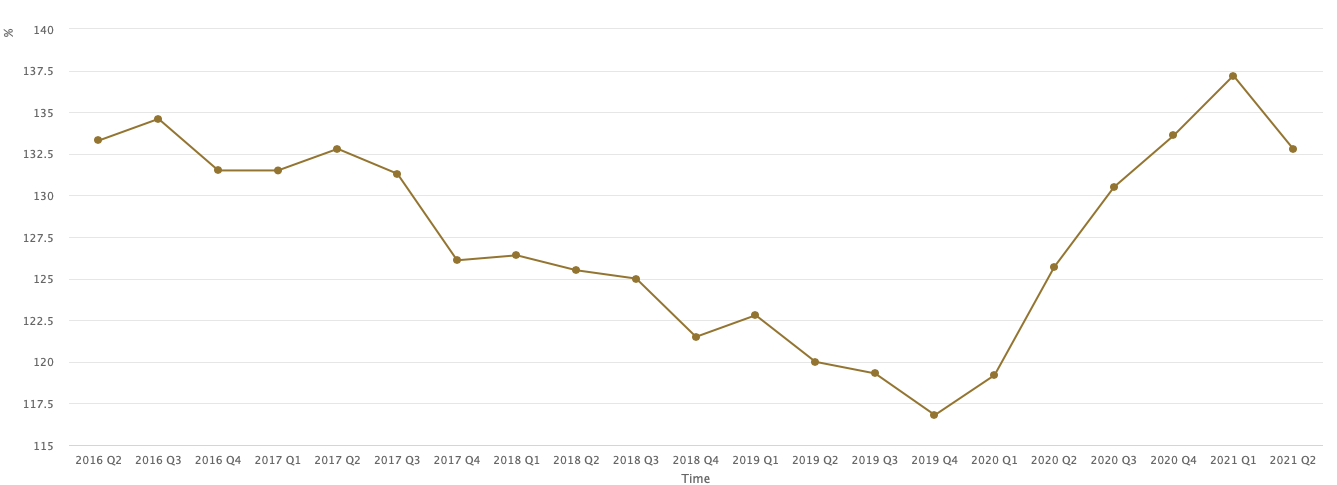

Portugal’s public debt falls to 132.8% of GDP in Q2

The country's public debt rose by €2.7 billion in June, to €277.5 billion. However, the debt ratio fell to 132.8% of GDP in the second quarter of this year.

Portugal’s public debt, as calculated for purposes of European Union budget rules, rose by €2.7 billion in June to €277.5 billion, a new high, according to data published on Monday by the Bank of Portugal (BoP). Although the figure is the highest ever, the ratio closed the second quarter at 132.8% of GDP, down from 137.2% of GDP registered in the first quarter.

“At the end of the second quarter of the year, the debt ratio stood at 132.8% of GDP, accounting for a decrease of 4.3 p.p. (percentage points) from the end of the first quarter,” the central bank said, referring to the second quarter, a period in which GDP grew 15.5% year-on-year and 4.9% quarter-on-quarter, according to Statistics Portugal (INE).

This fall is fully explained by the increase in GDP (denominator), thanks to the economic recovery seen in the second quarter following the loosening of Covid-19 restrictions. The second quarter of 2021 was the best in the Portuguese economy since the pandemic arrived in the national territory. With a higher GDP, the debt ratio fell significantly, even as the value of the debt itself reached a new record high.

In the second quarter, the stock of public debt grew by about €2.3 billion, and this is partly because of the arrival of the second instalment of SURE, the European Commission’s programme that supports employment. In June, according to the Bank of Portugal, the increase in public debt was “driven mainly by a rise in debt securities (€2.2 billion).”

The government’s forecast is to reach the end of the year with a public debt ratio that reaches 128% of GDP, 5.6 percentage points less than in 2020. This forecast is based on the annual economic growth of 4% and a deficit of 4.5% of GDP in 2021, but these forecasts may change when the State Budget for 2022 (OE 2022) is presented, especially because the government is confident that the economy will grow more.

IN the monthly data, the central bank figures also reveal that general government deposits – the so-called “financial cushion” – increased by €800 million to €21.5 billion. Thus, the public debt net of deposits increased by €1.9 billion compared to the previous month, to a total of €256 billion.