CGD is at risk of losing 900 million with the investment in La Seda Barcelona

Investments and loans made during the government where José Sócrates was prime minister to companies who are now bankrupt, weigh in on CGD’s balance.

Caixa Geral de Depósitos (CGD) is risking losing over 900 million euros due to high-risk transactions made in the previous decade. At issue are the operations made with the petrochemical sector group La Seda Barcelona.

It is the Portuguese newspaper Público that develops this story, reminding the origin of such operations. The decisions on the investment and financing were made during José Sócrates’ government, when Carlos Santos Ferreira was CGD’s chairman and Armando Vara was vice-chairman.

There are four companies involved: the Spanish company La Seda, that produces thermoplastic polyester for the manufacture of bottles, and the Portuguese companies Selenis (shareholder of La Seda and manufacturer of plastics), Artlant (supplier of La Seda) and Barbosa Almeida (shareholder). Between 2006 and 2010, these companies crossed paths because of CGD. The public bank financed all four companies, invested in La Seda and Artland and promoted the project that was going revitalize Sines’ Complex.

Today, La Seda, Artland and Selenis are three of the major CGD’s debtors, but, Público says, none of the companies have means to pay their debts. The Catalan enterprise has asked to be protected against creditors, Selenis, today called Jupiter, has declared bankruptcy, and Artlant is already in the Plano Especial de Revitalização (PER – Special Plan for Revitalization: a plan that aims to allow the debtor in an economically difficult situation or in imminent insolvency, but with a chance of recovery, to negotiate with creditors in order to reach an agreement in its revitalization).

