PM stresses need to conclude EU banking union to reduce market risks

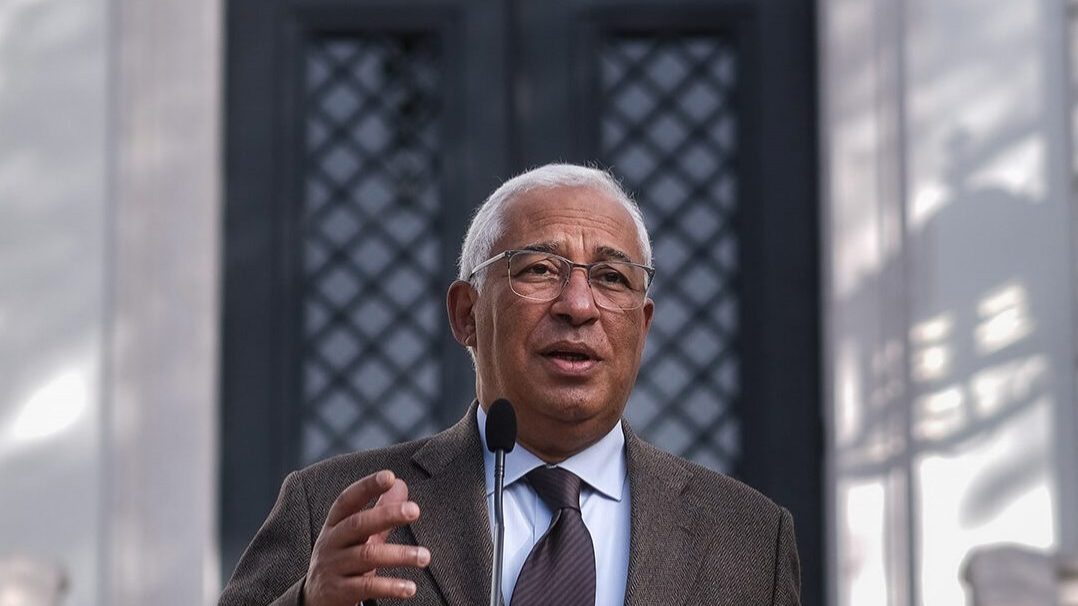

"We must not forget that the banking union is still incomplete and there is a fundamental pillar, which is the deposit guarantee, which has yet to be implemented," said António Costa.

Portugal’s prime minister, António Costa, on Thursday insisted on the need to conclude the process of transferring responsibility for banking policy within the European Union from the national to the EU level in certain circumstances – known as banking union – to ensure the stability of the sector and prevent a financial crisis similar to that of 2008.

“We [in Portugal] have insisted that it is in times of calm that problems should be dealt with, take advantage of the sunny days to deal with the roof,” Costa said, shortly before the start of a European Council meeting in Brussels. “This is not what happened and now there are many clouds in the sky. We should waste no time and conclude this banking union dossier to help avoid any risk in the market.”

While acknowledgeing that “since 2008 until now the whole regulatory framework of the European banking system has changed radically” and that the risk of contagion between banking institutions today is lower in case of bankruptcy, he stressed that there is more to do.

“We must not forget that the banking union is still incomplete and there is a fundamental pillar, which is the deposit guarantee, which has yet to be implemented,” he added.