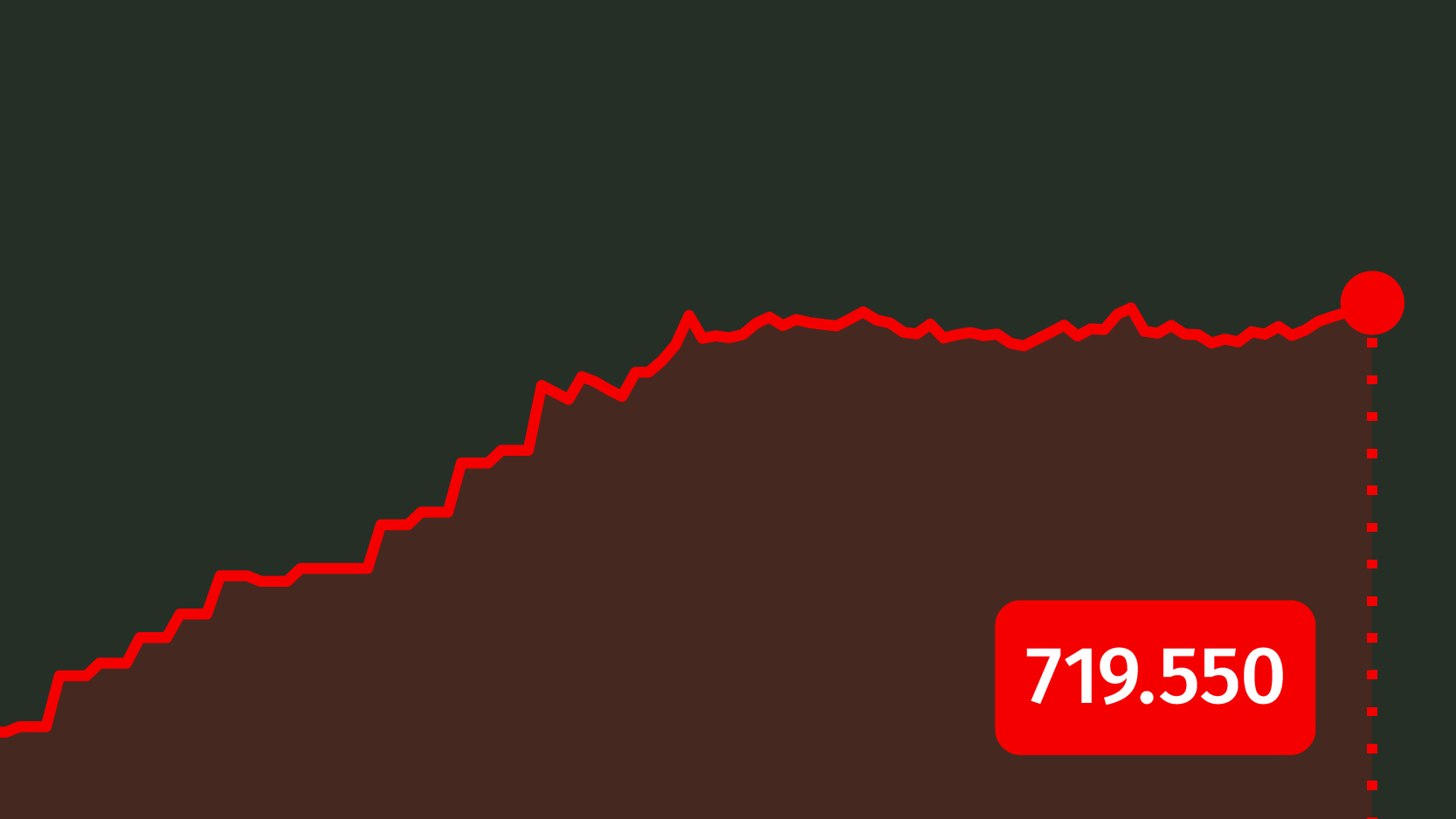

BCP plummets over 8% after merger of shares

BCP’s shares plummet more than 8%. Analysts had already given warnings about the bank’s possible volatile negotiations, since the market is adjusting to the merger of shares.

BCP’s shares have been decreasing significantly. This is the second day after Banco Comercial Português has merged 75 shares into one. Analysts say these stocks may negotiate with the volatility, since investors are adjusting to this operation, known as reverse stock split.

These stocks have reached a minimum of 8.4% to 1.196 euros. Recently, the BCP dropped 3.5% to 1.2580. In total, more than 58 billion of BCP shares have “disappeared” with the reverse stock split and were left aside this Monday. Each “new” bank share is now worth more than 1.3 euros, the same as the 75 “old” shares at 1.8 euros. The merger was one of the demands made by the Chinese group Fosun in order to be a part of the institution’s capital.

BCP’s shares decline sharply

BCP’s fall is turning the PSI-20’s index to negative. The Portuguese stock exchange drops 0.4% to 4,720.81. Portuguese bank BPI’s analysts had previously stated “the BCP should negotiate in a volatile manner, having investors adjust to the reverse stock split”. The plunge relates to an increase of 0.3% of Stoxx Europe 600.

Besides the merger of shares, the Chinese have asked the Portuguese bank to increase their voting limit from 20% to 30% and that it would increase the number of members of the statutory board. For that purpose, BCP’s shareholders will attend a general assembly scheduled for the 9th November. Nuno Amado will present the accounts on the 7th November.

However, the CEO of DifBroker, Pedro Lino, said Fosun’s interest is not sufficient to reverse the bank’s path:

"The interest Fosun has on BCP’s shares has given some strength, but it will not be sufficient to reverse its course. It will be necessary for the operating results to show the bank is worthy of investors’ trust.”