Ercros. Success of Bondalti takeover bid depends on the approval of small investors

Shares shot up 23% after competition authorities approved the takeover bid. Bondalti is now awaiting a decision from the Ministry of Economy before the operation returns to the CNMC.

Bondalti’s takeover bid for Ercros took another step forward after receiving the green light from the Spanish competition authority, the National Markets and Competition Commission (CNMC). The decision was applauded by investors, with shares climbing more than 23%, and is also a positive sign for the Portuguese company, which needs to convince small investors, who hold almost 77% of the capital, to accept the €3.505 it is offering for each share in the Spanish company.

More than a year and a half after announcing its offer for 100% of Ercros’ capital, Bondalti is still awaiting the outcome of a lengthy decision-making and approval process before shareholders are called upon to decide the future of the Spanish chemical company, which had a turnover of €643 million in 2024.

Following the CNMC’s decision to accept the takeover bid with commitments, the process now moves to the Spanish Ministry of Economy, which has 15 working days to decide whether or not to refer the operation to the Council of Ministers. According to the Spanish press, no opposition to the offer is expected, and it should proceed to the market regulator, which will be responsible for approving the prospectus and documentation. Once approved, the offer announcement will be published and the acceptance period will begin.

The new developments led Ercros shares to climb 23.3% to €3.20 per share at the end of last week. This performance brings the shares closer to the €3.505 [adjusted for dividends paid in the meantime] offered by Bondalti. At the current price, the offer price implies a premium of 9.5%.

After a period in which the shares exceeded the takeover bid price in the months following the announcement of the deal, the shares have been falling and are now trading below the offer price, a sign that shareholders’ intentions regarding acceptance of the offer may have changed following the withdrawal of Esseco’s takeover bid and in view of the challenging environment affecting the chemical sector in Europe, which has deteriorated the Spanish company’s accounts.

With 76.9% of the company’s capital dispersed among small positions in the market, it will be these minority investors who decide the fate of Ercros and determine whether Bondalti reaches the 75% threshold set for the takeover bid to be successful. According to the company’s shareholding structure at the end of 2024, lawyer Víctor Rodríguez Martín is the largest shareholder, with 6.09% of the capital, followed by businessman Joan Casas Galofré (6.02%). However, Galofré and his wife Montserrat García Pruns together control close to 10% of the capital.

There is also a 4.99% stake held by the US fund Dimensional Fund. The Samson Rock Event Driven fund and BlackRock hold 1.39% and 1.01%, respectively. All in all, these holdings above 1% total 23.11% of the capital, with the remainder dispersed on the stock exchange.

After an initial very negative reaction to the offer, with a group of shareholders representing 27% of the capital stating that they rejected the takeover bid and the company’s largest shareholder considering the offer ‘low’, conditions have changed and, given market developments, the outlook is more encouraging for the Portuguese chemical company.

In a note published after the withdrawal of the offer by Italy’s Esseco, Lighthouse analyst Alfredo Echevarría Otegui argues that Ercros offers Bondalti “a unique opportunity for truly synergistic inorganic growth”. With regard to shareholders, the expert notes that “it is clear that there is a great deal of uncertainty, but the current price seems more like a (great) opportunity than a risk”.

