The numbers of Stilwell’s first big deal ahead of EDP

The acquisition will allow the Portuguese company to double its presence in Spain, but still needs regulatory approval. Get to know the details of Stilwell's first big deal ahead of EDP.

EDP is preparing to double its presence in Spain. To do so, it will increase its capital by one billion euros and buy the Spanish wind farm Viesgo. Including debt, the transaction – which has several phases and is still awaiting several regulatory authorisations – is valued at 2.7 billion euros.

These are the big numbers in the business:

565 million euros

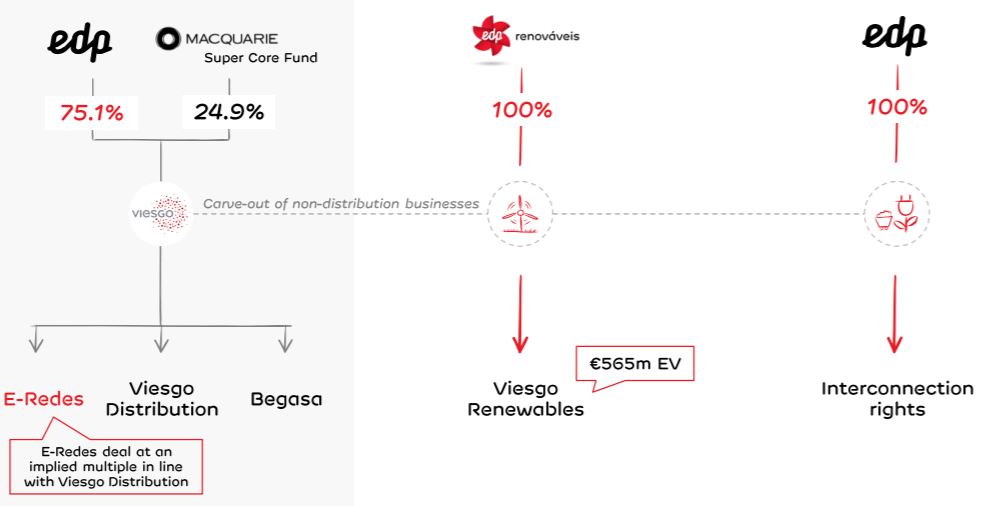

The first phase is the acquisition of the Spanish Viesgo. EDP’s subsidiary for electricity distribution in Spain, E-Redes, will buy the electricity distribution companies Viesgo, Viesgo Distribution and Begasa from the Mcquarie fund for 565 million euros. EDP will also acquire the two Viesgo thermal power plants in southern Spain.

1.1 million

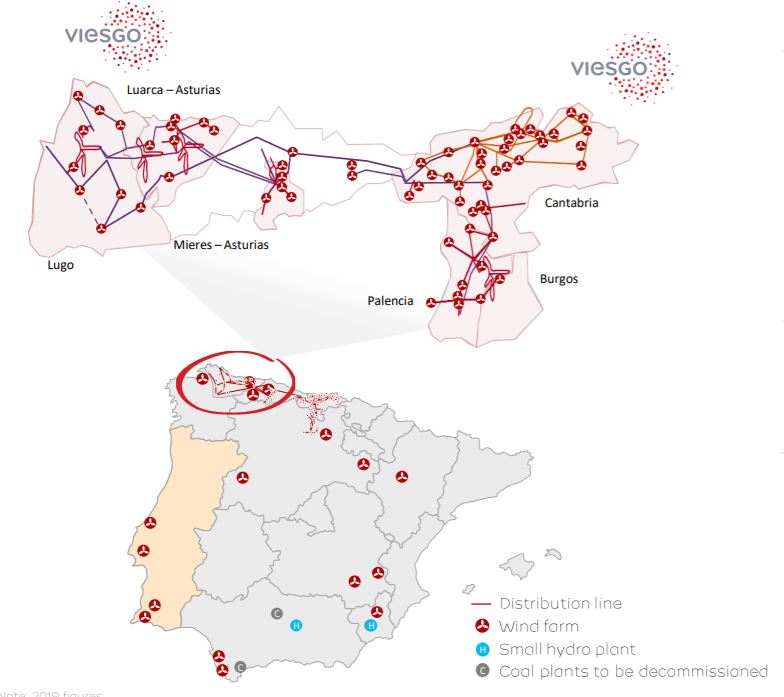

As part of the transaction, EDP will acquire 100% of Viesgo’s renewable business through its subsidiary EDP Renováveis. This business is composed of 24 wind farms and two mini-hydro power plants located in Spain and Portugal, with a total net installed capacity above 500 MW. According to EDP, the amount of 565 million to be paid to Viesgo for the renewable business has an implicit enterprise value over net MW ratio of 1.1 million euros.

75,1%

Thus, the renewable business is on the side of EDP Renováveis, while the networks and distribution are merged with the business of EDP Spain. The company resulting from this merger will continue to be 75.1% owned by EDP, while the remaining 24.9% is bought by Macquarie Infrastructure and Real Assets (MIRA), together with its funds.

2.7 billion euros

After the various phases, the Viesgo transaction involves a net investment by EDP of 900 million and will result in the consolidation by EDP of Viesgo’s existing net financial debt of 1.1 billion. MIRA will invest 700 million as part of the Viesgo transaction.

1,020 million

To partially finance the business, EDP also announced that it will carry out the first capital increase since 2004. There will be 1,020 million euros in new shares that can be subscribed by shareholders or investors with subscription rights. In the capital increase, up to a maximum of 309,143,297 new shares of EDP will be subscribed, representing a total of approximately 8.45% of the share capital.

23%

The subscription price for each new share is 3.30 euros, which represents a discount of 23% on the closing price of the shares this Thursday: 4.37 euros. There is still no date for the operation which had the green light from the main shareholder and whose success will be guaranteed by the banks.

September 3rd

While the capital increase takes place, EDP cannot communicate to the market new information that influences the operation. Therefore, the presentation of quarterly results has been postponed to September 3.

End of 2020

Upon completion of the transaction, EDP will fully merge Viesgo and will have majority representation on the board of directors, with the right to appoint the chairman, CEO and CFO. The acquisition is, however, subject to compliance with a series of conditions, including regulatory and governmental approvals, as well as the necessary corporate restructuring. The company expects the transaction to be completed by the end of the year 2020.

2 times

EDP believes that this business will strengthen the Group’s growth in the renewable and network segments. And it underlines that it will result in a growth to more than double the current electricity distribution operations in Spain of EDP, through perpetual licenses with full regulatory visibility until 2025.