Majority makes Left Bloc, PCP demands ‘highly unlikely’- Fitch

Fitch pointed out that the electoral result of Sunday's snap legislative elections reduces political uncertainty, creating a more stable scenario for decision-making processes.

Fitch highlights the changes to labour legislation and the end of the sustainability factor advocated by Portugal’s Left Bloc and Communist parties and that it considered a risk to budgetary targets are “highly unlikely” with the new Socialist majority.

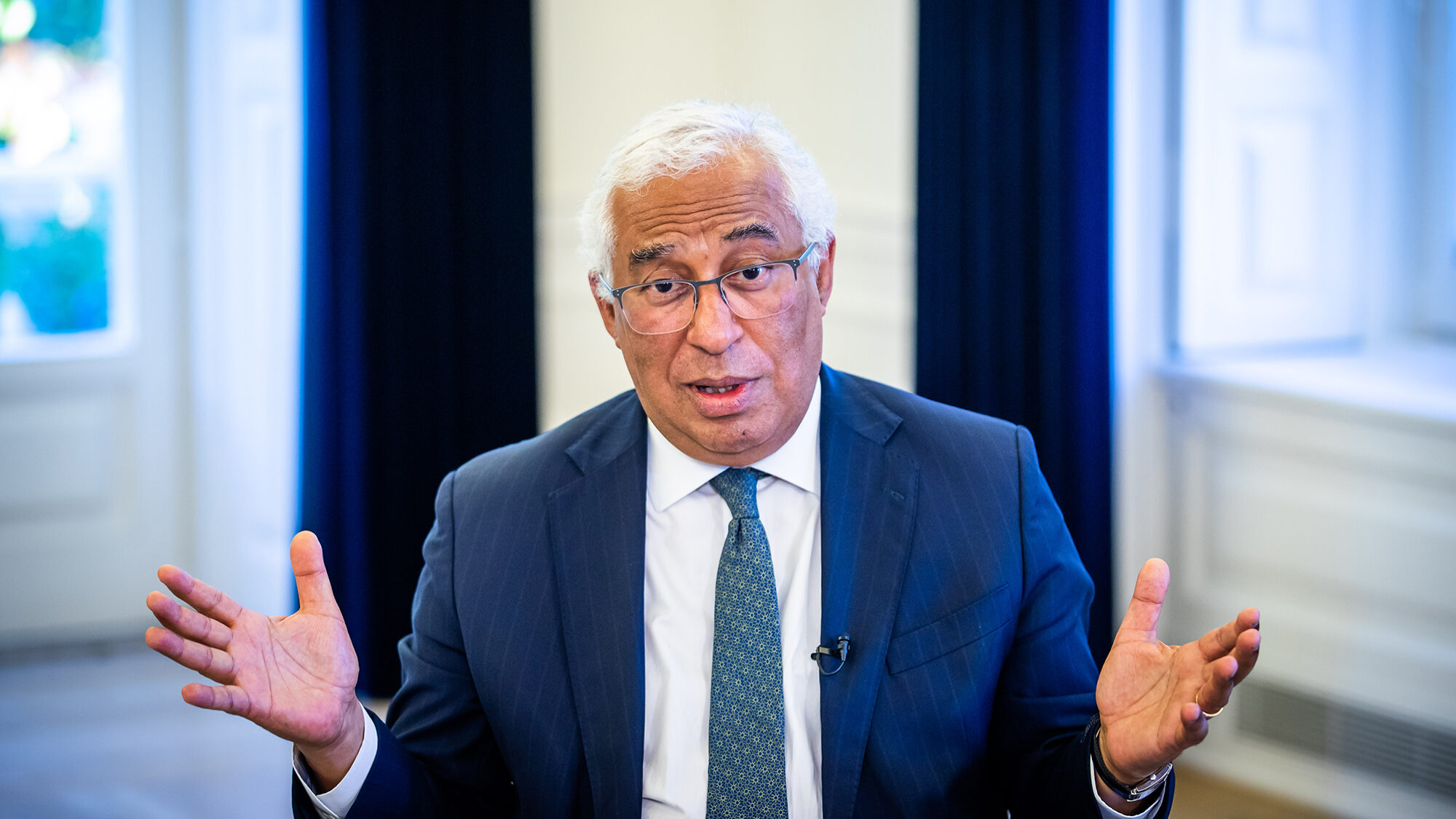

In a note today, the financial rating agency pointed out that the electoral result of Sunday’s snap legislative elections, which gave an absolute majority to António Costa, reduces political uncertainty, creating a more stable scenario for decision-making processes.

“Prime Minister António Costa’s absolute majority puts his Socialist Party in a stronger position to advance its budgetary and economic agenda,” the note on Sunday night’s election result reads.

Fitch analysts point out that “the surprising majority” may reflect widespread approval of the response to the pandemic and the economy’s strong recovery last year, recalling that this is the first majority government since 2015.

“Fitch sees this as positive, in part, because it reduces uncertainty about the direction of fiscal policy,” it reasons.

It points out, in this regard, that the budgetary proposals of the Left Bloc (BE) and the Portuguese Communist Party (PCP), which included changes to labour law and the end of the sustainability factor in pensions, “are now highly unlikely in the 2022 budget”.

“These proposals represented a risk to the budgetary targets,” it stressed, believing that the PS’s budget proposal for 2022 should pass “without significant changes”.

The agency also said that a majority government “also drastically reduces the risk of delays in the implementation” of the Recovery and Resilience Plan, expecting a positive impact on Gross Domestic Product (GDP) from Next Generation EU funds and +1.5 percentage points for investment growth in 2022.

Fitch projects a budget deficit of 3.2% of GDP in 2022, down from the 4.4% estimated for 2021, due to the end of pandemic support measures and economic growth, and expects fiscal policy to continue on a path of reducing public debt, which it projects will fall to 123.9% by 2023.