ATM: BPI’s takeover bid should be 3.15 euros

The Association of Investors and Technical Analysts ATM has taken into consideration the offer made by CaixaBank. They say the fair price for the takeover bid surpasses 1.134 euros.

CaixaBank has offered 1.134 euros for each share held by BPI. The retail investors’ association ATM considers this to be a low offer, especially because the Angolan bank BFA’s control was given over to Santoro, the Angolan company based in Lisbon.

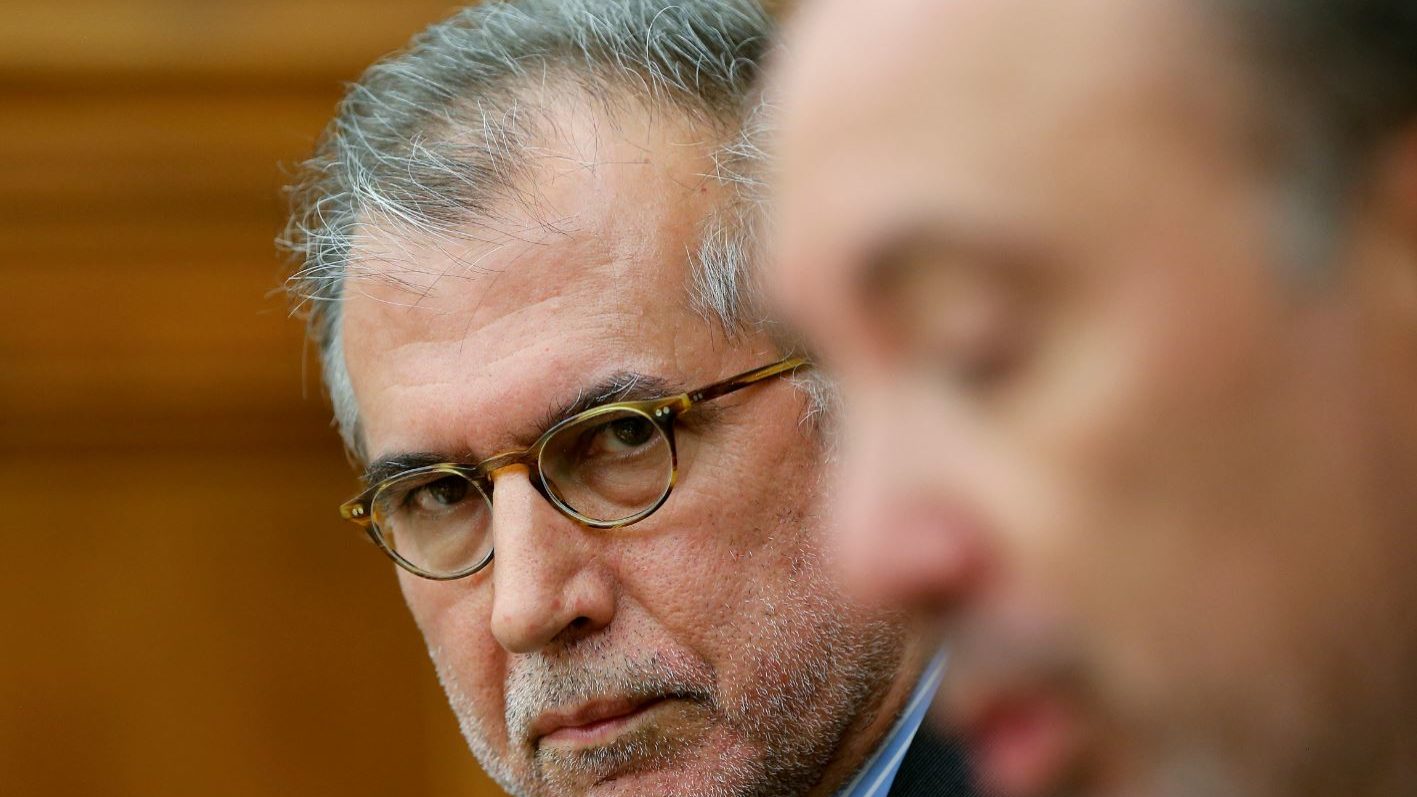

The control of BFA, in ATM’s perspective, has a higher value than the one implied in the offer. The President of the Board of Directors of ATM Octávio Viana points to a difference of 600 million euros, adding: “It means 2.12 euros more per share. We reach a fair takeover bid value of 3.15 euros. It is significant. It is a financial effort for CaixaBank, but the BPI itself has been for a year evaluating the securities at 2.26 euros”.

This is why the ATM requested the intervention of the regulator CMVM (Portuguese Securities Market Commission) through the nomination of an independent auditor. “If there is an independent auditor, the probability of setting forward 3.15 euros… I do not see any reason an auditor should move further away from that value”, says Octávio Viana. But “the 2.26 euros could avoid legal proceedings”.

