Finally, Fosun has 16.7% equity of BCP and is the largest shareholder

Fosun has purchased 16.7% equity of the bank headed by Nuno Amado and is, by now, its largest shareholder. Fosun has invested 175 million and can increase its equity to 30%.

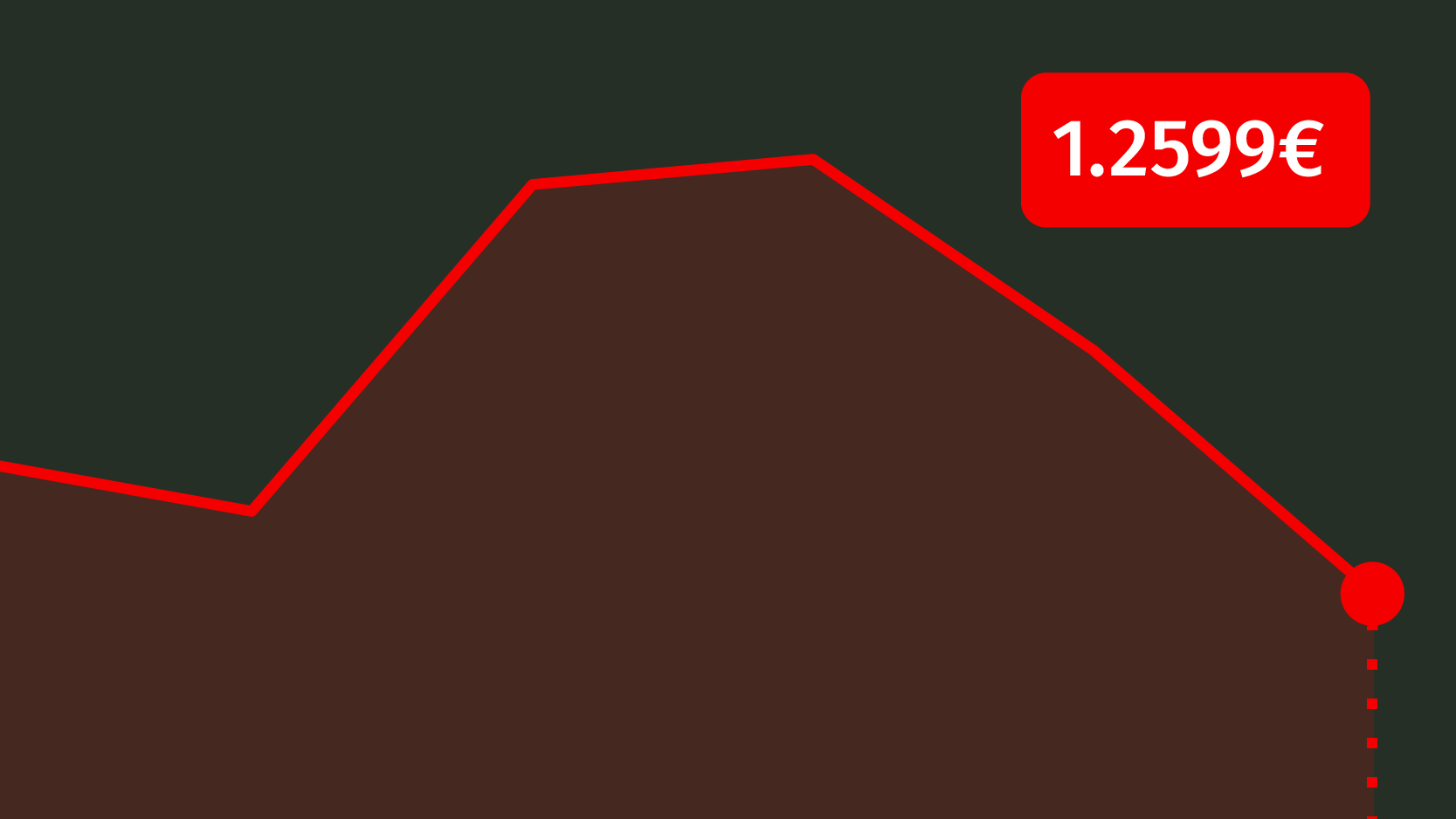

It is finally done. The Portuguese bank BCP speaks Chinese – or BCP已经说中国话, if you prefer. Fosun has already acquired 16.7% of the bank headed by Nuno Amado through an equity private placement, which demanded an investment of 175 million euros. The price per share was of 1.1089 euros, which corresponds to a discount of circa 11% compared to its current stock exchange quotation.

Therefore, Fosun is now the largest shareholder of Millennium BCP and is willing to increase its position up to 30%. With Sonangol, Sabadell and EDP, BCP now has reference shareholders from three different continents. And, also due to this dispersion, BCP’s decision process is held in Lisbon and concentrated on the management team.

After this position, Sonangol is left holding 14.87% equity and, together with Inter-Oceânico (1.7%), the Angolan companies have, jointly, 16.5% equity, almost identical to Fosun.

With this capital increase that allowed for a private placement, approved unanimously by the board, the Chinese were able to sign a three-year lock up agreement – a commitment which, for BCP’s management, allows to sell to the market an idea of trust in the future of the bank. In the press release about this transaction, Fosun emphasizes exactly that: “We regard this moment as the beginning of a journey that will allow BCP to take advantage of its enormous potential”. And they also say: “Fosun will correspond to this welcoming through an active support in making value proposals for the strengthening of the bank and development of their long-term strategy”.

Although there should be a proposal from the board to suspend it until the 19th December, there will be today a general assembly precisely to assure the increase in the bank status’ voting rights from 20 to 30% is approved. Fosun is aiming for 30% – and the European Central Bank has already approved this increase – and Sonangol has already requested the ECB’s authorization to surpass the 20%, as ECO revealed, exclusively; therefore, regardless of how, capital movements will happen in the upcoming months.

BCP still has to pay the Portuguese State 750 million euros worth of CoCo bonds (contingent convertibles) until July 2017; the bank’s board has several alternatives on the table, but rejects an increase of capital as the only alternative.

The now announced agreement came from a Memorandum of Understanding signed between BCP and Fosun on November 18, which also predicts that two board members will be appointed, probably by the end of the year.