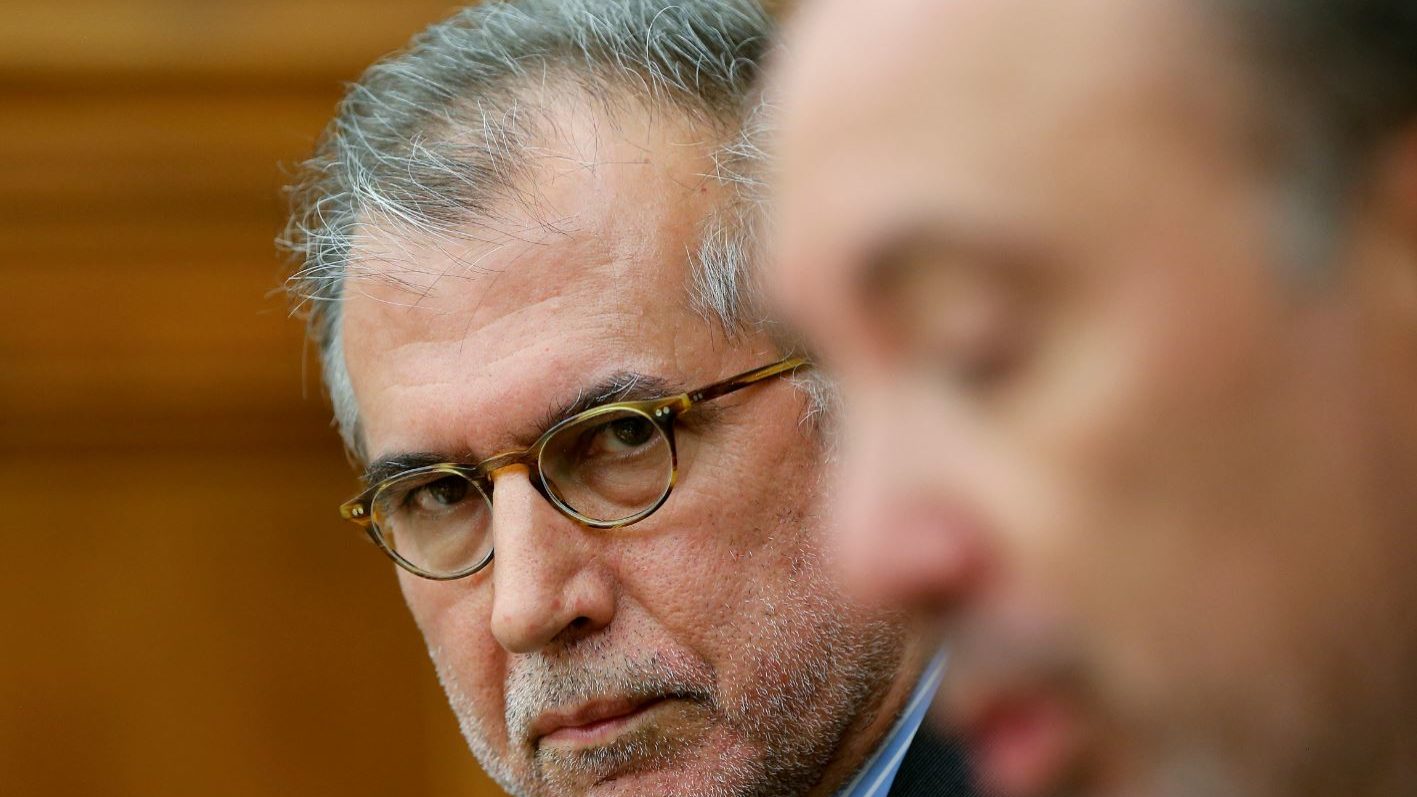

The tailor António Costa custom-makes laws to fit the banking

These are laws carefully measured. Prime minister António Costa has been like a tailor. With what threads is the government sewing reality?

Once reality is measured, António Costa has sewn the laws to assure a perfect fit for the client. The Portuguese banks Caixa Geral de Depósitos (CGD), Banco Português de Investimento (BPI) and Banco Comercial Português (BCP) are some of the custom-made suits the prime minister had tailored to fit the Portuguese needs. The opposition has been trying to cut down the hemlines of these laws, claiming unconstitutionality. ECO explains what laws were executed by the government’s studio during the first year of the mandate.

CGD: the alteration that went unnoticed

On 28 July 2016, a government decree-law went unnoticed, but is now at issue, because the simple change it made had many consequences such as the exemption for the board of the duty to declare their property to the Portuguese Constitutional Court. This change – combined with the lack of restriction in salaries – was critical for António Domingues to accept the chairman position in CGD.

The government also wanted to change the maximum positions administrators could gather, but the President of the Portuguese Republic Marcelo Rebelo de Sousa did not allow it.

2017 State Budget: Change in the IRC (Company tax)

The change in the IRC code, inscribed in the 2017 State Budget, will allow the banking sector to have interests with equity capital instruments issued to comply with the European rules deducted as a tax cost. The CGD will be one of the most benefited banks because it will issue one billion euros in bonds for the recapitalization Brussels demanded.

