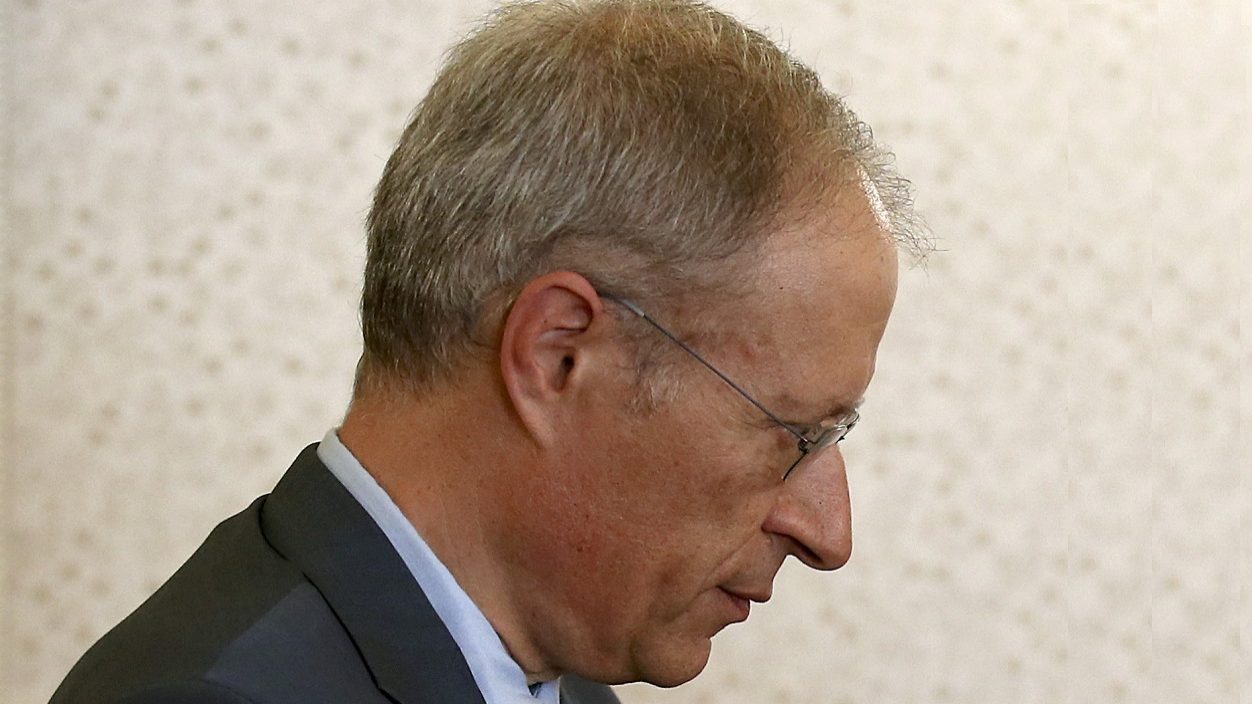

The CEO of the Promotional Bank presents his dismissal

José Fernando Figueiredo has left his job position. Henrique Cruz, from the Social Security Stabilization Fund, and Ana Beatriz Freitas, the new CEO of SPGM, will join the board of the institution.

José Fernando Figueiredo is no longer the CEO of IFD (Development Finance Institution), known as promotional bank. Henrique Cruz, from the institute which runs the Social Security Stabilization Fund, and Ana Beatriz Freitas, the new CEO of SPGM (Sociedade Portuguesa de Garantia Mútua), will join the board of the institution, ECO ascertained. The chairmain Alberto Castro will remain in office.

The Economy ministry confirmed to ECO that José Fernando de Figueiredo is leaving, but refrained from making any further comments. Starting on July 1st, 2017, José Fernando Figueiredo will no longer stay in office as IFD’s CEO. While headed by him, the institution was able to implement several credit lines with mutual guarantee, either from business angels or venture capital, supported by Portugal 2020 funds coming from several Operational Programmes (one line of credit for one billion euros for investment and one line of 33 millions for business angels, which could make startups have 60 million euros). José Fernando Figueiredo also revealed the blockage in the venture capital line has been solved, and 220 million euros contracts were signed concerning venture capital funds.

Furthermore, José Fernando Figueiredo revealed there is a first operation with the European Investment Bank which is currently being concluded. ECO knows the operation consists of a credit line of 500 million euros, from a global programme worth one billion euros.

Among the reasons for the dismissal of José Fernando de Figueiredo could be the Portugal 2020 reprogramming, which will happen this year, and which should represent a deduction of the financial instruments meant for IFD. This should happen not only because of the flaw in the market which justified its creation is now being corrected by the commercial banking, but also because the current Executive considers that an excessive amount of financial instruments were given within this community aid framework.