PM slams ECB rate hike, more important than ever for state to cut debt

"It's absolutely essential that a country with the level of debt that Portugal has, continues to reduce its debt so that it suffers as little as possible from the interest rate increase."

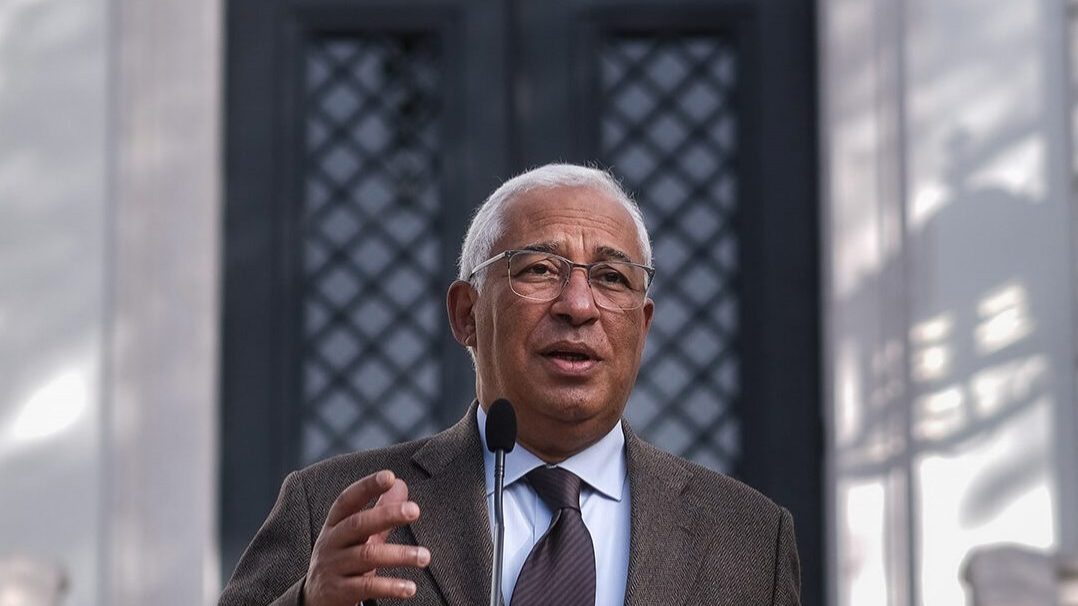

Portugal’s prime minister on Wednesday criticised the rise in interest rates by the European Central Bank (ECB) and considered that “it is now more important than ever” for the country to continue to reduce its debt.

In the debate on general policy in parliament, António Costa said that for business confidence in the Portuguese economy to be maintained, “it is absolutely fundamental to guarantee the predictability and continuity of budgetary policy and the continued and sustained reduction of public debt”.

“We have not had to cut pensions or lower salaries, nor increase taxes to reduce the debt, we have done so year after year in a sustained manner, fulfilling the commitments we made to our partners while they wanted to be our partners, continuing to fulfil our commitments to the Portuguese, who will always be our partners, and also continuing to fulfil our international commitments,” he said, in response to an address by socialist MP Filipe Neto Brandão.

Considering that “it is very important that we maintain” this trajectory, the prime minister stated that “it is even more important today than ever”.

“Because in a context where the European Central Bank, badly, continues to maintain a policy of raising interest rates, no matter who it hurts, it is absolutely essential that a country with the level of debt that Portugal has, continues to reduce the amount of its debt so that it suffers as little as possible from the interest rate increase decided by the European Central Bank,” he argued.

“What has proved its worth is what we must continue. Whoever it takes, whatever it costs, we will maintain this path because it is this path that gives us the freedom to decide on the support that needs to be decided when it is necessary to decide on it”, stressed the head of government, noting that “international confidence and credibility have been maintained and have been positively evaluated by the rating agencies”.

Costa also pointed out that “the big news next Friday will not be the result of the deficit, the big news on Friday will be what we can do thanks to the freedom that the good management of 2022 gives us to act now to support Portuguese families”.

In response to the PS (socialist) bench, the prime minister also pointed out that “in the set of measures to support the economy, whether to families or to companies, last year, in extraordinary measures”, “6.4 billion euros” were invested.

“We have redistributed to the economy and to families almost three times what was the extra revenue that resulted from the increase in VAT inflation,” he said.

Socialist MP Filipe Neto Brandão said that “the international economic climate only proves the wisdom of the option taken by this government for a sustained reduction of public debt”.

“If we had chosen a different path, and there was no shortage of people in this House who called on the government to do so, the constraints we would be facing today would be different and much worse”, he considered, pointing out that “only by pursuing a sustained path of debt reduction, only by ensuring the conditions for debt financing, can we ensure that the necessary funds are released for social spending”.

Further on, in response to another PS MP, the prime minister assured that “with this government the answer will never be austerity and will always be the greatest solidarity possible”.

Also in the second round of the debate, the PSD (Social Democratic Party) parliamentary leader, Joaquim Miranda Sarmento, insisted on a question he had already asked the prime-minister in the first round: if he could guarantee that the State and social security had not lost or would not lose money with the exposure to Crédit Suisse, the bank that was rescued last weekend.

In his answer, António Costa pointed out that the social security financial stabilisation fund cannot invest more than 20% of its funds in shares, with a return of more than 55% since 2018.

“Obviously, like all investment in shares, there are those that yield more, those that yield less and those that generate losses. This one, as is well known, has not made a profit, on the contrary, although, as a whole, the profitability obtained with the Swiss market since 2018 totals €81 million,” he said.

Asked by several benches about the privatisation of TAP – what timeframe or percentage the state would be willing to divest – the prime minister declined to set a time limit (“it would only benefit the buyer”) and said that the level of state participation will depend on “the negotiations, the guarantees and the partners”.

“In 2015, there were specific reasons for us not to have less than 50%,” he added.