The ECB buys over a billion of Portuguese debt in September

Last month, the central bank accelerated the process of buying the Portuguese public debt, reassuring the markets on the eventual illiquidity of national market.

The European Central Bank (ECB) has once more accelerated the purchase of Portuguese debt. In total, the euro monetary authority purchased national government bonds of nominal value of 1,022 million euros in September as a part of its Public Sector Purchase Programme (PSPP).

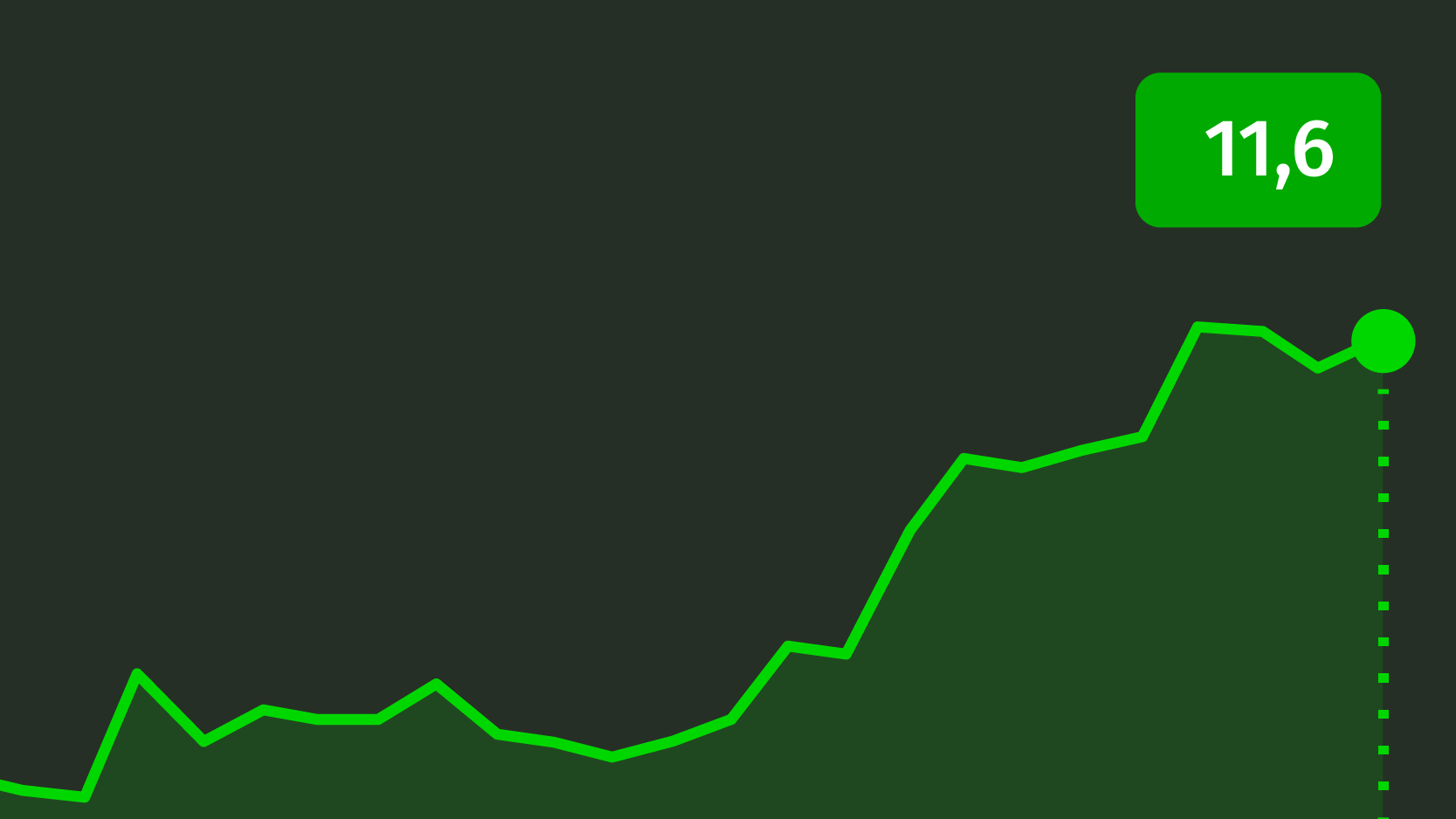

Last month’s purchases reassured the markets and helped dispel some doubts about the eventual illiquidity of securities eligible for ECB’s purchase programme. The central bank cannot hold more than 33% of a line of bonds, and investors have showed concern over the fact that in July and August debt purchase from ECB decelerated – having a total of purchases of 958 million in July and 722 million in August. ECB’s data updates about September indicate their portfolio of Portuguese debt security rose up to a total of 21.84 billion euros.

By the end of September, investors’ risk perception reached its peak since February, which worried DBRS, the Canadian agency that keeps Portugal eligible for the ECB’s purchase program and that will revise the rating of Portuguese debt in October 21st. The interest rate associated with 10 year-bonds has currently plunged five base points to 3.34%.