Election result eases execution of RPP, says Moody’s

With the PS absolute majority in the legislative elections, "it is now very likely that Portugal will receive the €3bn of EU funding this year, which will support economic growth," says Moody's.

The PS absolute majority in Sunday’s legislative elections removes the political uncertainty associated with the ‘geringonça’ coalition and “paves the way” for effective implementation of the Recovery and Resilience Plan (RRP), Moody’s said Tuesday.

“This election result is positive in credit terms because it removes the political uncertainty that was associated with the previous ‘geringonça’ coalition, in which the minority PS depended on other parties further to the left to push through important legislation,” reads an analysis note from the financial rating agency.

Additionally, Moody’s said, “having a majority government bodes well for the Portuguese government’s ability to meet the National Recovery and Resilience Plan (NRP) milestones and targets that were agreed with the European Union (EU) under the Next Generation EU (NGEU) programme,” whose “projects and financing are crucial to Portugal’s near-term growth prospects and long-term improvements in the economy’s growth potential.”

“These positive policy developments alleviate the NGEU implementation risks that arose following last year’s political impasse, which triggered the early elections. With this strengthened mandate from the Government, it is now very likely that Portugal will receive the €3bn of EU funding this year, which will support economic growth,” it contends.

Moody’s warns, however, that “the country’s long-term growth potential depends on the full implementation of the RRP over the 2022-26 period”.

“Despite significant progress in reforms since the global financial crisis, Portugal’s growth potential remains constrained by structural rigidities in the labour and business markets, while low investment and low levels of skills and innovation have widened the productivity gap with competitors,” it notes.

In this regard, the agency said that the RRP “addresses some of Portugal’s investment gaps in terms of skills, infrastructure and innovation, which will be a growth driver”.

“A more robust economic outlook should accelerate the positive debt dynamics”: “We think that in 2021 Portugal’s debt burden has already started to decline and stronger growth potential should sustain this trend in the coming years. By 2024, we expect that the pandemic-related increase in debt will have been completely cancelled”.

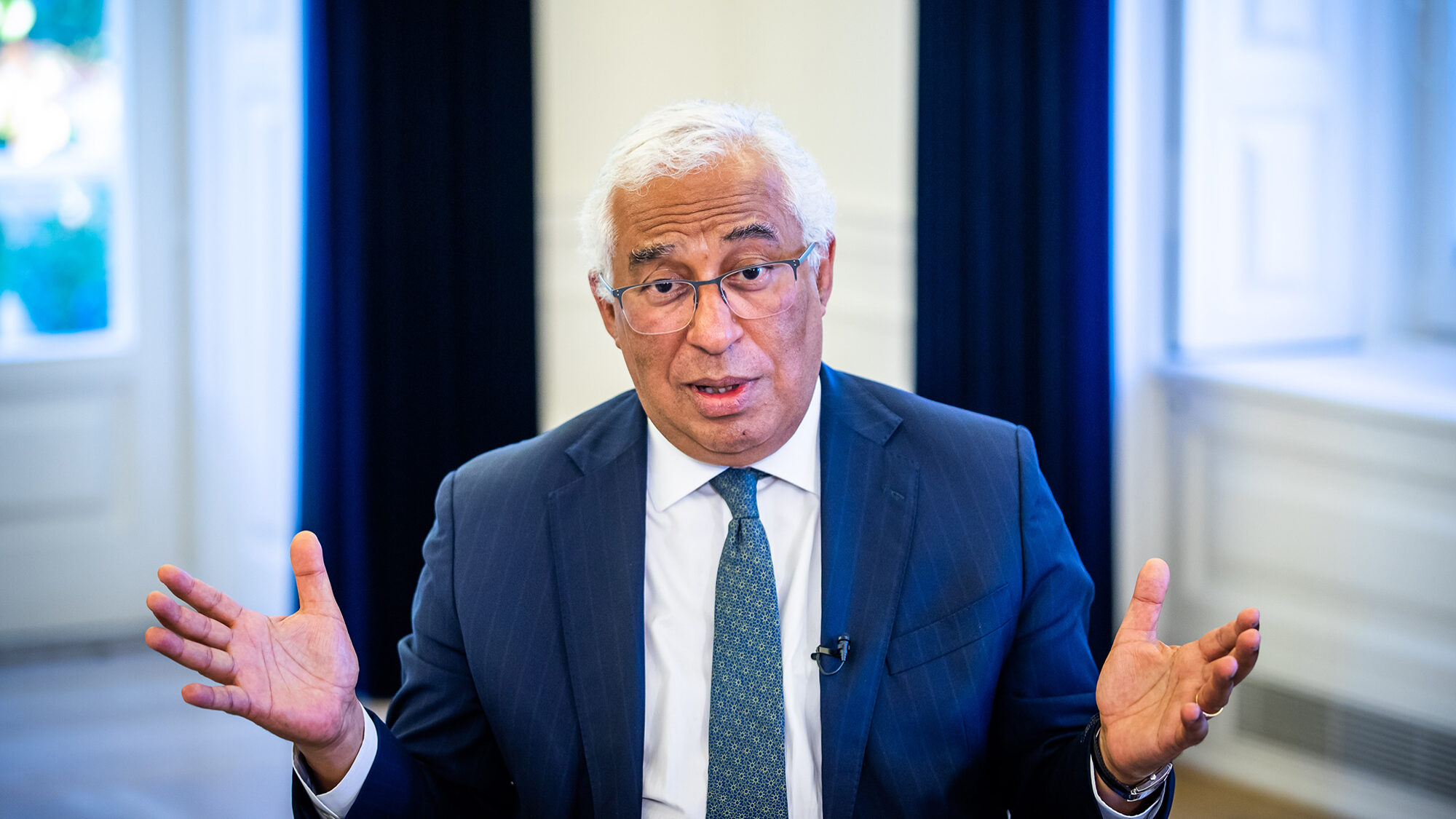

According to the ‘rating’ agency, “the previous governments of [António] Costa implemented prudent fiscal policies, so the country entered the pandemic in a balanced fiscal position”.

“The prime minister has already announced that he will move forward with the budget plan for 2022 and we continue to project that the deficit should decrease to 3.1% of GDP [Gross Domestic Product] this year, compared to the estimate of 4.2% of GDP in 2021”.