Portuguese public debt plunges in 2021. How?

In the Stability Programme, the Government says they will, in just five years, cut down public debt by more than 18 points. How can the mystery of public debt reduction be explained?

In the Stability Programme, there’s a number which stands out: 109.4% of GDP, the public debt ratio projected for 2021, the final year contemplated in the Programme presented by the Finance minister. This time, the surprise is that the number is quite small: it is 13.4 percentage points lower than what the Public Finance Council expected and 15.9 points lower than the IMF’s projections.

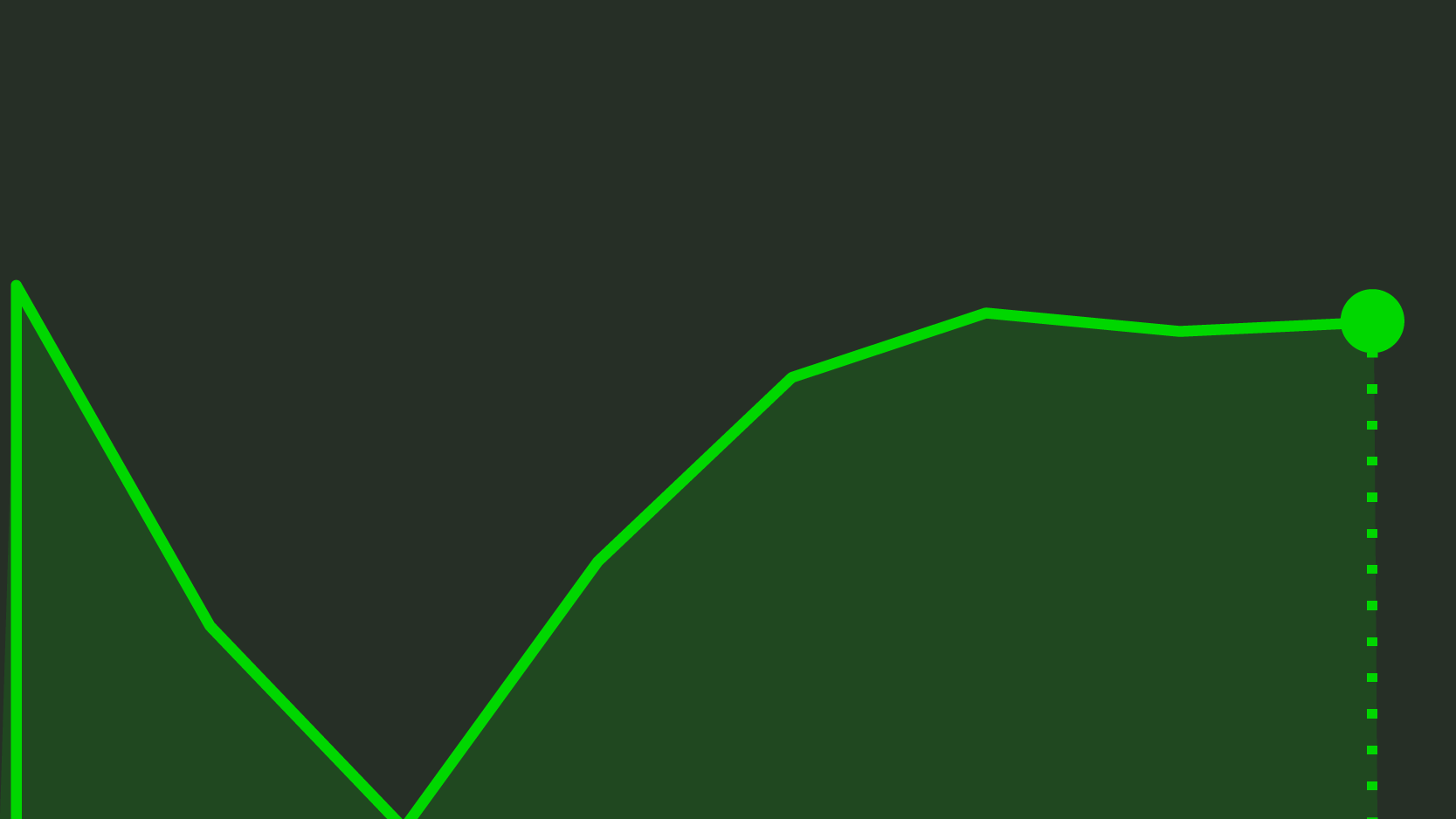

Mário Centeno paints Portugal’s portrait in the Stability Programme: in 2021, Portugal will have a growing economy, a budgetary surplus and a public debt which is below 110% of GDP, which shrunk 8.2 percentage points from 2020 to 2021, after a steady decrease since 2017. This means the minister predicts that in 2021, Portugal will have the lowest debt of the decade.

Public debt below 110% GDP

The decrease in public debt promised by the minister will happen in a context where the Portuguese GDP will grow (in nominal terms, it will increase between 3% and 4% per year) and where the deficit will shrink — two factors which, in fact, help improve the ratio. Mário Centeno explains the 18.4 percentage points variation by stating: “This trajectory was essentially influenced by the effect of the primary balance, which is growing throughout the projection period”.

According to the numbers presented, the primary surplus will be increasingly larger: in 2017, it will help reduce the public debt ratio with 2.5 percentage points, but in 2021 it will be 4.9 percentage points. From 2018 onward, the debt ratio will decrease not only because public service will generate a surplus which is deducted from the nominal value of the debt, but because the GDP value will increase enough to cover the changes in interests’ costs, meaning GDP will have less influence in indebtedness . This “dynamic effect” will harm this year’s debt ratio by 0.1 percentage points, but is already contributing to its reduction from 2018 onward; in 2021, it should help with 0.7 points.

The Stability Programme also explains: “The other debt-deficit adjustments (stockflow) have differentiated contributions throughout the time period contemplated. The highlight goes to the larger use of bank deposits between 2018 and 2019 and an increase in those deposits in 2020, anticipating the 2021 debt amortization”. This effect alone will give a 2.6 points contribution to the reduction of the debt ratio: for the abnormal debt reduction in 2021, Centeno is counting on the help of the debt-deficit adjustment.

Lastly, the contribution of the primary balance (4.9 percentage points, 0.5 points larger that what is expected for 2020) is also counting on a one-off measure which will fully be used to reduce debt: in order to thicken the primary surplus in 2021, the European Financial Stability Facility will pay Portugal 948 million euros in pre-paid margins.