Associação Mutualista Montepio returns to losses. Tax handout is hurting accounts, afterall

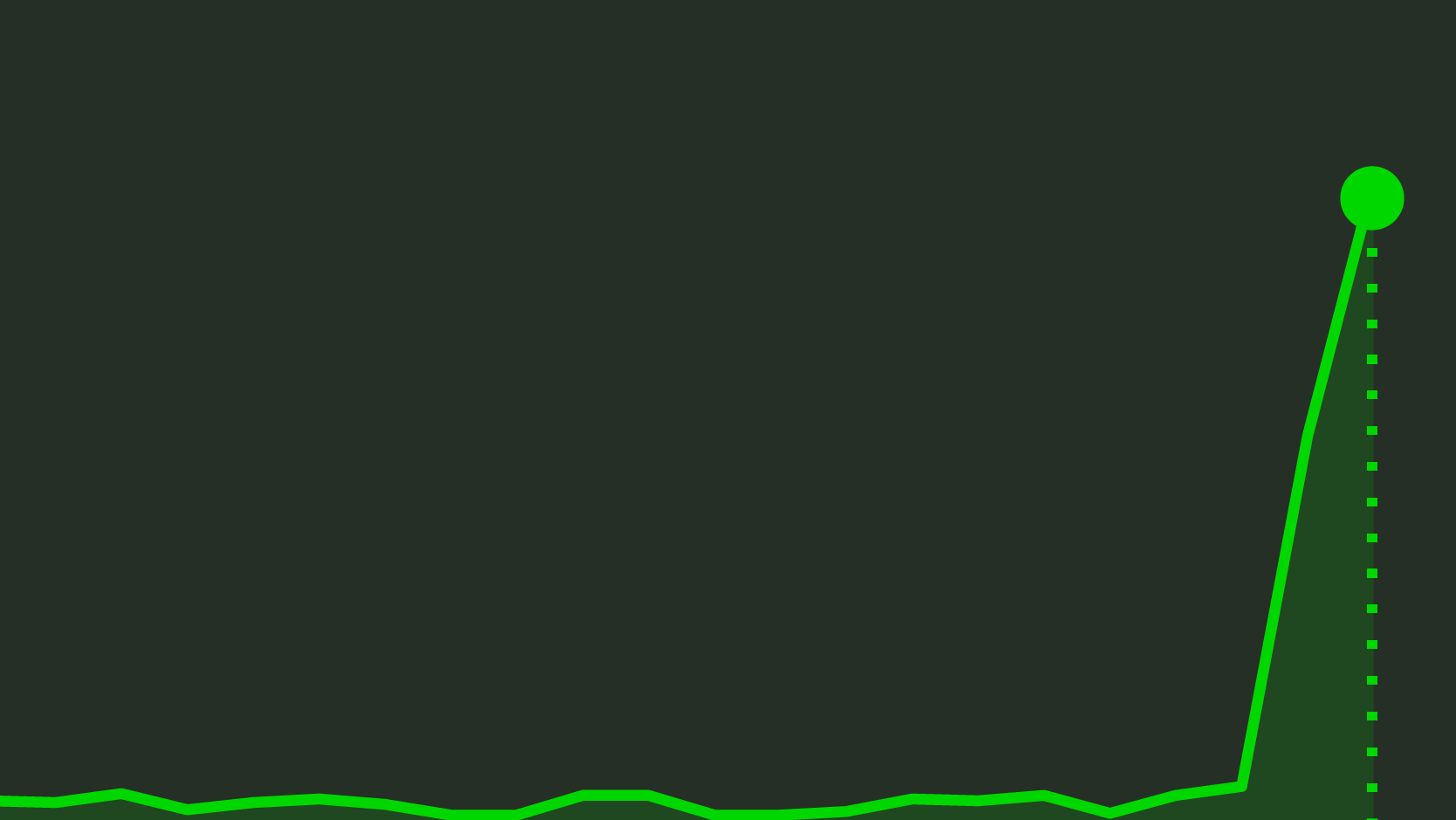

Associação Mutualista ended the first quarter with nine million euros' losses. More than half the loss corresponds to the reversal of tax credits, ECO knows.

Associação Mutualista Montepio Geral (AMMG) registered nine million euros’ losses in the first quarter of the year, a performance that was widely worsened by the reversal of part of the tax credits that AMMG registered in last year’s accounts, ECO ascertained.

A little over one month ago, when it approved the 2017 accounts, the entity headed by Tomás Correia knew it would have to achieve profits in the future in order to be able to benefit from a ‘tax handout’ of over 800 million euros that allowed for the accounting profit of 587 million euros last year. However, if losses were suffered, that tax credit would have to be reversed and accounted as a loss. That was what happened in the first quarter of the year.

From the nine million euros’ losses registered between January and March of 2018, around three million euros correspond to an operational result, that is, the normal activities of Associação Mutualista. Another million corresponds to the annual transfer from AMMG to Fundação Montepio, which was registered in the first quarter. The remaining losses of five million euros, however, concern the reversion of the deferred tax assets (DTA).

What happens with those DTA is that, by representing the right to an economic value of a potential future tax deduction, a company or bank can only really take advantage of them if it presents a taxable income in the next couple of years.

However, in the case of AMMG, since there was no profit in the first quarter, it is not possible to pay the Company Tax (IRC). As a result, without that tax deduction, a part of those DTA had to be dispelled and accounted as a loss.

As announced in March, AMMG ascertained 808 million euros in DTA, coming from mathematical provisions to cover responsibilities concerning its products and past losses. Those losses were made available for a future tax deduction from the moment AMMG was exempted from the Company Tax (IRC), which is allowed for social solidarity institutions.