Going by analysts led to profit in the Portuguese stock market

Following analysts' recommendations doesn't always end well, but doing so last year would have led to more profit than the Portuguese benchmark.

Following analysts’ recommendations doesn’t always end well, but doing so last year would have led to more profit than the Portuguese benchmark. Foreign analysts are far more accurate than the Portuguese in their recommendations and price targets, albeit being more pessimistic. The buy research notes are predominant but investors have a larger tendency to follow the stock selling recommendation.

The Portuguese Securities Market regulator, CMVM, analysed the returns on the 100 thousand euros portfolio performance between October 1, 2015, and September 30, 2016, and found the eight portfolios that follow analyst recommendations have all presented a better result than the PSI-20 Total Return Index itself. The benchmark lost 5,04%.

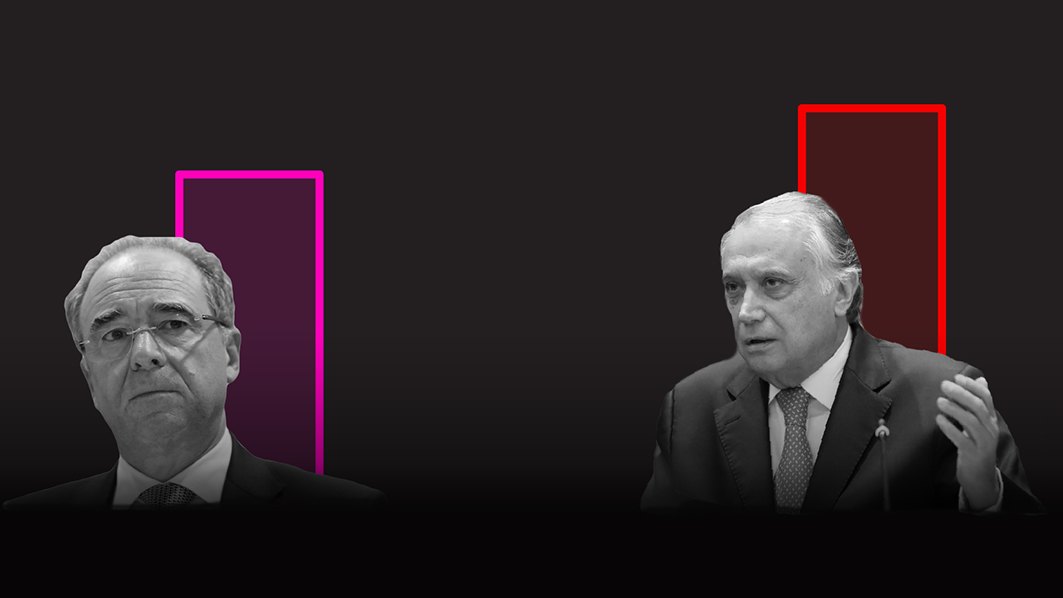

Following Santander recommendations would have generated a 2.32% return on investment, while BPI and Goldman Sachs returned 2.18% and 2.17%, respectively. The Spanish analysts of Santander surpassed CaixaBI, the best performer of the previous year simulation presented by CMVM. Intermoney was the worst performer, even though it managed to outperform PSI-20.

The result proves the CMVM’s finding that foreign analysts are far better in their predictions for the Portuguese stock market. Credit Suisse, Citigroup and Société Générale are the banks that got the highest rate of success in their recommendations and also in predicting the price of the stocks. CMVM states that these results aren’t a proof of the consistency of the analysts, but rather a matter of luck.

Most of the analysts recommendations are that investors should buy stocks. 49.9% of the 482 research notes presented a buy rating and only about 10% were for investors to sell them. But CMVM notes that investors tend to follow more the sell research notes, as proven by the impact these recommendations had on the various companies followed by analysts in Portugal.

The number o research notes issued by analysts for the Portuguese stock has fallen by almost a quarter last year, according to CMVM. Also, the number of companies followed by analysts decreased, which proves the increasing lack of interest in the Portuguese stock market.