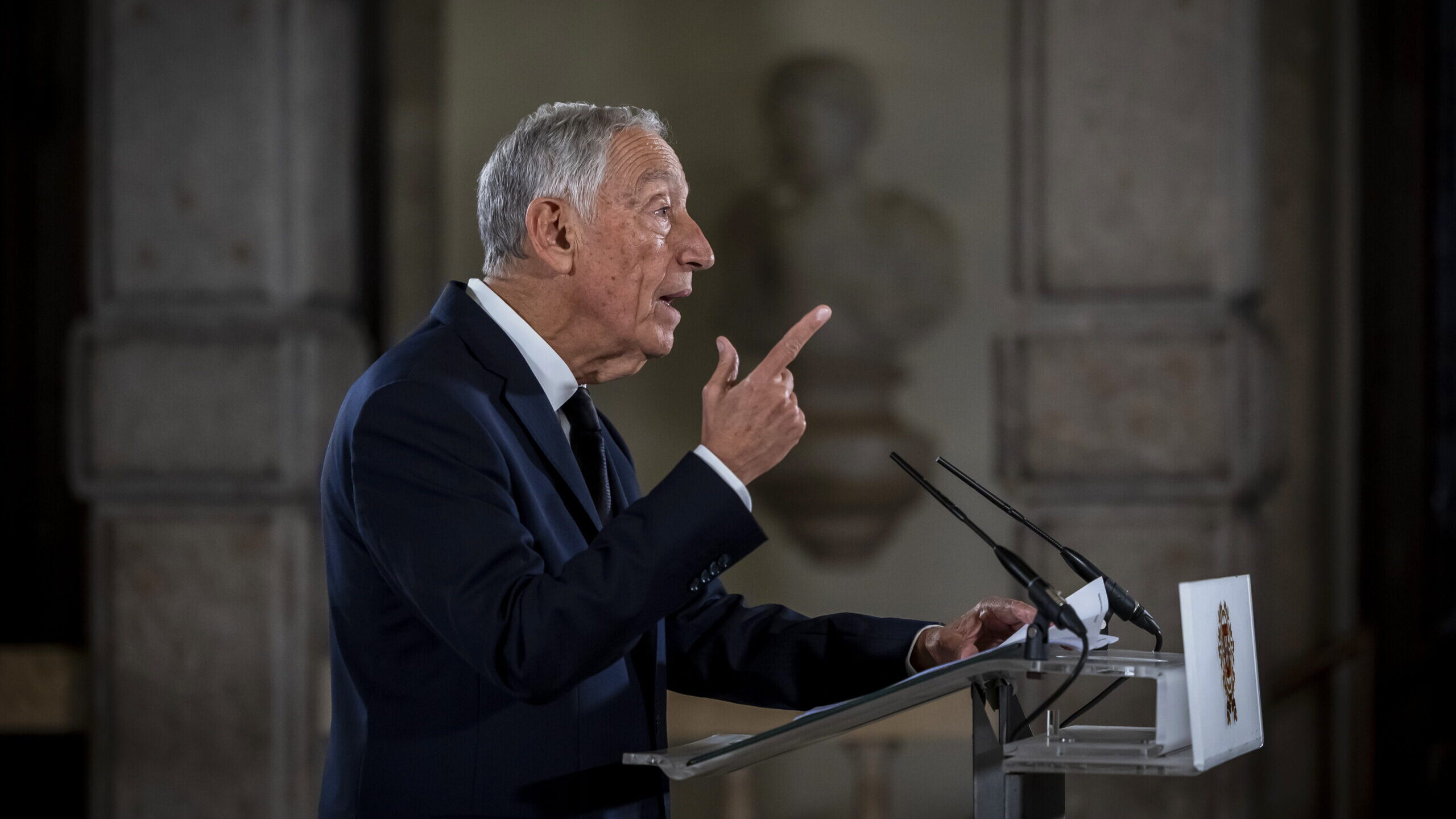

“We believe that the offer price represents an opportunity for Ercros shareholders. In addition, the alliance with Bondalti is very beneficial for Ercros and its employees, given the increasing level of competitiveness in the sector”, said João de Mello, president of Bondalti, in a statement after the CNMC’s decision last Thursday.

“With the integration, we hope to create the necessary conditions for the two companies, combined, to overcome the major challenges we face”, said João de Mello, President of Bondalti.

“The European chemical sector requires significant investment and the creation of larger-scale industrial groups with the capacity to act in an integrated manner and face the major challenges that are transforming production and distribution systems: increased international competition, energy transition, digital transformation and the regulatory framework”, Bondalti argues in a statement.

Bondalti’s objective, once the operation is completed, is to promote the delisting of Ercros shares from the Stock Exchange, with the offer being conditional on the acceptance of more than 75% of the capital, “allowing for effective integration and the creation of a European industrial group with the necessary scale”.

The chemical sector has faced major challenges, penalised by rising costs and lower demand. While Bondalti’s profits fell to €41 million last year, with EBITDA of €71 million, Ercros went from profits of €27.6 million in 2023 to losses of €12 million in 2024.

The merger of the two companies would create synergies and strengthen their strategic position in the sector. With industrial units in Estarreja (Portugal) and Cantabria (Spain) and logistics facilities in Aveiro, Barreiro (Portugal) and Vigo (Spain), Bondalti, if it succeeds in buying Ercros, guarantees that it will maintain the company’s headquarters in Barcelona, as well as jobs and local presence in the communities where the company operates.