Banco CTT gains 700 clients a day. CEO says there will be more agencies

The CEO of Banco CTT explained, in an interview to ECO, how they were able to gather 200 thousand clients. He looked back on the bank's activity and anticipated some goals for the future.

Banco CTT is the most recent player in the Portuguese banking (a little over one year of age), an institution which is fighting to become a relevant bank in the sector. During the first 15 months of its existence, Banco CTT got 200 thousand clients, according to what the financial institution told ECO. The largest slice of those clients was obtained this year: 700 new clients a day elected the bank headed by Luís Pereira Coutinho to have a financial relationship.

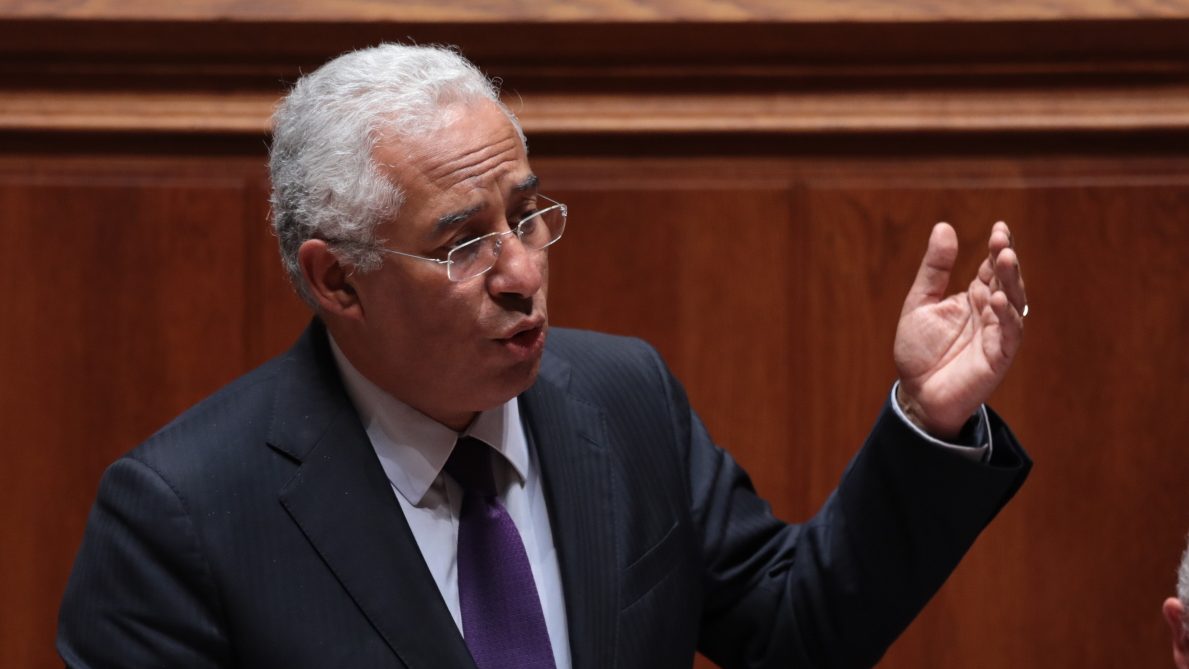

“We are very proud of this number, because it is very a very strong amount of clients in a relatively short amount of time. Having 700 new clients a day adhering to the bank’s proposal is a very important milestone“, states Luís Pereira Coutinho, CEO of Banco CTT, in an interview to ECO.

The CEO justifies the amount of new clients with the bank’s offer to private ones: the offer is “very simple, very easily understood, very practical, absolutely transparent”, namely concerning costs. Costs that Luís Pereira Coutinho states to be very reasonable: “we have no account maintenance commission costs, we have no annuity for debit card, debit card and online transactions also have zero costs”.

When asked about this simplicity and free of charge strategy and his intentions of keeping it, the CEO answered this is not “a promotion”, but principles which are part of the bank’s offer.

This is the strategy, not a promotion. Not charging fees and the simplicity are part of our offer. Banco CTT will maintain that strategy.

The presence of the CTT brand in the country (CTT – Portuguese postal services) allows the bank to be well-received in the market. There are 203 agencies opened in CTT stores, and the CEO says Banco CTT wants to open 10 more branches by the end of the year, which, he clarified, does not imply a significant increase in the number of employees.

Most of the bank’s clients choosing Banco CTT are young and working aged (86% of the total), which are mostly coming from other banks. Luís Pereira Coutinho clarifies that those clients seek firstly “basic services: current accounts, savings accounts, debit and credit cards”. There is also an increasing amount of clients seeking housing credit: Banco CTT decreased their minimum spread from 1.75% to 1.3%.