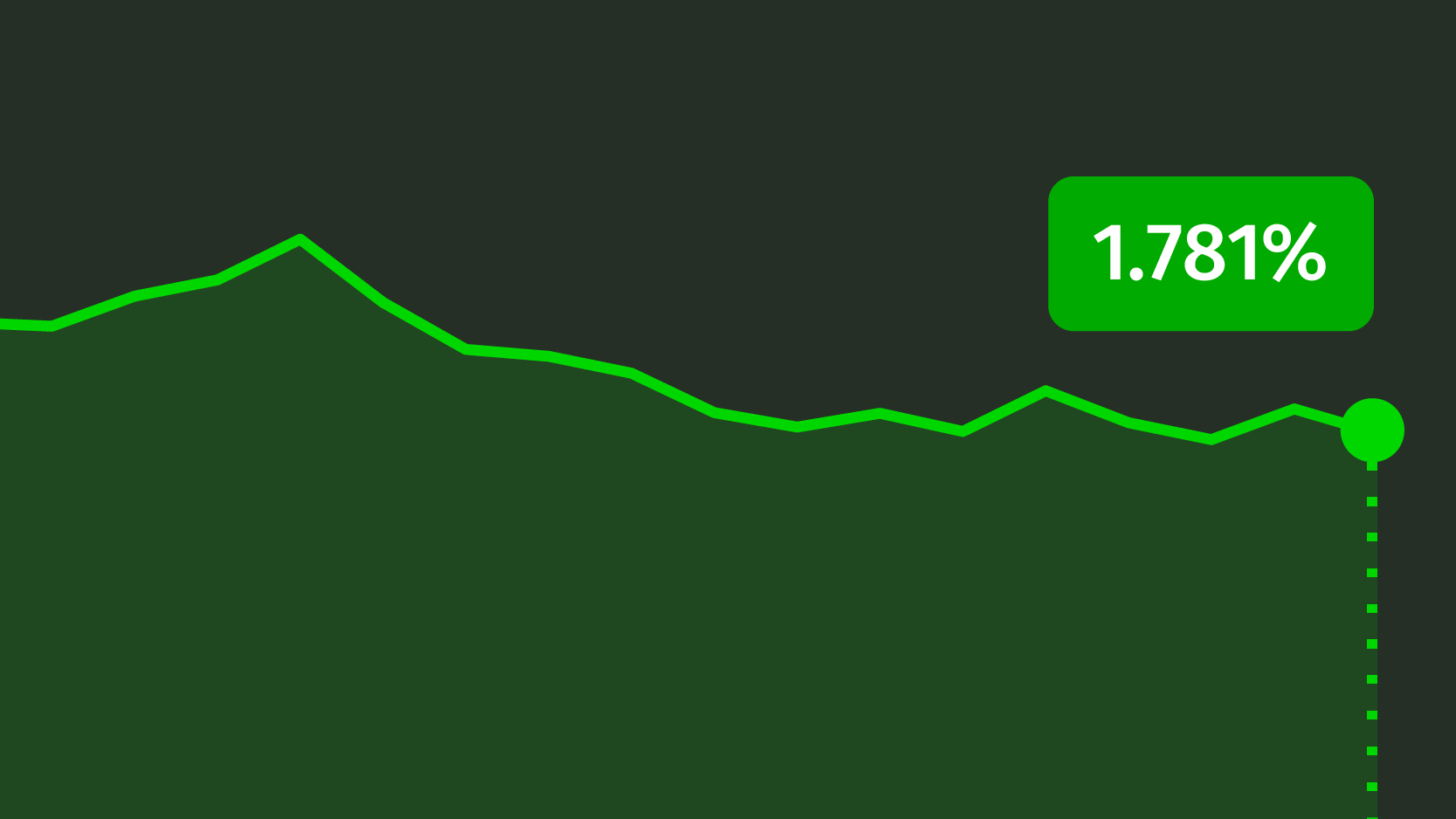

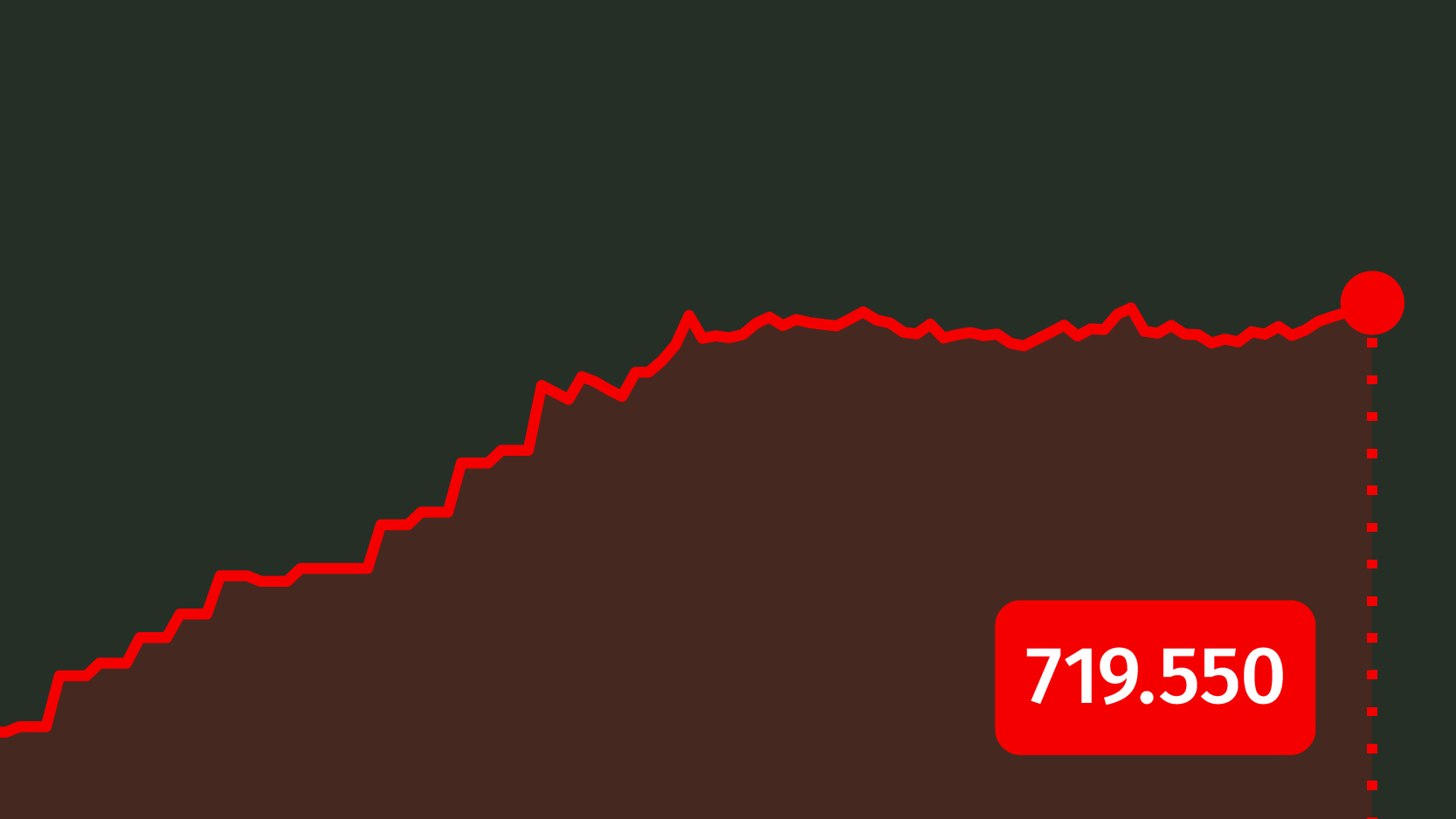

CGD has invested 121.3 million euros in La Seda and has financed the company with 75 million; invested 25 million in Artlant, to whom CGD claims 520 million; and granted credits of 165 million to Selenis. All told, the public debt exposure of the public bank to these companies goes up to 906.3 million euros, around 22% of the 4.1 billion in public money that will contribute to the 5.2 billion euros’ recapitalization of CGD.

Besides this information, Público also brings forward the CGD has accounted for over 6 billion euros in lost credit between 2011 and 2015, out of which 4.2 billion come from investment banking loans in the project finance area. Weighting in the balance CGD is the loan of over one billion to BCP’s shareholders, in 2007.