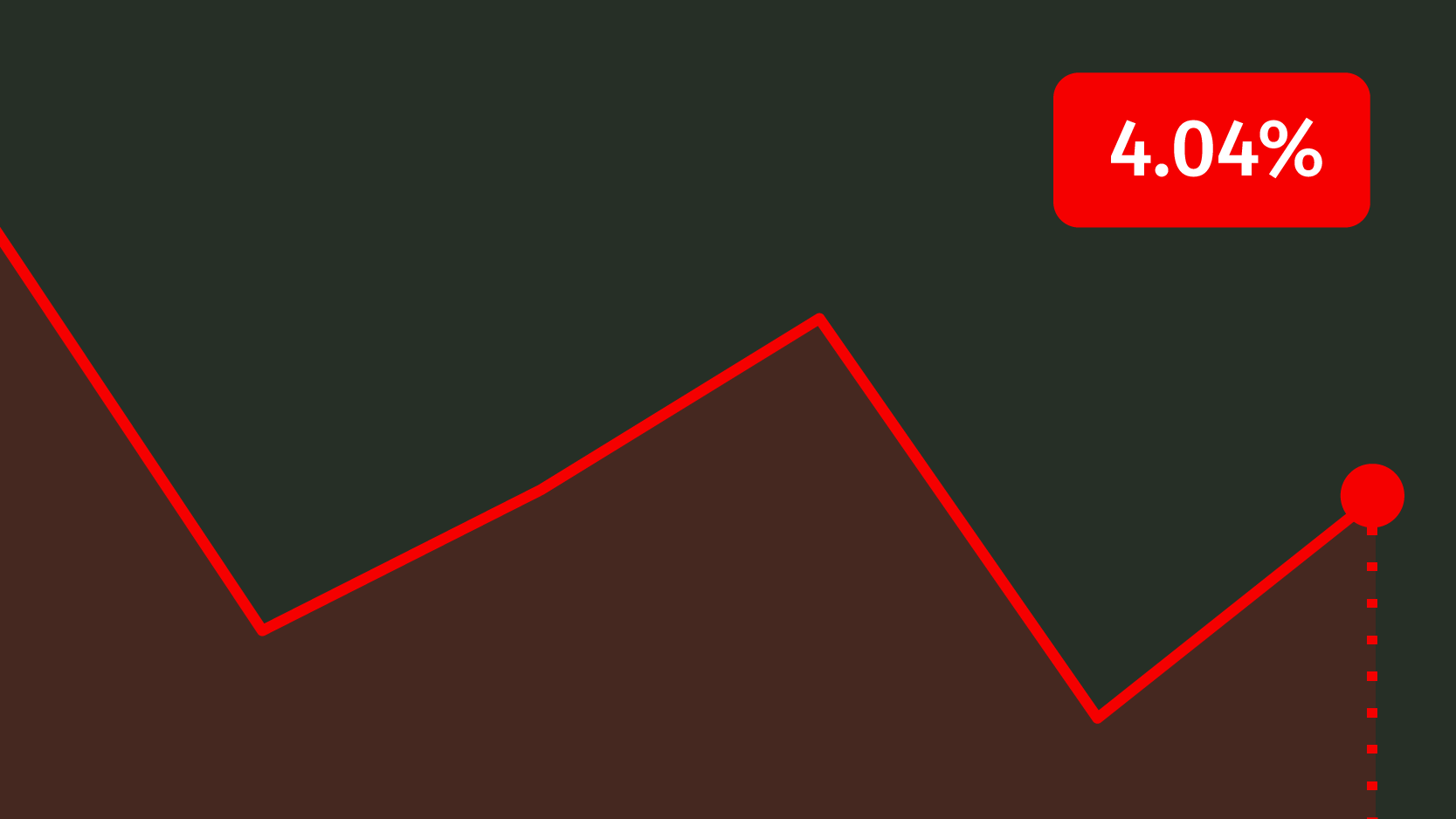

This Wednesday’s issuance happens in a period of a relief in the secondary market concerning Portuguese debt yields. This morning, the reference rate concerning the ten-year sovereign debt reached minimums of six months.

Portuguese interests decrease to minimums

The implied yield for ten-year bonds gives in two basis points to 3.231% — its minimum since November 8th. The rate is stepping back, showing a relief tendency which occurred in all Portuguese debt maturities. For example, the five-year interest rate decreased to 1.667%.

Demand reached 1,620 million euros for 12-months Treasury bills, 1.62 times larger than the amount placed; as for six-months Treasury bills, demand reached 1,115 million euros, 2.23 times larger than the amount placed.

Optimism returns to the market after the Portuguese economy’s 2.8% growth in the first quarter of 2017, the best percentage since the fourth quarter of 2007, surpassing all estimates. This allowed the Portuguese economy have the sixth largest homologous growth in the Euro Area, tied with the Netherlands. In addition, the Portuguese Government anticipated today the early repayment of 7.2 billion euros to the IMF between 2018 and 2019.

This Wednesday’s issuance was the fifth short-term debt issuance performed by the IGCP. Between January and May, Portugal has issued seven billion euros worth of Treasury bills, achieving negative interests in the last issuances.