CMVM accuses Ricardo Salgado of deceiving investors in BES’s capital increase

BES carried out a capital increase in June 2014 and in this operation relevant data on the financial situation of the bank and GES were omitted. CMVM accuses five administrators.

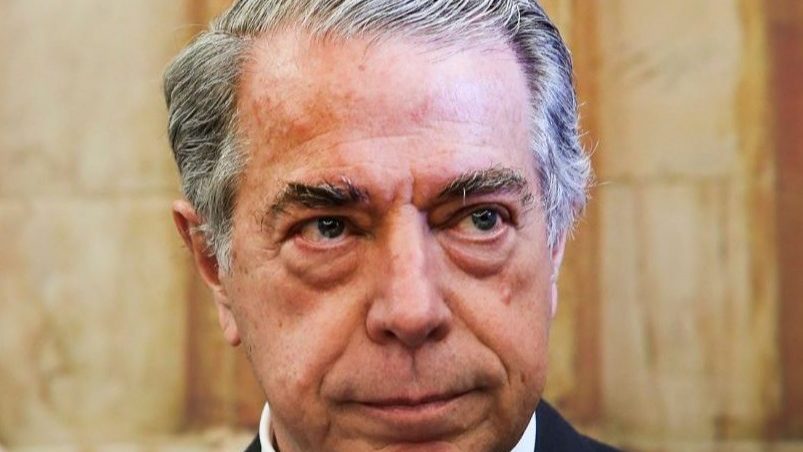

On June 11th, 2014, Ricardo Salgado stated that the 1,045 million euro capital increase completed that day had been “the most successful since privatisation at 1992″. In that written statement to Público, the then president of Banco Espírito Santo (BES) tried to put out the fires already lit with the discovery of the hiding of 1,200 million euros from the Banco Espírito Santo de International (ESI) accounts, the holding company of Grupo Espírito Santo (GES) in Luxembourg. Now, the CMVM has filed an accusation against five BES directors, including Ricardo Salgado, for deceiving investors in the bank’s capital increase weeks before the resolution, a “serious offence” with a fine of up to five million euros each.

A banking syndicate supported the capital increase operation, but in the end, it was not necessary to resort to that ‘cushion’. At the time, demand exceeded the stock supply by 79%, at 0.65 euros per share, which made it unnecessary for the international banking union to resort to firm underwriting. And in this operation, the core of the bank, namely Espírito Santo Financial Group (ESFG) and Crédit Agricole, shrank their positions in the bank’s capital. In contrast, institutional investors (investment banks, funds and insurance companies) increased their holdings from 37% to 45% of the capital.

According to information ECO had access to, the board of directors of the CMVM approved the accusation against the bank and the administrators on January 16th and sent immediately afterwards to the accused, who have 20 working days to respond if they so wish. In the indictment, detailed, BES itself (in liquidation), Ricardo Salgado, Amílcar Morais Pires, Joaquim Goes, José Manuel Espírito Santo and Rui Silveira are accused. With this accusation, the investors who entered this capital increase gain a relevant “support” for the legal proceedings that have already been initiated, precisely for lack of information on the financial situation of BES and the group in which it was integrated. The CMVM, which was officially contacted, refrained from making any comments.

BES’s capital increase, it should be recalled, was imposed by the Bank of Portugal as early as February 4th, 2014, as it considered it necessary to strengthen the bank’s capital ratios. Already at that time, the Bank of Portugal considered that the Angolan State guarantee was not valid for compliance with prudential ratios. After several exchanges of correspondence between the supervisor, BES’s administration and the controlling shareholder, ESFG, the bank approved a capital increase and its prospectus on May 15th, 2014, and, shortly thereafter, on May 20th, it was the CMVM that approved the disclosure of this prospectus. The capital increase was closed on June 11th, and, on June 16th, BES issued a statement to the market reporting the results of the operation.

For the CMVM, now led by Gabriela Figueiredo Dias (at the time of the capital increase, the chairman of the supervisor was Carlos Tavares, now chairman of Banco Montepio), the failures both in the information provision in the prospectus and in the absence of addenda to the prospectus because of operations already made after the disclosure of this document to investors, correspond to very serious offences under Article 393 of the Securities Code.

In practical terms, the CMVM accuses BES and those five directors of misleading investors. In the accusation, the supervisor identifies what he considers to be a lack of quality of the information in the capital increase prospectus and the absence of addenda to the said prospectus. And there are several operations that, in the supervisor’s opinion, should have been included in the announcement of the capital increase to the market or that should have been added later, among which the following stand out:

- BES and the directors mentioned above did not include in the prospectus the total amount of securities issued by GES companies and held by BES Group clients, in the order of 3.1 billion euros, of which 1.1 billion in retail clients of the bank.

- BES did not include in the prospectus information on the amounts of debt securities issued by ESFG, Rioforte, ESCOM and ES Tourism companies which, at the time of the capital increase, were held by BES Group clients, totalling 1.65 billion euros.

- BES did not include in the prospectus the total amount of BES’s funding to ESFG of 533 million euros.

- BES did not state in the prospectus the knowledge it already had of credits granted by BESA (BES Angola) amounting to 3.9 billion euros which were already worth close to zero and a further 1.7 billion euros which had to be restructured.

- BES did not add to the prospectus the information on the two comfort letters to companies of the Petroleos de Venezuela group (PDVSA), through which the bank undertook to reimburse debt securities issued by ESI and acquired by the companies of that Venezuelan group, of the order of 372 million dollars.

- BES did not add 135 million euros of financing to Rioforte on June 12th to the prospectus or to the listing of the new shares, bringing the total debt to 236 million euros.

To the five directors accused, who may also respond in writing, the CMVM details the functions they had within the BES Group, the bank and its subsidiaries, the powers of each and especially the attendance and voting on the boards of directors and executive committees in which those operations were decided, from the outset the board that approved the capital increase, on May 15th, 2014. Without having done anything to correct the information to investors that was missing or to add supplements to the prospectus, deliberately, knowingly and voluntarily, in a fraudulent manner.

What does Article 135º nº1 of the Securities Code say?

- The prospectus must contain full, true, timely, clear, objective and lawful information that will enable the addressees to form well-founded judgments regarding the offer, the securities which are the subject of the offer and the rights attaching thereto, the specific features, the patrimonial, economic and financial position and the forecasts concerning the evolution of the issuer’s activity and results and of any guarantor.

What does Article 393º nº2, paragraph d, of the Securities Code say?

- The violation of any of the following duties constitutes a very serious offence:

- d) To include information in the prospectus, the base prospectus, the respective addenda and corrigendum, or the final terms of the offer, that is complete, true, current, clear, objective and lawful in accordance with the models provided for in Commission Regulation (EC) No. 809/2004 of 29 April.

What does Article 388º nº1, paragraph a, of the Securities Code say?

- The following fines are applicable to the offences provided for in this section:

- a) Between (euro) 25,000 and (euro) 5,000,000, when they are qualified as very serious;

What does Article 402º nº1 of the Securities Code say?

- The offences of mere social order provided for in this Code are imputed as malice or negligence.