Portugal will be able to once again repay the IMF

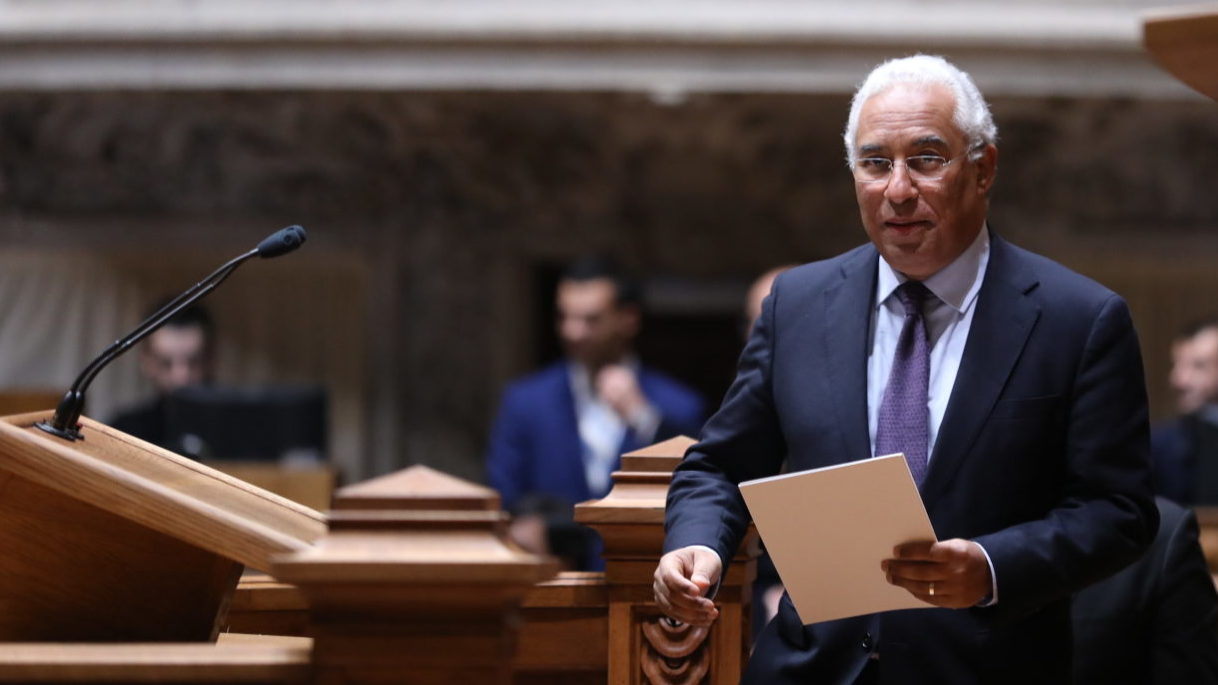

Since banks are returning the state aid, Portugal has more room for maneuver to repay their debt to the IMF, stated António Costa, PM, alongside Ana Botín, who commended Santander Totta.

During the inauguration ceremony of the new Lisbon headquarters of the bank Santander Totta, the Portuguese prime minister stated Portugal is now able to restart amortizing its debt to the International Monetary Fund (IMF), due to the “positive growth” of the financial sector. Because of this positive evolution, Ana Botín, CEO of the bank Santander, highlights Totta as an example to the Group.

António Costa stated that Portugal has “a high level of public and private indebtedness, although it is improving; there was a reduction in the liquid debt last year”, adding that “gross debt would have decreased as well” if not for the support operations of Banif and CGD.

According to António Costa, if primary balances are released as the government predicted, it will be possible to “answer positively to the management of debt”. The PM also highlights: “The Portuguese state has now comfort margins for its financial strength, and the positive evolution of the financial system indicates the needs which justified last year developments will not happen again”.

The prime minister also pointed to the “return of CoCo bonds” from BCP, worth 700 million euros to be paid to the state after the capital increase is concluded, and to the return of the funds to BPP‘s aid to consider it is now possible to “restart making new payments to the IMF”.

The economy is accelerating

António Costa confirmed the Portuguese economy is accelerating: “In the third quarter of 2016, Portugal had the largest rhythm of all members of the European Union“.

The PM also pointed to the latest provisional data from Statistics Portugal (INE) concerning unemployment as very good: “The 10.2% unemployment rate means there was a decrease of more than two percentage points throughout 2016; there were 100,000 new job positions created”. Costa also pointed to the deficit as a positive sign for the economy, stating it is “safe to say the 2016 deficit will not surpass the 2.3% threshold”.

“Totta is a good example for Santander Group”

The CEO of the Santander Bank, Ana Botín, highlighted the financial robustness of Santander Totta, “the number one bank in Europe and number six worldwide”, since it produced very positive results throughout the years in spite of the severe economic crisis Portugal suffered.

“Totta is a good example for the Santander Group, it generates results in the correct way”, stated the banked, commending the effort Portugal has been making in terms of fiscal consolidation, along with the strategies it has been implementing in order to stimulate economic growth. “The Portuguese and the Spanish have been working hard and our countries have made a great effort in the past years”, she pointed out.