Portugal’s Economy Minister welcomes Isabel dos Santos’ sales of stakes

Portugal's Economy Minister considers that the exit of the shareholder of companies such as the energy company Efacec or the bank EuroBic may avoid reputational damage.

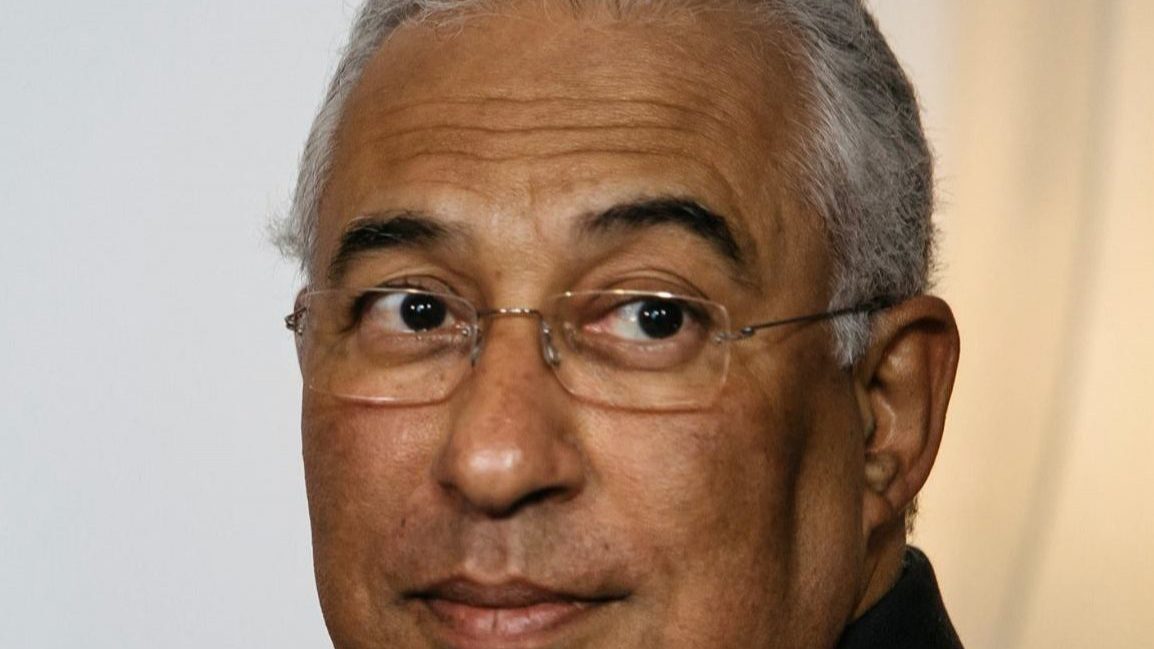

The Portuguese Economy Minister, Pedro Siza Vieira, welcomes the possibility of selling Isabel dos Santos’ investments in Portugal. In an interview with Reuters, the person in charge said he considers that the exit of the shareholder of companies such as Energias Efacec or EuroBic bank could avoid reputational damages.

“I think this is a good step because we want to avoid any reputational damage in the activity of these companies,” said the Economy Minister Pedro Siza Vieira, in an interview with Reuters, regarding the exit of Isabel dos Santos from the shareholder structure of Portuguese companies.

The Angolan woman is being accused of fraud in the country due to alleged embezzlement while she was president of the state-owned oil company Sonangol. The case was made public by the investigative journalism consortium (ICIJ) which revealed over 715,000 files indicating how the daughter of the former president of Angola, using EuroBic, transferred 15 million dollars to a company of her own in Dubai.

Isabel dos Santos has holdings in 22 companies with headquarters or presence in Portugal, including Nos and Galp, but also Efacec and EuroBic, the latter two being in the process of being sold. These are the divestments that Siza Vieira says are positive.

“If you look at the impact, which is adverse, on the origins of Isabel dos Santos’ money – which has yet to be proven – the damage to the companies reputation could be significant. So her willingness to alienate quickly is useful in this context. It means that the damage to reputation can be diminished and, I hope, totally avoided,” the Minister said in statements to Reuters.

Alongside the judicial investigations that are being conducted by the Angolan justice system, the Portuguese Attorney General’s Office is also monitoring the situation. The Bank of Portugal is conducting an inspection at Eurobic to evaluate the procedures against money laundering and the Securities Market Commission is investigating the auditors involved in the case.

“Society has become more intolerant of corruption, of lack of transparency, of tax evasion,” Siza Vieira added. “I don’t wish to suppose or conclude that any of this has happened in these particular cases.”