“If there is no independent auditor, we set out for litigation. And that takes time. ECB will become involved. It is worse for CaixaBank, BPI and its investors… It will withdraw value from everyone”, he emphasizes, adding the regulator is aware of that and “agrees the solving of the problem has to come down to a broad agreement among shareholders. This means there will have to be a rise in quid pro quos that please minority shareholders and do not question CaixaBank”.

Octávio Viana reacted to the news delivered by ECO that stated CMVM’s new president Gabriela Figueiredo Dias asked to be excused from the decisions of BPI’s regulator. He stated that in his meeting with the president he sees no incompatibility between the fact her father, Jorge de Figueiredo Dias, is a member of the Supervisory Board of BPI, the bank headed Fernando Ulrich, and her righteousness and ability to distance herself, adding “If she decides to excuse herself, it will be entirely her decision”.

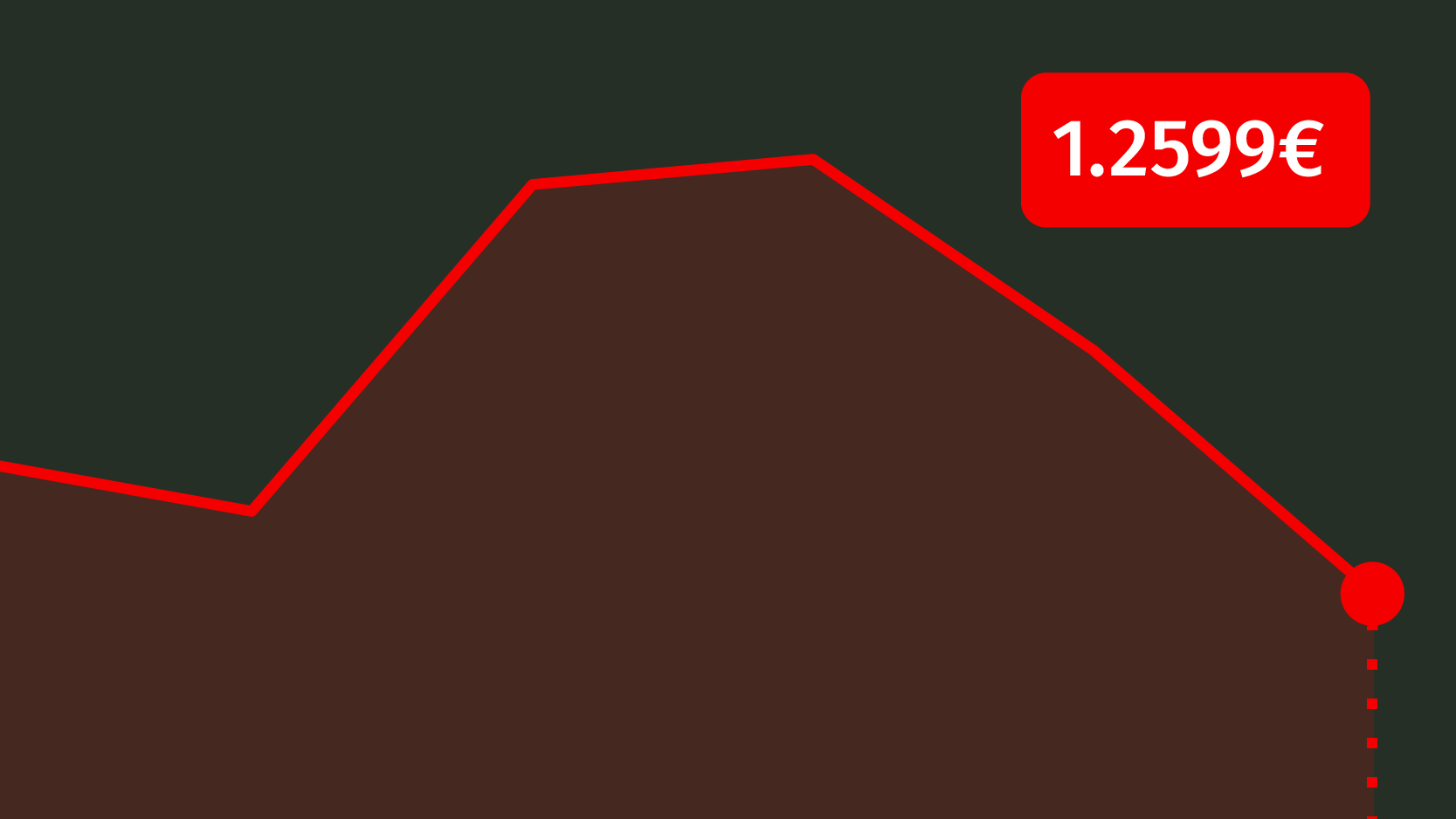

BPI’s shares rise this morning at 0.27% to 1.133 euros.