Commerzbank: “Portugal is not out of the woods yet”

Commerzbank analysts believe that despite some positive surprises, it is too early to "sound the all-clear" for Portugal. The country is still not out of the woods which led to the 2011 bailout.

This is the diagnosis Commerzbank makes of Portugal: the country has recovered, but is is not “out of the woods yet”.

Analysts from the German bank believe “Portugal’s economy has posted strong growth lately, the budget deficit for 2016 was below target and the yields of ten-year government bonds have fallen well below 4% again despite lower ECB buying. But it is too early to sound the all-clear”, they state in an economic research published this Friday.

Commerzbank believes it will become increasingly more challenging for Portugal to keep up the surprisingly positive performance. For example, about the deficit, they state: “It is questionable whether the government can continue to reduce the budget deficit as planned”. A new increase in investment without reducing interest charges will make it difficult comply with a deficit of 1.5% this year and 1.0% in 2018, the Portuguese Executive goals.

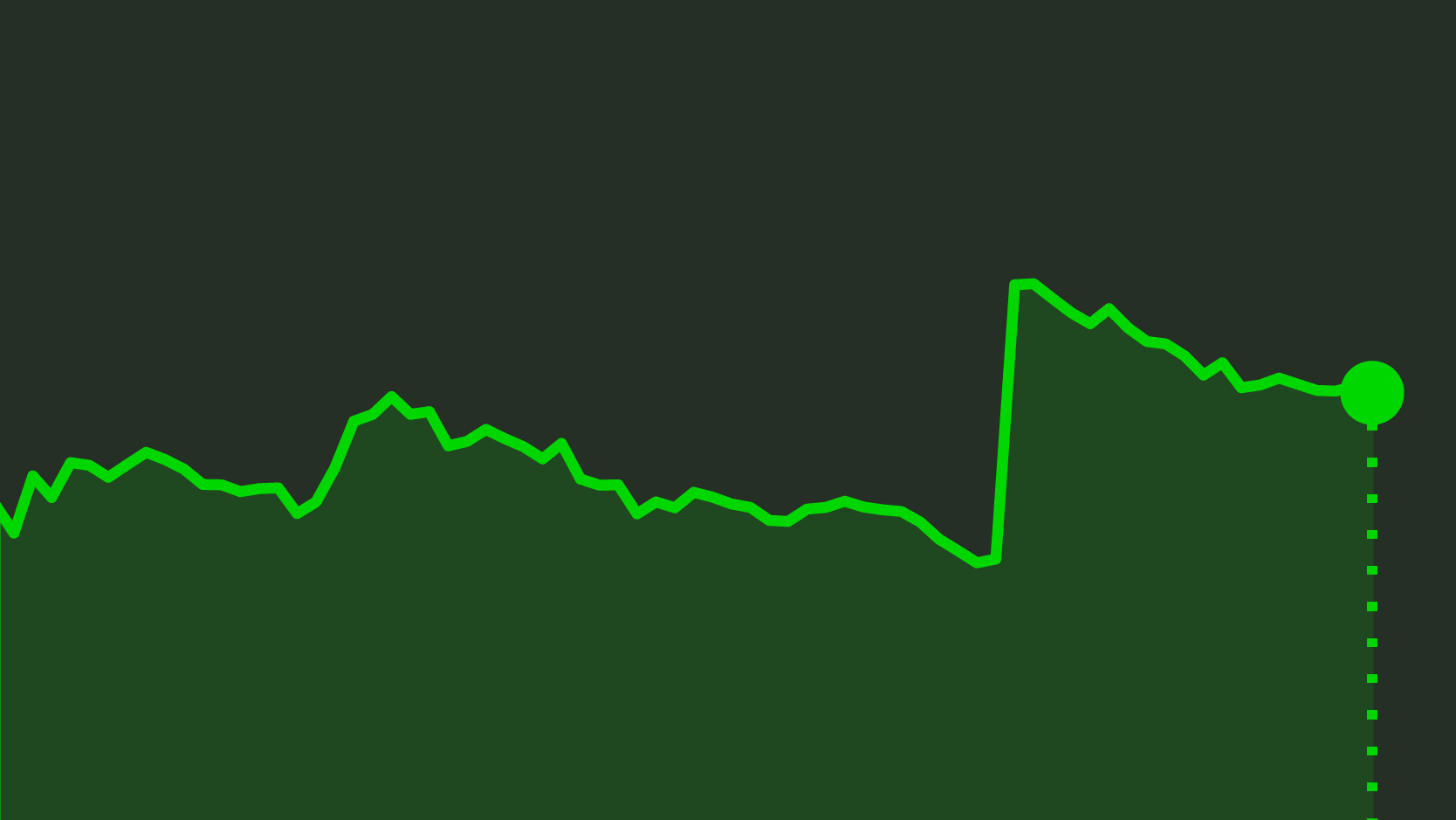

As for bond interests, the ten-year rate is at 3.4%, after having surpassed the 4.3% threshold in March. Commerzbank believes it is a commendable performance considering the ECB continues reducing its purchases of the Portuguese debt; however, they believe a decrease in interests is unlikely to happen again, mainly because the main rating agencies should maintain Portugal’s rating as “junk” at least until 2018.

In their analysis of the country, Commerzbank highlights that Portugal is still facing “some structural problems“, highlighting, for example, “some of the measures the Government has taken since assumption of power will only have their full negative effect in the coming years”, giving the “disproportionate increase of the minimum wage” as an example.

There are also external risks: “The country is currently benefiting — as is the entire Euro Area — from a stronger global economy, while the still high level of private and public deb is sustainable only thanks to the ECB’s ultra-loose monetary policy”. However, “if one (or even both) of these factors were to drop out of the equation, the country’s still substantial problems should become more evident again”, Commerzbank argues. Because of this scenario, the German bank suggests the country could be deprived from access to the market, as was the case when Portugal was forced to request international financial aid in 2011.