After all, Efacec suffered losses of €183.9 million in 2021

Efacec ended the year with the 'disclosure' of all accounts, and this led to consolidated losses of €183.9 million.

In July 2020, the (still) Minister of Economy, Pedro Siza Vieira, stated in Parliament that the State had nationalised 71.73% of Efacec in the hands of Isabel dos Santos to “enable the continuity of the company, ensuring the stability of its financial and operational value”. The figures for 2021 are approved by the board of directors, the viability of the company seems assured with the sale to DST, still awaiting approval from Brussels, but the financial and operational value could hardly be more unstable: Efacec recorded a consolidated loss of €183.9 million, a operating loss of almost 40 million and a net debt of €193 million. Here are Efacec’s closed accounts for 2021.

The closure and approval of Efacec’s accounts were essential for the reprivatisation process of the industrial company, led by Ângelo Ramalho, and which is under analysis by the Directorate-General for Competition (DG COMP) under the State aid regime. But the numbers turned out to be worse than anticipated and, in fact, are a kind of closing of accounts for liquidation, that is, with the assumption of all the ‘trapdoors’ hidden over the past years: An example is the negative impact of more than €73 million in the goodwill and brand item, and which contributed decisively to the consolidated loss. But not only that. Deferred taxes were also recognised in the 2021 accounts and were never presented in the specifications for the reprivatisation nor did they justify any analysis by Haitong in assessing the proposals. And here the impact was €37.5 million.

Contacted officially, Efacec declined to comment on the 2021 accounts, which will still have to pass through the general meeting of shareholders, which has the State and the partners Mello Group and TMG.

The degradation of Efacec’s accounts throughout the year 2021 is notorious, as ECO revealed in successive news items. The target announced to the candidates for reprivatisation pointed towards a positive EBITDA of €22.9 million, but in the last quarter, a operating loss of €31.8 million was already admitted. In the end, the approved accounts registered a EBITDA of €38.9 million.

The Cabinet approved the sale of the State’s stake in Efacec to the Portuguese group DST on February 24. And in view of these accounts, one can understand what the Secretary of State João Nuno Mendes said at the briefing where the sale operation was announced: “After signing the sale contract, there will be a period of restructuring of the company’s equity, which may result, at this stage, in a stake of up to 25% in Efacec resulting from the capitalisation by Parpública”, he explained. This is also a legal requirement, because with these losses, Efacec falls under the so-called article 35, with negative equity. Efacec will start by reducing its capital, and then the State will increase it by €60 million with quasi-equity financial instruments. This operation, called Operation Harmony, will be followed by a capital increase by the new shareholder, with €81 million, a figure confirmed by João Nuno Mendes. Finally, prior to the signing of the contract (pre-closing), Banco de Fomento will advance with the refinancing line. A line that, as ECO advanced, will refinance the company’s debt by €100 million, at 25-years, with an interest rate of 1.25%, convertible into non-voting preferential shares.

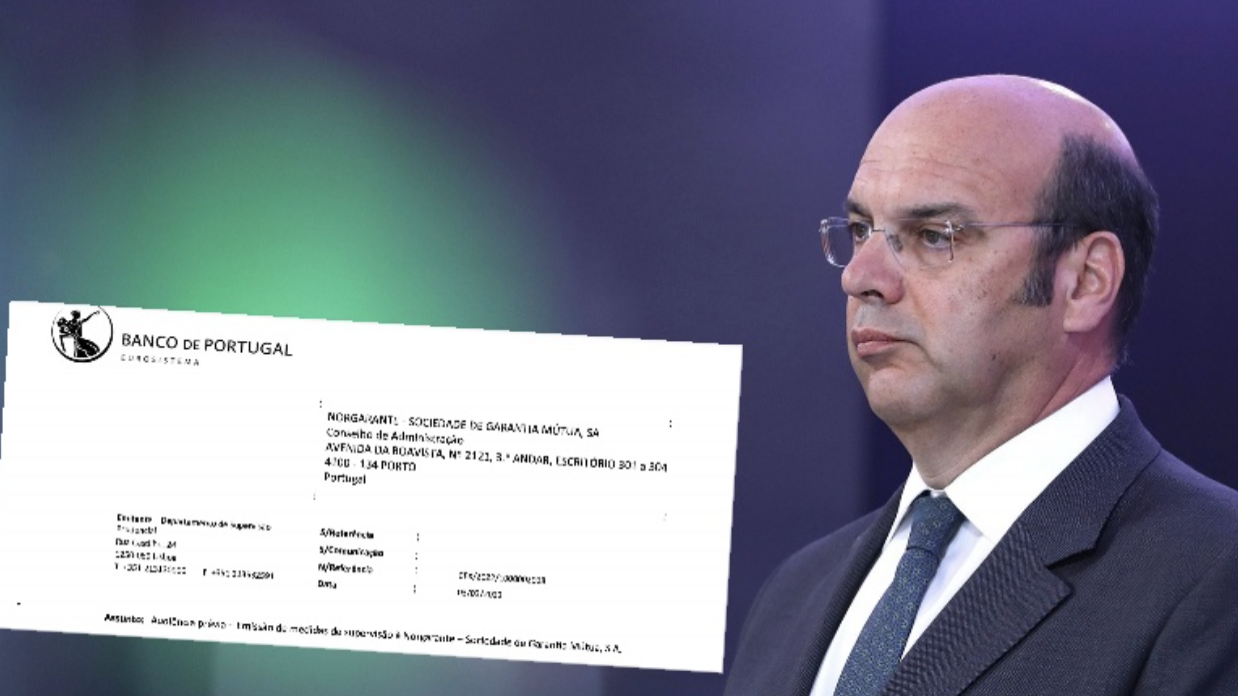

In fact, this operation and the recapitalisation of the company will be the solution to respond to the Bank of Portugal’s demands. As ECO revealed, the supervisor considered that the granting of public guarantees decided by the government (Economy and Finance) and Banco de Fomento through its subsidiary, mutual guarantee company Norgarante, violated the law. The guarantees of €99 million – made in two operations, one of 63 million and the other of 36 million – violated the general regime for financial institutions. The Bank of Portugal notified Norgarante of the illegality and demanded the regularisation of the situation, within 30 days, and the company has already responded: The sale of Efacec will allow the liquidation of the said public guarantees. It was these two operations that allowed the viability of the company from its nationalisation in July 2020 until its sale to DST on February 24, a deal that is dependent on approval from Brussels.