PM satisfied by ECB head’s confidence in soundness of EU banking system

EU leaders today reiterated that the banking sector "is resilient, with strong capital and liquidity positions" on a day when several European banks are in sharp stock market declines.

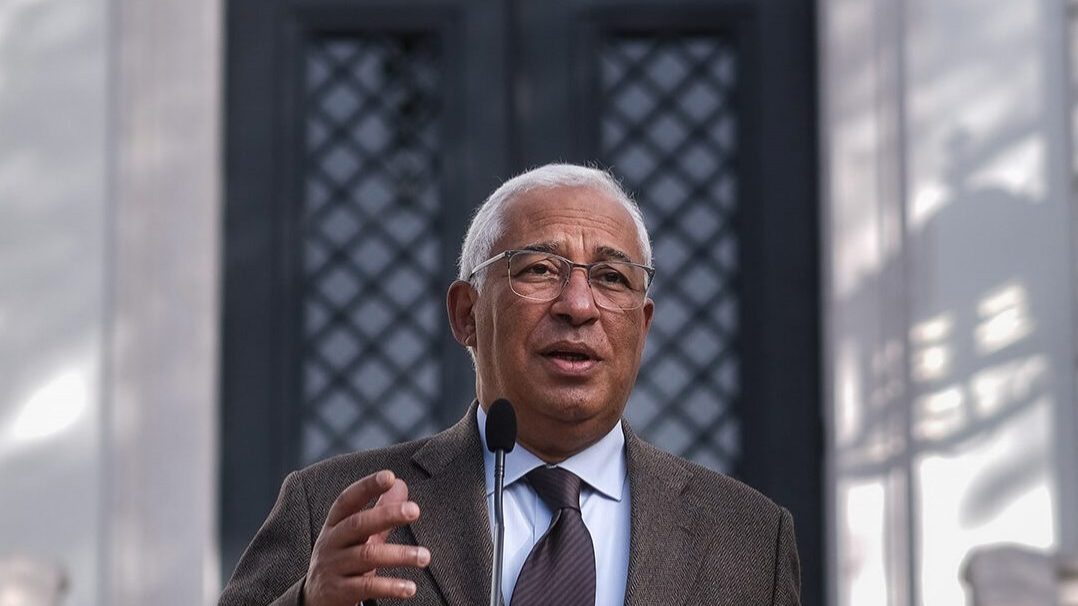

Portugal’s prime minister, António Costa, on Friday expressed “satisfaction” with “the message of great confidence” that the president of the European Central Bank (ECB), Christine Lagarde, conveyed to European Union (EU) leaders regarding the soundness of the European financial system.

In a brief press conference after the Euro Summit, which closed two days of work by the heads of state and government of the 27, and on a day when the main European stock exchanges accentuated losses, dragged down by banking, due to the return of fears about the financial health of European banks, Costa highlighted the ECB president’s message.

“The first message I would like to convey is that we have noted with pleasure the message of great confidence that Mrs Lagarde conveyed about the solidity of the European financial system, explaining in detail the differences between the European regulatory system and the US or even Swiss regulatory system, and therefore the reasons why we can have confidence in the stability of the financial system,” the head of government said.

The prime minister pointed out that, for his part, he had “the opportunity to stress that this stability and this confidence would certainly be strengthened if we could speed up the conclusion of the Banking Union, particularly with the deposit guarantee system.”

According to Costa, “this would also be fundamental to, associated with the Capital Union, strengthen the investment capacity of companies and in companies, so that they may accelerate their modernisation process and participation in the double transition, digital and energy”.

“With the guarantee that is given of sufficient liquidity in the banking system, it is very important that this liquidity is directed towards productive investment, towards the energy transition, towards the creation of more and better jobs, and not continue to be consumed, as it has been excessively, in investment in real estate,” he stated.

Asked what he had the opportunity to tell Lagarde about the successive interest rate hikes that have been decided by the ECB, Costa said that the institution’s president’s position is publicly known, and reiterated today in Brussels, as well as his own.

“It is known what Mrs Lagarde said, because she said in the Council exactly what she has been saying in public. As for what I said in the Council, it is also exactly what I have been saying in public: the ECB should be very prudent about the way it is conducting this monetary policy,” he said.

António Costa warned that “it is true that the economy has shown a lot more robustness than what was expected, but we all fear that this stems from the fact that there has been a very significant accumulation of savings and liquidity as a result of the pandemic and, as these savings diminish, the measures to increase interest rates may have an effect”.

“As far as member states are concerned, and in particular states where there is high access to credit for home ownership, naturally they have to adopt measures to protect households from the effects of this ECB policy,” he commented.

EU leaders today reiterated that the banking sector “is resilient, with strong capital and liquidity positions” on a day when several European banks are in sharp stock market declines.

In a statement released at the end of the eurozone summit – which was held under extended arrangements – on the second day of the European Council, EU leaders assured that the resilience of the EU banking system has been “significantly strengthened” by the Banking Union.

“Our banking system is resilient, with strong capital and liquidity positions,” the communiqué stressed, in which the heads of state and government recommitted “to complete the Banking Union”.

The summit’s words contrast with the fall that several banks – including Germany’s Deutsche Bank and Commerzbank – on the stock exchange, due to recent turbulence in the sector and uncertainty over interest rate developments.

The banking union aims to ensure that the banking sector in the euro area and the EU in general is stable, safe and reliable, thus contributing to financial stability.

At the euro summit, Portugal was represented by the prime minister, António Costa. The president of the Eurogroup, Paschal Donohoe, and the president of the European Central Bank, Christine Lagarde, attended as guests.