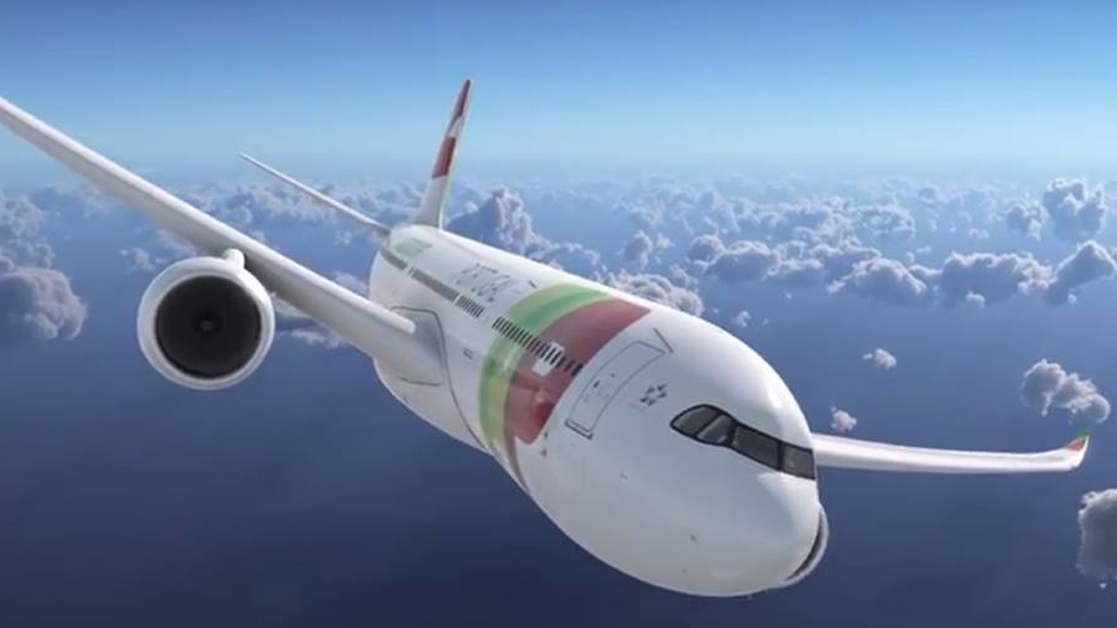

TAP wants to approach Brussels with new partner in sight

In the coming weeks, the airline will choose an investment bank to help find potential investors interested in injecting liquidity into TAP.

TAP is expected to choose in the coming weeks an investment bank that will do a market test to look for potential interested parties to enter the company’s capital, the Público newspaper advanced this Friday.

This is an important point for the airline to deliver the first version of the recovery plan in Brussels within two months, with the possibility of having a new partner, available to inject liquidity into the company. On the table could only be an investment intention, which would reduce the state’s position, and not an agreement signed between the parties.

The Ministry of Finance had already admitted that “expert technical support” might be needed in the restructuring’s drafting plan that is being designed with the support of the Boston Consulting Group because of the “size and complexity of the liabilities and debt instruments included.”

On Thursday, TAP approved at an extraordinary general meeting the proposal to increase capital from the current 15 million to “up to 1200 million euros,” to be carried out “in kind, one or more times”, a step to increase the weight of the state in the airline that has already used half of the public aid, as the Jornal Económico reported. 500 million euros are mainly for wages and suppliers.