Removing voting rights cap: the love triangle between Isabel dos Santos, CaixaBank and BPI

On the 18 April, there was the promulgation of a decree-law made-to-measure the Spanish from CaixaBank and, to some extent, against Angolan Isabel dos Santos. That change – removing voting rights cap – predicts shareholders can reassess their voting rights limits at least every five years. This will allow for Caixabank to acquire BPI, the sale of part of the BFA to Isabel dos Santos Unitel and, therefore, fulfill the ECB’s wish to decrease the exposure of the bank in Angola.

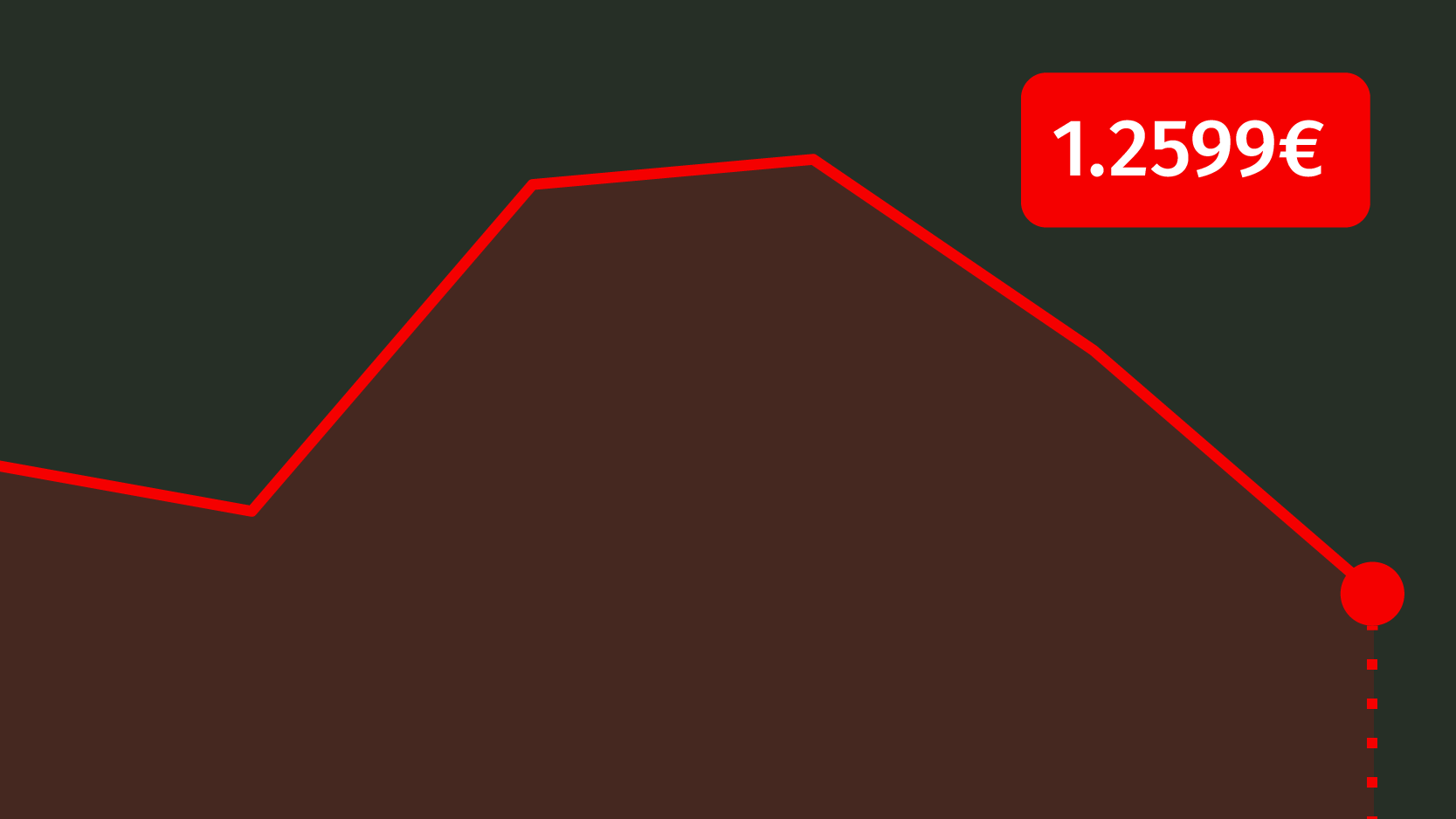

BCP: legal security to Fosun

Fosun wanted it, the government abided and BCP was thankful. In order to prevent any legal doubts, the government approved a decree-law concerning the merging of shares. The reverse stock split can be made without reducing corporate capital. This law was custom-fit to BCP, where “makeup” was applied to the shares’ value – which was one of the Chinese Fosun demands.

PSD/CDS (Portuguese Social Democratic Party/ Portuguese Democratic and Social Center Party): Banks can convert deferred taxes to tax credits

António Costa is not the only one trying to be like a tailor, namely in banking. In the past, this practice of custom-making laws to fit real cases has also happened. One of the examples of the PSD/CDS government is the special regime implemented so banking can convert deferred taxes to tax credits.