“The mother of all recessions has arrived.” UniCredit predicts a 15% drop in Portugal’s GDP

"The mother of all recessions has arrived." It is with this phrase that the Italian bank introduces the new forecasts for this year. Portuguese GDP will fall 15% in 2020, but recover 10% in 2021.

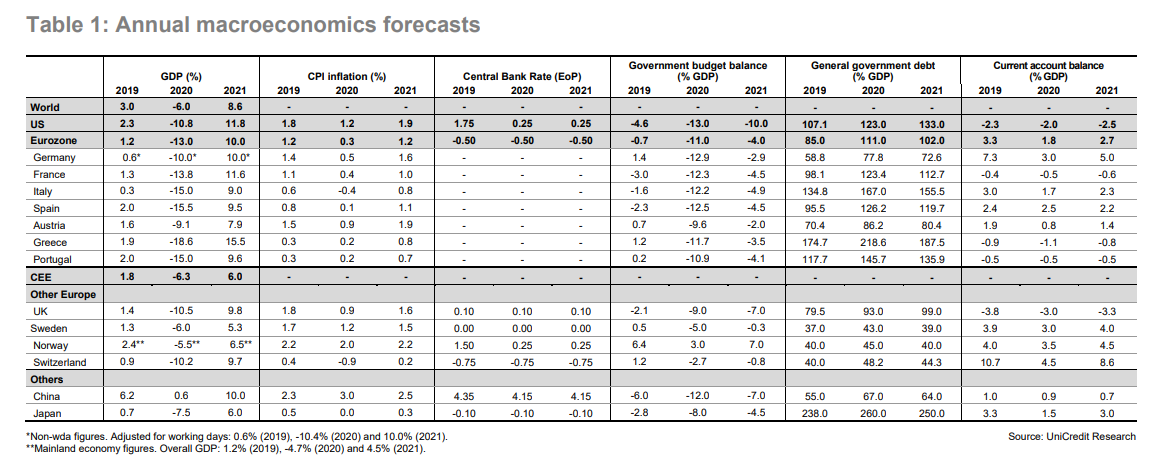

The Portuguese economy could shrink 15% in 2020, according to the latest forecasts by the Italian bank UniCredit. Even worse will be Spain and Greece, whose GDP could fall 15.5% and 18.6% respectively. Overall, The Eurozone GDP is expected to contract 13% this year.

“The mother of all recessions has arrived”. It is with this phrase that UniCredit begins the forecasts in which it already incorporates the economic impact of the coronavirus. The drama of the words is reflected in the pessimism of the figures: the bank expects the worst recession ever for Portugal with GDP shrinking 15%, the deficit rising to 10.9% of GDP, public debt reaching 145.7% (117.6% in 2019) and external accounts becoming negative (-0.5% of GDP).

This is a pessimistic scenario for the Portuguese economy in a year when the world economy is expected to fall by 6%, twice the number seen during the 2008/2009 financial crisis. These forecasts were built on the assumption that measures to contain the spread of the virus will remain in place until June in both Europe and the US, beginning to be “gradually” reversed in H2 2020.

The Italian bank assumes that economic activity will not return to normal, as some measures will have to be maintained until there is a vaccine or massive immunity, in order to prevent a second wave of the outbreak. The risk of a second outbreak should delay business investment and increase savings “just in case”. If there is a high level of bankruptcy and an increase in unemployment, the scenario could be even worse.

In the Eurozone, GDP is expected to fall 25% in H1 2020 and 13% in the fiscal year, recovering with 10% growth in 2021. However, UniCredit’s economists warn that the response of the member states has been “uncoordinated”. “The division between the South and North of the Eurozone has re-emerged and financial solidarity is still elusive,” the bank said.

UniCredit predicts a 5% contraction in Q1

In this scenario, the Portuguese economy should contract 5% in Q1 2020 and between 20 and 25% in H1 2020, recovering with 10% growth in H2 2020 and in 2021.

“These developments would represent the worst recession the country has ever experienced, worse than the one registered during the great recession (when GDP contracted 3.1% in 2009) and the 1975 oil crisis (GDP contracted 5.1%),” recalls the Italian bank.

As in the other countries that took preventive measures, the Portuguese economy recorded a “remarkable and sudden deterioration”. UniCredit points out that Portugal is “particularly vulnerable” to such a shock since 27% of the economy is linked to tourism, one of the sectors most affected by this situation.

In addition, the business sector is made up “almost entirely” of SMEs (97% of the total), with a “relatively fragile” financial situation, which will be tested by this “abrupt cash flow disruption.”